27941 Chiclana Unit 81 Mission Viejo, CA 92692

Estimated Value: $804,726 - $948,000

2

Beds

2

Baths

1,240

Sq Ft

$707/Sq Ft

Est. Value

About This Home

This home is located at 27941 Chiclana Unit 81, Mission Viejo, CA 92692 and is currently estimated at $876,682, approximately $707 per square foot. 27941 Chiclana Unit 81 is a home located in Orange County with nearby schools including Philip J. Reilly Elementary, Newhart Middle School, and Capistrano Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 2011

Sold by

Lonsert Michelle

Bought by

Lonsert Michelle M and Wielsen Sarah

Current Estimated Value

Purchase Details

Closed on

May 4, 2009

Sold by

Lonsert Donald J and Lonsert Michelle M

Bought by

Lonsert Michelle and Nielsen Sarah

Purchase Details

Closed on

Sep 12, 2006

Sold by

Lonsert Michelle M

Bought by

Lonsert Donald J and Lonsert Michelle M

Purchase Details

Closed on

Apr 30, 2003

Sold by

Gross Allen Dean

Bought by

Nielsen Kenneth and Nielsen Sarah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,000

Outstanding Balance

$49,075

Interest Rate

4.37%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$827,607

Purchase Details

Closed on

Dec 18, 1998

Sold by

Kunz Thomas R

Bought by

Gross Allen Dean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,235

Interest Rate

6.77%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lonsert Michelle M | -- | None Available | |

| Lonsert Michelle | -- | None Available | |

| Lonsert Donald J | -- | None Available | |

| Lonsert Michelle M | -- | None Available | |

| Nielsen Kenneth | $350,000 | Fidelity National Title Co | |

| Gross Allen Dean | $175,500 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nielsen Kenneth | $126,000 | |

| Previous Owner | Gross Allen Dean | $170,235 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,880 | $490,471 | $343,399 | $147,072 |

| 2024 | $4,880 | $480,854 | $336,665 | $144,189 |

| 2023 | $4,776 | $471,426 | $330,064 | $141,362 |

| 2022 | $4,686 | $462,183 | $323,592 | $138,591 |

| 2021 | $4,595 | $453,121 | $317,247 | $135,874 |

| 2020 | $4,550 | $448,475 | $313,994 | $134,481 |

| 2019 | $4,460 | $439,682 | $307,837 | $131,845 |

| 2018 | $4,375 | $431,061 | $301,801 | $129,260 |

| 2017 | $4,289 | $422,609 | $295,883 | $126,726 |

| 2016 | $4,207 | $414,323 | $290,081 | $124,242 |

| 2015 | $4,161 | $408,100 | $285,724 | $122,376 |

| 2014 | $4,082 | $400,106 | $280,127 | $119,979 |

Source: Public Records

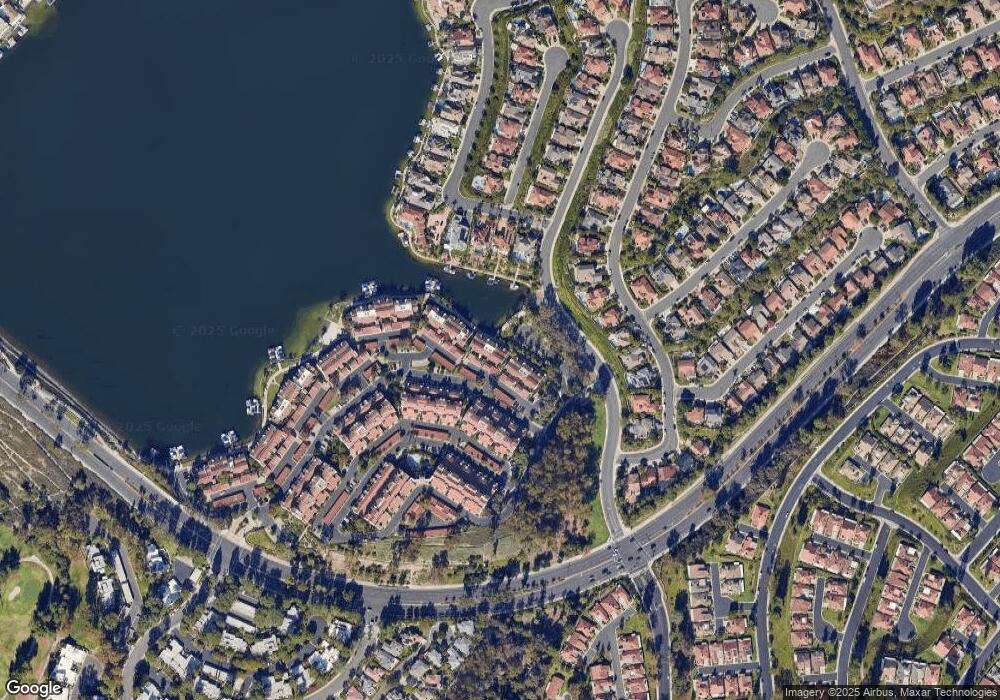

Map

Nearby Homes

- 27913 Trocadero Unit 68

- 27887 Mazagon

- 27879 Chipiona Unit 52

- 27882 Finisterra Unit 117

- 28037 Via Tirso

- 27805 Barbate Unit 15

- 22971 Tiagua

- 23232 El Greco

- 23247 Cherry Hills St

- 23247 El Greco

- 23531 Via Murillo

- 28229 Nebrija

- 23323 El Greco

- 22791 Tindaya

- 23552 Bermuda Dunes

- 23224 Coso Unit 51

- 23264 Copante

- 23332 Coso Unit 134

- 28401 Alava

- 22691 Lajares

- 27939 Chiclana Unit 84

- 27947 Chiclana Unit 86

- 27937 Chiclana Unit 80

- 27935 Chiclana Unit 83

- 27949 Chiclana Unit 87

- 27933 Chiclana Unit 79

- 27933 Chiclana

- 27945 Chiclana Unit 82

- 27951 Chiclana

- 27953 Chiclana Unit 88

- 27955 Chiclana Unit 92

- 27955 Chiclana

- 27957 Chiclana Unit 89

- 27959 Chiclana

- 27976 Finisterra

- 27961 Chiclana

- 27963 Chiclana Unit 94

- 27963 Chiclana

- 27943 Chiclana Unit 85

- 27966 Finisterra Unit 152