2856 E Dunbar Dr Unit 36 Phoenix, AZ 85042

South Mountain NeighborhoodEstimated Value: $331,357 - $399,000

3

Beds

2

Baths

1,535

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 2856 E Dunbar Dr Unit 36, Phoenix, AZ 85042 and is currently estimated at $355,089, approximately $231 per square foot. 2856 E Dunbar Dr Unit 36 is a home located in Maricopa County with nearby schools including T G Barr School, South Mountain High School, and Phoenix Coding Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2020

Sold by

Davis Robert G

Bought by

Davis Robert G and Gray Karen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Outstanding Balance

$110,915

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$244,174

Purchase Details

Closed on

Feb 14, 2020

Sold by

Davis Robert G

Bought by

Davis Robert G and Gray Karen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Outstanding Balance

$110,915

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$244,174

Purchase Details

Closed on

Oct 29, 2006

Sold by

Kb Homes Sales Phoenix Inc

Bought by

Davis Robert G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,000

Interest Rate

6.38%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis Robert G | -- | Grand Canyon Title Agency | |

| Davis Robert G | -- | Grand Canyon Title Agency | |

| Davis Robert G | $260,154 | First American Title Ins Co | |

| Kb Home Sales Phoenix Inc | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davis Robert G | $140,000 | |

| Closed | Davis Robert G | $140,000 | |

| Closed | Davis Robert G | $182,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,530 | $11,323 | -- | -- |

| 2024 | $1,446 | $10,783 | -- | -- |

| 2023 | $1,446 | $24,980 | $4,990 | $19,990 |

| 2022 | $1,416 | $18,730 | $3,740 | $14,990 |

| 2021 | $1,460 | $17,060 | $3,410 | $13,650 |

| 2020 | $1,442 | $16,520 | $3,300 | $13,220 |

| 2019 | $1,393 | $15,610 | $3,120 | $12,490 |

| 2018 | $1,353 | $13,570 | $2,710 | $10,860 |

| 2017 | $1,261 | $12,000 | $2,400 | $9,600 |

| 2016 | $1,197 | $11,950 | $2,390 | $9,560 |

| 2015 | $1,112 | $11,010 | $2,200 | $8,810 |

Source: Public Records

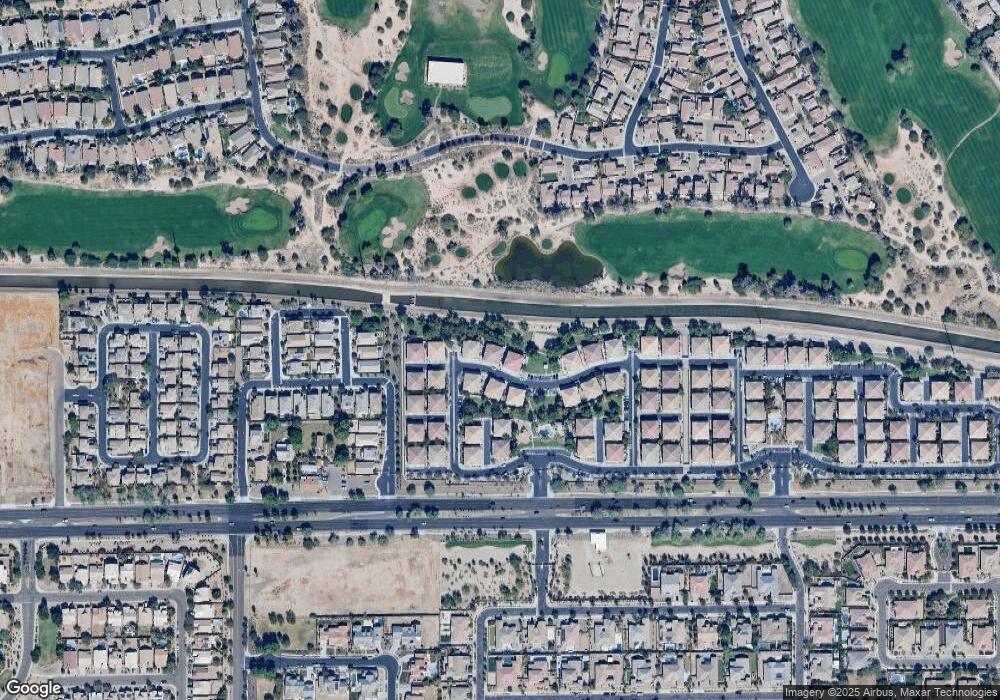

Map

Nearby Homes

- 2868 E Dunbar Dr Unit 39

- 2941 E Darrow St Unit 97

- 7423 S 28th Place

- 7515 S 30th Place Unit 50

- 3047 E Fremont Rd

- 7204 S Golfside Ln

- 2822 E Constance Way

- 7530 S 31st Way Unit 108

- 7029 S Golfside Ln

- 2618 E Fremont Rd

- 2746 E Fawn Dr

- 2803 E Baseline Rd

- 4208 E Baseline Rd Unit 5

- 2825 E Harwell Rd

- 3131 E Legacy Dr Unit 1057

- 3131 E Legacy Dr Unit 1104

- 3131 E Legacy Dr Unit 2055

- 3131 E Legacy Dr Unit 1107

- 3131 E Legacy Dr Unit 2008

- 3131 E Legacy Dr Unit 2013

- 2852 E Dunbar Dr Unit 34

- 2848 E Dunbar Dr Unit 35

- 2848 E Dunbar Dr Unit Lot 86

- 2864 E Dunbar Dr

- 2884 E Dunbar Dr

- 2860 E Dunbar Dr Unit 38

- 2844 E Dunbar Dr Unit 33

- 2836 E Dunbar Dr Unit 32

- 2849 E Dunbar Dr Unit 54

- 2837 E Dunbar Dr Unit 49

- 2853 E Dunbar Dr Unit 52

- 2845 E Dunbar Dr Unit 51

- 2857 E Dunbar Dr Unit 53

- 2841 E Dunbar Dr Unit 50

- 2861 E Dunbar Dr Unit 57

- 2865 E Dunbar Dr Unit 55

- 2869 E Dunbar Dr Unit 56

- 2832 E Dunbar Dr

- 2824 E Dunbar Dr Unit 29

- 2828 E Dunbar Dr Unit 28