2712 Oak Rd Unit 61 Walnut Creek, CA 94597

Contra Costa Centre NeighborhoodEstimated Value: $504,000 - $592,000

3

Beds

2

Baths

1,181

Sq Ft

$451/Sq Ft

Est. Value

About This Home

This home is located at 2712 Oak Rd Unit 61, Walnut Creek, CA 94597 and is currently estimated at $532,091, approximately $450 per square foot. 2712 Oak Rd Unit 61 is a home located in Contra Costa County with nearby schools including Indian Valley Elementary School, Walnut Creek Intermediate School, and Las Lomas High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 10, 2013

Sold by

Shoka Max Luhende and Shoka Estrella Hernandez

Bought by

Gong Shuang and Wong Martin R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,200

Outstanding Balance

$182,165

Interest Rate

3.48%

Mortgage Type

New Conventional

Estimated Equity

$349,926

Purchase Details

Closed on

Jun 2, 2008

Sold by

Shoka Max Luhende and Shoka Estrella Hernandez

Bought by

Shoka Max Luhende and Shoka Estrella Hernandez

Purchase Details

Closed on

Jul 8, 2004

Sold by

Waxman Jacob I

Bought by

Shoka Max Luhende and Shoka Estrella Hernandez

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,400

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gong Shuang | $366,000 | Old Republic Title Company | |

| Shoka Max Luhende | -- | None Available | |

| Shoka Max Luhende | $365,500 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gong Shuang | $256,200 | |

| Previous Owner | Shoka Max Luhende | $292,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,881 | $450,691 | $283,222 | $167,469 |

| 2024 | $5,741 | $441,855 | $277,669 | $164,186 |

| 2023 | $5,741 | $433,192 | $272,225 | $160,967 |

| 2022 | $5,662 | $424,699 | $266,888 | $157,811 |

| 2021 | $5,509 | $416,372 | $261,655 | $154,717 |

| 2019 | $5,375 | $404,025 | $253,896 | $150,129 |

| 2018 | $5,208 | $396,104 | $248,918 | $147,186 |

| 2017 | $5,102 | $388,338 | $244,038 | $144,300 |

| 2016 | $4,995 | $380,724 | $239,253 | $141,471 |

| 2015 | $4,882 | $375,006 | $235,660 | $139,346 |

| 2014 | $4,821 | $367,661 | $231,044 | $136,617 |

Source: Public Records

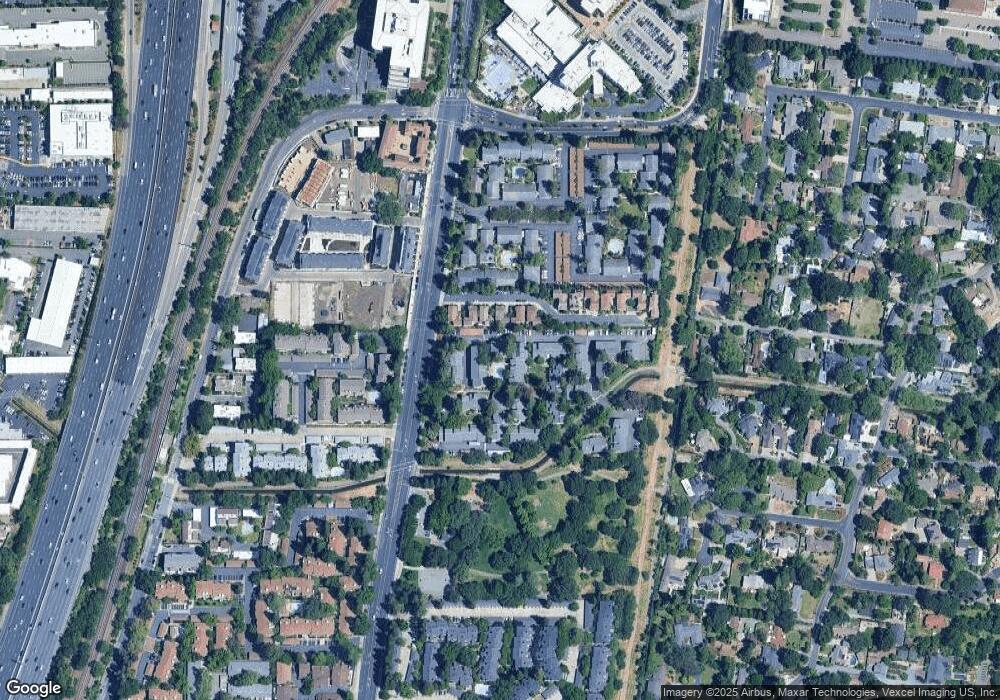

Map

Nearby Homes

- 2712 Oak Rd Unit 60

- 2712 Oak Rd Unit 57

- 2708 Oak Rd Unit 9

- 2709 Oak Rd Unit H

- 2716 Oak Rd Unit 111

- 2716 Oak Rd Unit 117

- 2704 Oak Rd Unit 80

- 2704 Oak Rd Unit 77

- 2724 Oak Rd Unit 88

- 178 Oak Cir

- Plan 5X at Oak Grove

- Plan 6 at Oak Grove

- Plan 3 at Oak Grove

- Plan 4X at Oak Grove

- Plan 5 at Oak Grove

- Plan 6X at Oak Grove

- 2735 Oak Rd

- 225 Oak Cir

- 231 Oak Cir

- 186 Oak Cir

- 2712 Oak Rd Unit 63

- 2712 Oak Rd Unit 62

- 2712 Oak Rd Unit 59

- 2712 Oak Rd Unit 58

- 2712 Oak Rd Unit 56

- 2712 Oak Rd Unit 55

- 2712 Oak Rd Unit 54

- 2712 Oak Rd Unit 53

- 2712 Oak Rd Unit 52

- 2712 Oak Rd Unit 51

- 2712 Oak Rd Unit 50

- 2712 Oak Rd Unit 67

- 2712 Oak Rd Unit 66

- 2712 Oak Rd Unit 65

- 2712 Oak Rd Unit 64

- 314 Parnell Ct Unit 316

- 310 Parnell Ct Unit 312

- 318 Parnell Ct Unit 320

- 306 Parnell Ct Unit 308

- 324 Parnell Ct