2808 Catalina Heights Way Vista, CA 92084

Vista Valley NeighborhoodEstimated Value: $971,000 - $1,657,000

--

Bed

--

Bath

3,193

Sq Ft

$450/Sq Ft

Est. Value

About This Home

This home is located at 2808 Catalina Heights Way, Vista, CA 92084 and is currently estimated at $1,435,311, approximately $449 per square foot. 2808 Catalina Heights Way is a home with nearby schools including Monte Vista Elementary School, Rancho Minerva Middle School, and Rancho Buena Vista High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2014

Sold by

Chirra Joseph and Floren Gloria

Bought by

Chirra Flores Family Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Outstanding Balance

$320,863

Interest Rate

4.2%

Mortgage Type

New Conventional

Estimated Equity

$1,114,448

Purchase Details

Closed on

Aug 26, 2013

Sold by

Chirra Joseph and Floren Gloria

Bought by

Chirra Joseph and Floren Gloria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$595,000

Interest Rate

4.75%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Feb 20, 2004

Sold by

Floren Gloria and Chirra Joseph

Bought by

Chirra Joseph and Floren Gloria

Purchase Details

Closed on

Sep 16, 1994

Sold by

Chirra Joseph

Bought by

Floren Gloria

Purchase Details

Closed on

Jul 31, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chirra Flores Family Trust | -- | Accommodation | |

| Chirra Joseph | -- | Ticor Title Company | |

| Chirra Joseph | -- | Ticor Title Company Of Ca | |

| Chirra Joseph | -- | Ticor Title Company Of Calif | |

| Chirra Joseph | -- | -- | |

| Chirra Joseph | -- | -- | |

| Floren Gloria | -- | -- | |

| -- | $162,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chirra Joseph | $417,000 | |

| Closed | Chirra Joseph | $595,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,932 | $1,106,917 | $368,986 | $737,931 |

| 2024 | $11,932 | $1,085,213 | $361,751 | $723,462 |

| 2023 | $11,648 | $1,063,935 | $354,658 | $709,277 |

| 2022 | $11,619 | $1,043,074 | $347,704 | $695,370 |

| 2021 | $11,361 | $1,022,623 | $340,887 | $681,736 |

| 2020 | $11,321 | $1,012,138 | $337,392 | $674,746 |

| 2019 | $11,155 | $992,293 | $330,777 | $661,516 |

| 2018 | $10,608 | $972,838 | $324,292 | $648,546 |

| 2017 | $10,414 | $953,764 | $317,934 | $635,830 |

| 2016 | $10,171 | $935,063 | $311,700 | $623,363 |

| 2015 | $10,146 | $921,018 | $307,018 | $614,000 |

| 2014 | $2,928 | $251,984 | $251,984 | $0 |

Source: Public Records

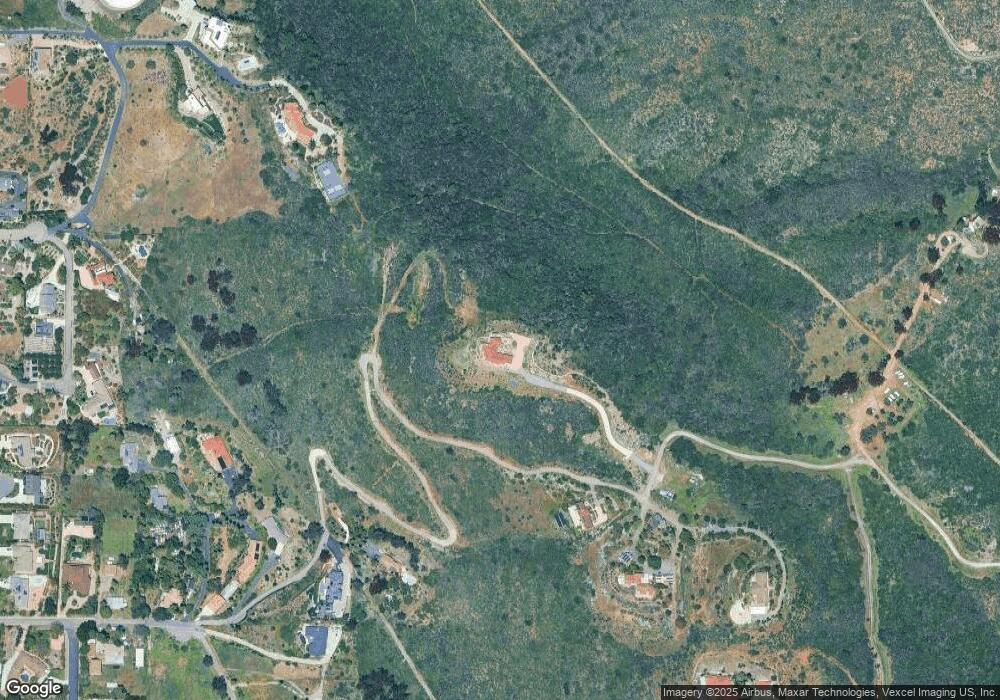

Map

Nearby Homes

- 600 Hardell Ln

- 2362 Edgehill Rd

- 2342 Carioca Place

- 2535 San Clemente Ave

- 2511 San Clemente Ave

- 2261 Edgehill Rd Unit 178-250-15-00

- 2034 Alessandro Trail

- 1955 Friendly Dr

- 632 634 Truly

- 0 Buena Creek Unit 39 250029341

- 817 Avenida Taxco

- 1911 Foothill Dr

- 682 Ora Avo Ln

- 2068 Camino Culebra

- 326 Sunrise Cir

- 3696 Camino de Las Lomas

- 330 Skyline Dr

- 3188 Ora Avo Terrace

- 1657 Foothill Dr

- 3342 Silver Oak Ln

- 0 Catalina Heights Way Unit T10124368

- 2538 Catalina Ave

- 2527 Catalina Heights Way

- 0 Edgehill Rd

- 2807 Catalina Heights Way

- 2485 Catalina Ave

- 2386 Edgehill Rd

- 2510 Catalina Ave

- 2508 Catalina Ave

- 2508 Catalina Ave

- 2512 Catalina Ave

- 2815 Catalina Heights Way

- 2455 Edgehill Rd

- 2502 Catalina Ave

- 2504 Catalina Ave

- 2384 Edgehill Rd

- 2046 Mango Glen

- 000 Catalina Ave

- 2458 Catalina Ave

- 2092 Mango Glen