Estimated Value: $388,571 - $409,000

3

Beds

1

Bath

1,500

Sq Ft

$266/Sq Ft

Est. Value

About This Home

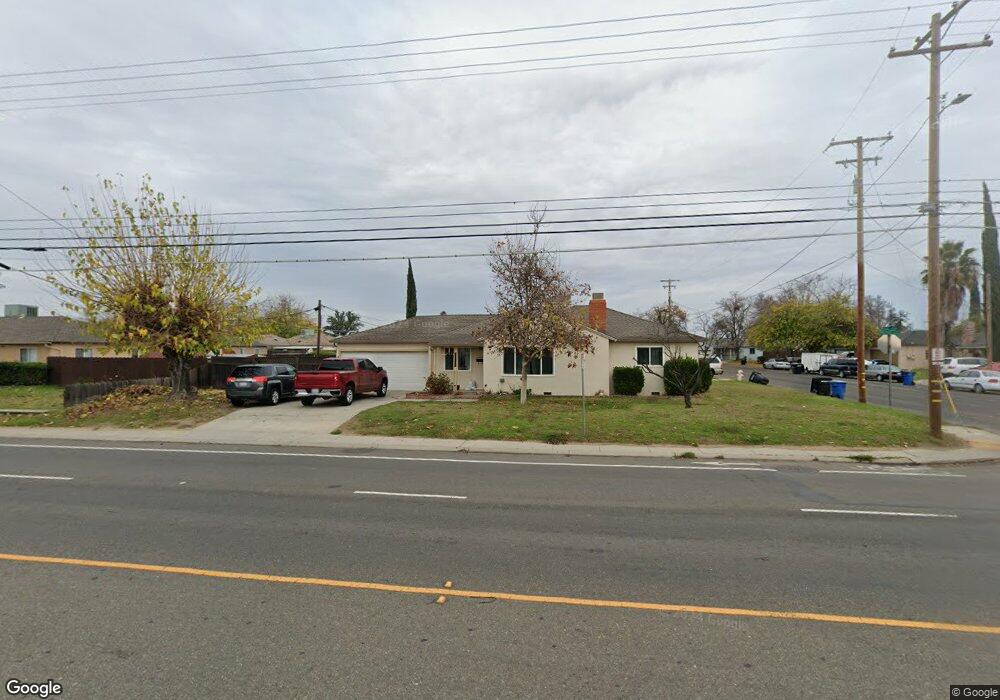

This home is located at 2719 E Whitmore Ave, Ceres, CA 95307 and is currently estimated at $398,524, approximately $265 per square foot. 2719 E Whitmore Ave is a home located in Stanislaus County with nearby schools including Carroll Fowler Elementary School, Mae Hensley Junior High School, and Ceres High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 2, 2009

Sold by

Us Bank National Association

Bought by

Wyatt Dirk L and Wyatt Heather A

Current Estimated Value

Purchase Details

Closed on

Sep 24, 2008

Sold by

Ross Shannon and Ross Christine

Bought by

Us Bank Na

Purchase Details

Closed on

Feb 22, 1999

Sold by

Corn Cynthia E and Corn Cynthia E

Bought by

Ross Shannon and Ross Christine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,853

Interest Rate

6.78%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wyatt Dirk L | $81,000 | Fidelity National Title Co | |

| Us Bank Na | $174,375 | None Available | |

| Ross Shannon | $96,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ross Shannon | $95,853 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,224 | $104,295 | $38,625 | $65,670 |

| 2024 | $1,148 | $102,251 | $37,868 | $64,383 |

| 2023 | $1,117 | $100,247 | $37,126 | $63,121 |

| 2022 | $1,108 | $98,283 | $36,399 | $61,884 |

| 2021 | $1,098 | $96,357 | $35,686 | $60,671 |

| 2020 | $1,064 | $95,370 | $35,321 | $60,049 |

| 2019 | $1,057 | $93,501 | $34,629 | $58,872 |

| 2018 | $1,035 | $91,668 | $33,950 | $57,718 |

| 2017 | $1,027 | $89,872 | $33,285 | $56,587 |

| 2016 | $1,007 | $88,111 | $32,633 | $55,478 |

| 2015 | $993 | $86,788 | $32,143 | $54,645 |

| 2014 | $972 | $85,089 | $31,514 | $53,575 |

Source: Public Records

Map

Nearby Homes

- 2721 Villa Ramon Dr

- 2109 Oriole Dr

- 2590 Magnolia St

- 2912 Dale Ave

- 1954 Robin Dr

- 1821 Rose Ave

- 2841 Fowler Rd Unit 33

- 2841 Fowler Rd Unit 149

- 2313 Thomas St

- 3010 Roeding Rd

- 2644 Parkway

- 1821 Myrtlewood Dr

- 1813 Lupin Ln

- 3632 9th St

- 1805 Myrtlewood Dr

- 1655 Moffett Rd

- 3012 Donner Dr Unit 32

- 3524 Homestead Way Unit 57

- 1647 Moffett Rd

- 1645 Moffett Rd

- 2417 Lilac Ct

- 2416 Charlotte Ave

- 2413 Lilac Ct

- 2727 E Whitmore Ave

- 2412 Charlotte Ave

- 2416 Lilac Ct

- 2716 E Whitmore Ave

- 2720 E Whitmore Ave

- 2712 E Whitmore Ave

- 2409 Lilac Ct

- 2412 Lilac Ct

- 2708 E Whitmore Ave

- 2724 E Whitmore Ave

- 2408 Charlotte Ave

- 2704 E Whitmore Ave

- 2735 E Whitmore Ave

- 2408 Lilac Ct

- 2417 Rose Ave

- 2404 Charlotte Ave