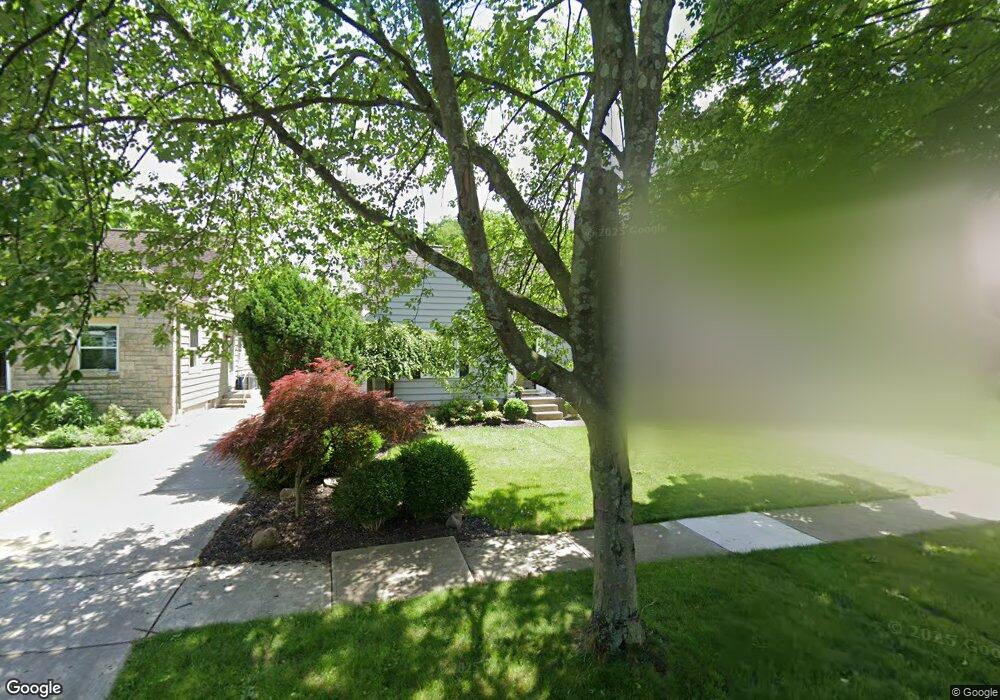

279 Richards Rd Columbus, OH 43214

Clintonville NeighborhoodEstimated Value: $396,794 - $495,000

3

Beds

1

Bath

1,471

Sq Ft

$302/Sq Ft

Est. Value

About This Home

This home is located at 279 Richards Rd, Columbus, OH 43214 and is currently estimated at $444,949, approximately $302 per square foot. 279 Richards Rd is a home located in Franklin County with nearby schools including Indian Springs Elementary School, Dominion Middle School, and Whetstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2010

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Graver Anne E and Graver Derek Lee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,224

Outstanding Balance

$132,576

Interest Rate

5.14%

Mortgage Type

FHA

Estimated Equity

$312,373

Purchase Details

Closed on

Mar 16, 2010

Sold by

Miller Kirk F

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

Apr 10, 2001

Sold by

Dave Rajharvyasi

Bought by

Miller Kirk F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,450

Interest Rate

7.05%

Purchase Details

Closed on

Mar 26, 2001

Sold by

Harvyasi Curtis Lalita

Bought by

Miller Kirk F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,450

Interest Rate

7.05%

Purchase Details

Closed on

Jul 7, 1994

Sold by

Harvyasi Lenore C

Bought by

Is Dave Raj Harvyasi and Is Lalita Harvyasi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

8.61%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Graver Anne E | $202,900 | Independent | |

| Federal Home Loan Mortgage Corp | $142,000 | Attorney | |

| Miller Kirk F | $62,700 | -- | |

| Miller Kirk F | $62,700 | -- | |

| Is Dave Raj Harvyasi | $80,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Graver Anne E | $199,224 | |

| Previous Owner | Miller Kirk F | $121,450 | |

| Previous Owner | Is Dave Raj Harvyasi | $80,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,118 | $114,030 | $52,990 | $61,040 |

| 2024 | $5,118 | $114,030 | $52,990 | $61,040 |

| 2023 | $5,052 | $114,030 | $52,990 | $61,040 |

| 2022 | $5,526 | $106,540 | $34,580 | $71,960 |

| 2021 | $5,535 | $106,540 | $34,580 | $71,960 |

| 2020 | $5,543 | $106,540 | $34,580 | $71,960 |

| 2019 | $4,971 | $81,940 | $26,600 | $55,340 |

| 2018 | $4,780 | $81,940 | $26,600 | $55,340 |

| 2017 | $5,017 | $81,940 | $26,600 | $55,340 |

| 2016 | $5,067 | $76,480 | $29,610 | $46,870 |

| 2015 | $4,600 | $76,480 | $29,610 | $46,870 |

| 2014 | $4,611 | $76,480 | $29,610 | $46,870 |

| 2013 | $2,166 | $72,835 | $28,210 | $44,625 |

Source: Public Records

Map

Nearby Homes

- 374 Acton Rd

- 188 Chatham Rd

- 440 Chatham Rd

- 531 Richards Rd

- 37 Glencoe Rd

- 467 Brevoort Rd

- 30 E Torrence Rd

- 82 Blenheim Rd

- 107 E Dunedin Rd

- 544 Piedmont Rd

- 390 Lenappe Dr

- 126 Erie Rd

- 83 Clinton Heights Ave

- 196 W North Broadway St

- 4299 Colerain Ave

- 243 E Schreyer Place

- 222 W North Broadway St

- 3546 Beulah Rd

- 84-86 W Como Ave

- 76 E Lakeview Ave

- 279 Richards Rd

- 285 Richards Rd

- 273 Richards Rd

- 285 Richards Rd

- 293 Richards Rd

- 267 Richards Rd

- 272 Fallis Rd

- 278 Fallis Rd

- 266 Fallis Rd

- 299 Richards Rd

- 259 Richards Rd

- 3727 Granden Rd

- 258 Fallis Rd

- 284 Richards Rd

- 278 Richards Rd

- 278 Richards Rd

- 292 Richards Rd

- 253 Richards Rd

- 252 Fallis Rd

- 298 Richards Rd

Your Personal Tour Guide

Ask me questions while you tour the home.