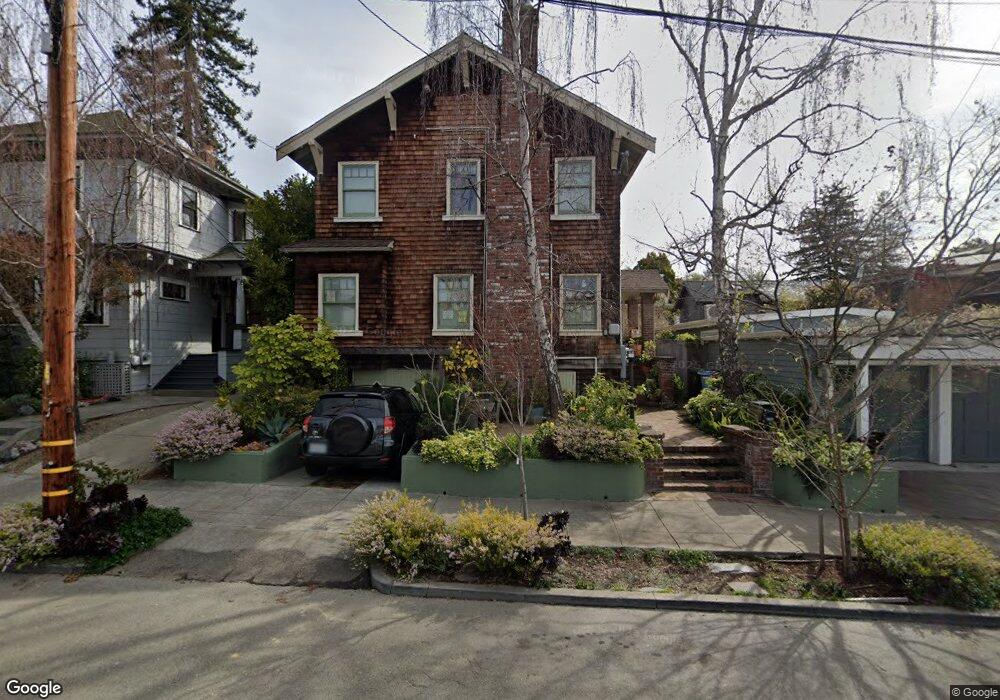

2823 Cherry St Berkeley, CA 94705

Elmwood NeighborhoodEstimated Value: $2,189,000 - $2,776,000

4

Beds

3

Baths

2,428

Sq Ft

$1,067/Sq Ft

Est. Value

About This Home

This home is located at 2823 Cherry St, Berkeley, CA 94705 and is currently estimated at $2,590,019, approximately $1,066 per square foot. 2823 Cherry St is a home located in Alameda County with nearby schools including Emerson Elementary School, John Muir Elementary School, and Malcolm X Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2024

Sold by

Darling Nathan and Darling Alexandra Blair

Bought by

Darling And Darling Revocable Trust and Darling

Current Estimated Value

Purchase Details

Closed on

Sep 25, 2018

Sold by

Murray Douglas and Glenn Bernadette

Bought by

Blair Alexandra and Alexandra T L Blair Living Tru

Purchase Details

Closed on

Jan 26, 2015

Sold by

Murray Douglas S and Glenn Murray Bernadette

Bought by

Douglas Murray and Douglas Bernadette Glenn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Darling And Darling Revocable Trust | -- | None Listed On Document | |

| Darling Nathan | -- | None Listed On Document | |

| Blair Alexandra | $2,275,000 | Chicago Title Company | |

| Douglas Murray | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $36,382 | $2,593,464 | $761,328 | $1,832,136 |

| 2024 | $36,382 | $2,542,618 | $746,402 | $1,796,216 |

| 2023 | $35,618 | $2,492,772 | $731,769 | $1,761,003 |

| 2022 | $35,017 | $2,443,902 | $717,423 | $1,726,479 |

| 2021 | $34,815 | $2,344,985 | $703,357 | $1,641,628 |

| 2020 | $32,460 | $2,320,500 | $696,150 | $1,624,350 |

| 2019 | $31,483 | $2,275,000 | $682,500 | $1,592,500 |

| 2018 | $12,230 | $708,473 | $212,542 | $495,931 |

| 2017 | $11,786 | $694,584 | $208,375 | $486,209 |

| 2016 | $11,332 | $680,968 | $204,290 | $476,678 |

| 2015 | $11,163 | $670,743 | $201,223 | $469,520 |

| 2014 | $11,223 | $657,607 | $197,282 | $460,325 |

Source: Public Records

Map

Nearby Homes

- 2951 Linden Ave

- 2611 Piedmont Ave Unit 4

- 2732 Parker St

- 2477 Prince St

- 2702 Dana St

- 6446 Colby St

- 2401 Carleton St

- 2543 Chilton Way

- 2319 Ward St

- 2509 Dwight Way

- 2409 College Ave

- 2243 Ashby Ave

- 2550 Dana St Unit 2F

- 2316 Blake St Unit D

- 2907 Channing Way

- 2537 Ellsworth St

- 2 Panoramic Way Unit 105

- 2 Panoramic Way Unit 304

- 0 Gravatt Dr Unit 41122154

- 204 El Camino Real

- 2821 Cherry St

- 2827 Cherry St

- 2817 Cherry St

- 2727 Russell St

- 2815 Cherry St

- 2733 Russell St Unit B

- 2733 Russell St Unit A

- 2733 Russell St

- 2828 Cherry St

- 2824 Cherry St

- 2830 Cherry St

- 2811 Cherry St

- 2832 Cherry St

- 2824 Piedmont Ave Unit 1

- 2822 Piedmont Ave

- 2828 Piedmont Ave Unit 3

- 2826 Piedmont Ave

- 2820 Piedmont Ave

- 2820 Cherry St Unit 2820

- 2818 Cherry St Unit 2818