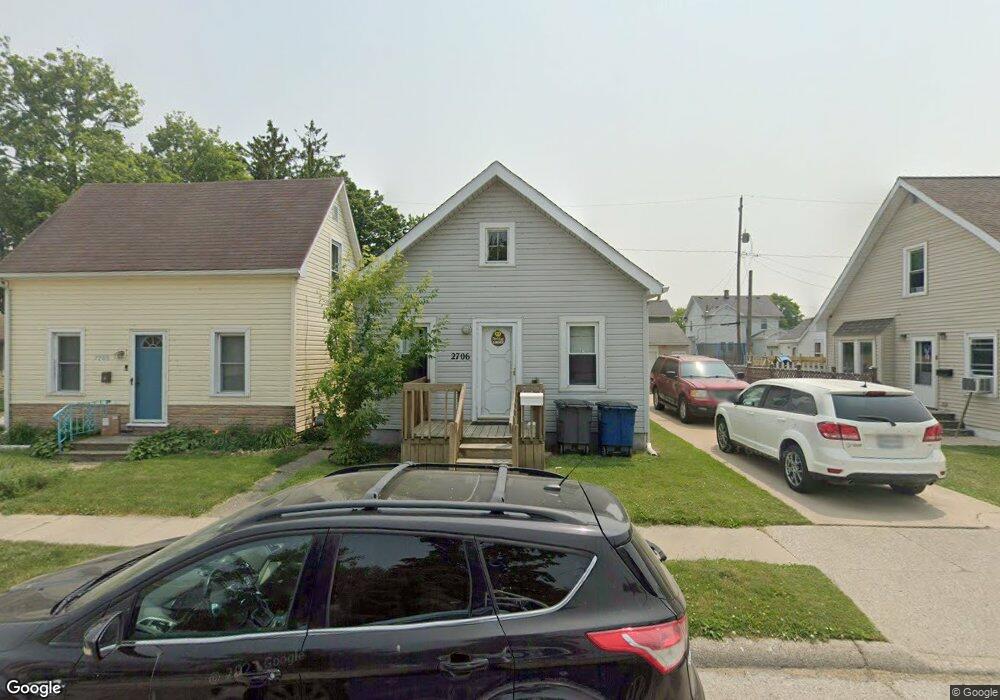

2706 122nd St Toledo, OH 43611

Point Place NeighborhoodEstimated Value: $101,000 - $145,000

2

Beds

1

Bath

796

Sq Ft

$153/Sq Ft

Est. Value

About This Home

Point Place 2 bedroom, 1 full bath w/ bonus dormer and basement. Washer and dryer hook up in basement. Attic storage off the dormer as well.

Available for move in October 1st!

Rent is $900 per month plus tenant pays all utilities. Move in requires first months rent of $900, first month's water prepaid of $50 plus security deposit of $900. A standard application includes background, credit check and income verification.

No previous evictions.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 1999

Sold by

Comer Richard

Bought by

Fink Brent W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,955

Outstanding Balance

$13,988

Interest Rate

7.61%

Mortgage Type

FHA

Estimated Equity

$107,639

Purchase Details

Closed on

Apr 28, 1999

Sold by

Mominee Wiliam J and Nowak Collette R

Bought by

Corner Richard

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fink Brent W | $47,500 | American 1St | |

| Corner Richard | $20,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fink Brent W | $47,955 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 10/10/2025 10/10/25 | Off Market | $900 | -- | -- |

| 10/02/2025 10/02/25 | For Rent | $900 | -- | -- |

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $774 | $23,940 | $4,795 | $19,145 |

| 2023 | $1,289 | $19,915 | $4,025 | $15,890 |

| 2022 | $1,290 | $19,915 | $4,025 | $15,890 |

| 2021 | $1,293 | $19,915 | $4,025 | $15,890 |

| 2020 | $1,208 | $16,380 | $3,325 | $13,055 |

| 2019 | $1,175 | $16,380 | $3,325 | $13,055 |

| 2018 | $1,137 | $16,380 | $3,325 | $13,055 |

| 2017 | $1,108 | $14,560 | $4,830 | $9,730 |

| 2016 | $1,104 | $41,600 | $13,800 | $27,800 |

| 2015 | $1,094 | $41,600 | $13,800 | $27,800 |

| 2014 | $916 | $14,560 | $4,830 | $9,730 |

| 2013 | $916 | $14,560 | $4,830 | $9,730 |

Source: Public Records

Map

Nearby Homes