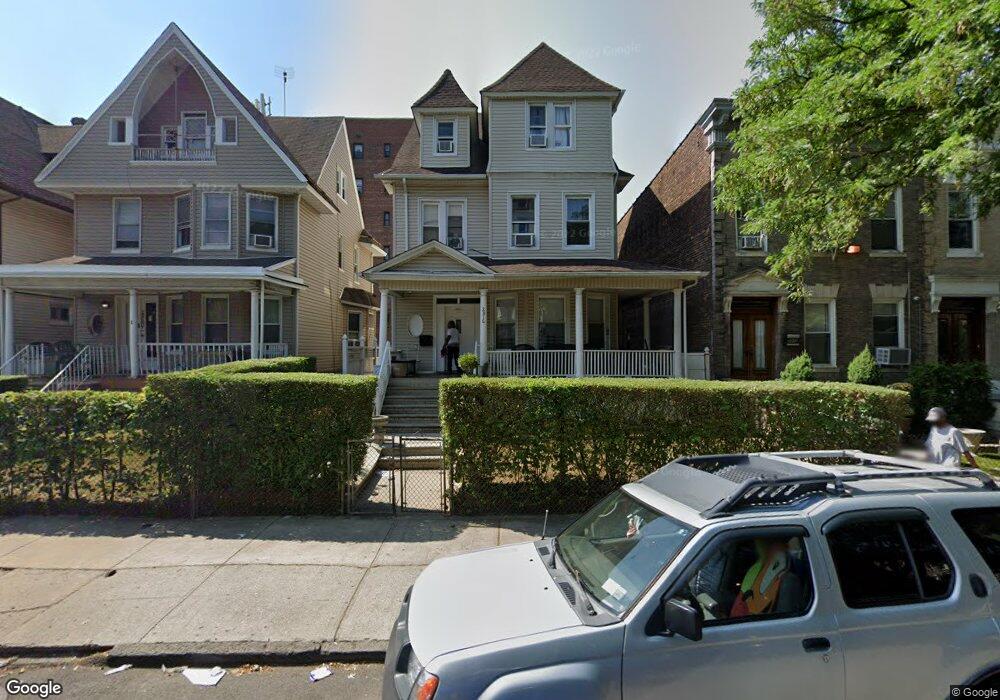

2816 Farragut Rd Brooklyn, NY 11210

Flatbush NeighborhoodEstimated Value: $945,197 - $1,337,000

--

Bed

--

Bath

2,439

Sq Ft

$480/Sq Ft

Est. Value

About This Home

This home is located at 2816 Farragut Rd, Brooklyn, NY 11210 and is currently estimated at $1,170,549, approximately $479 per square foot. 2816 Farragut Rd is a home located in Kings County with nearby schools including J.H.S. 278 Marine Park, Central Brooklyn Ascend Charter, and Midwood Montessori.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2003

Sold by

Exantus As To 0 Gladys and Renard As To 99 Interest Ida

Bought by

Renard Ida

Current Estimated Value

Purchase Details

Closed on

Apr 26, 2000

Sold by

Mason Nathaniel

Bought by

Renard Ida and Exantus Gladys

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,700

Interest Rate

8.12%

Purchase Details

Closed on

May 9, 1996

Sold by

Bain Michael

Bought by

Mason Nathaniel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Interest Rate

8.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Renard Ida | -- | -- | |

| Renard Ida | -- | -- | |

| Renard Ida | $204,000 | Commonwealth Land Title Ins | |

| Renard Ida | $204,000 | Commonwealth Land Title Ins | |

| Mason Nathaniel | $215,000 | First American Title Ins Co | |

| Mason Nathaniel | $215,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Renard Ida | $183,700 | |

| Previous Owner | Mason Nathaniel | $172,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,468 | $59,340 | $20,220 | $39,120 |

| 2024 | $6,468 | $67,920 | $20,220 | $47,700 |

| 2023 | $6,170 | $83,340 | $20,220 | $63,120 |

| 2022 | $5,722 | $71,220 | $20,220 | $51,000 |

| 2021 | $6,023 | $65,820 | $20,220 | $45,600 |

| 2020 | $2,976 | $58,920 | $20,220 | $38,700 |

| 2019 | $5,614 | $65,160 | $20,220 | $44,940 |

| 2018 | $5,161 | $25,318 | $10,759 | $14,559 |

| 2017 | $4,869 | $23,886 | $10,427 | $13,459 |

| 2016 | $4,768 | $23,851 | $11,482 | $12,369 |

| 2015 | $2,498 | $23,704 | $12,813 | $10,891 |

| 2014 | $2,498 | $22,364 | $12,296 | $10,068 |

Source: Public Records

Map

Nearby Homes

- 2804 Farragut Rd

- 579 E 29th St

- 2722 Farragut Rd

- 1462 Flatbush Ave Unit 3C

- 1462 Flatbush Ave Unit 4B

- 1462 Flatbush Ave Unit 5 B

- 1462 Flatbush Ave Unit PHD

- 1462 Flatbush Ave Unit PH-E

- 1462 Flatbush Ave Unit PH-A

- 1462 Flatbush Ave Unit 3-G

- 1470 Flatbush Ave

- 2801 Glenwood Rd

- 1525 Flatbush Ave

- 93 Kenilworth Place

- 566 E 32nd St

- 50 Kenilworth Place Unit 5M

- 563 E 32nd St

- 720 E 31st St Unit 5K

- 720 E 31st St Unit 4K

- 645 E 26th St Unit 6J

- 2812 Farragut Rd

- 2820 Farragut Rd

- 2810 Farragut Rd

- 2806 Farragut Rd

- 2806 Farragut Rd Unit 2

- 2806 Farragut Rd Unit 1

- 2824 Farragut Rd

- 690 E 29th St Unit 2FL

- 617 E 28th St

- 2802 Farragut Rd

- 619 E 28th St

- 625 E 28th St

- 2811-2815 Farragut Rd

- 2809 Farragut Rd

- 2807 Farragut Rd

- 632 E 29 St

- 632 E 29th St

- 2805 Farragut Rd

- 629 E 28th St

- 607 E 29th St