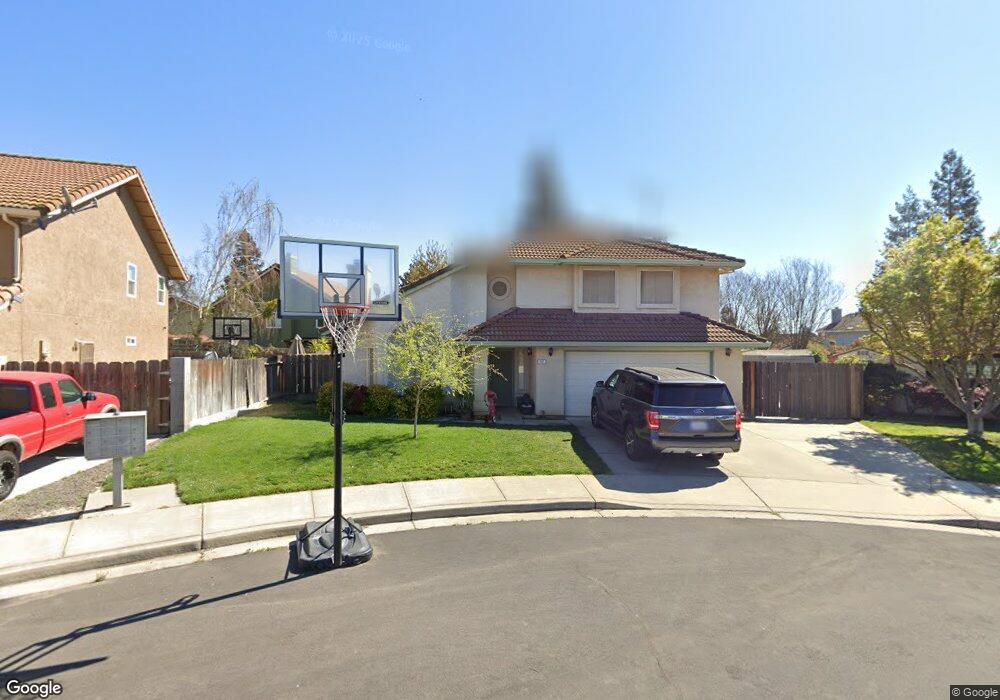

287 New Ct Oakdale, CA 95361

Estimated Value: $450,000 - $558,000

4

Beds

3

Baths

2,002

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 287 New Ct, Oakdale, CA 95361 and is currently estimated at $518,079, approximately $258 per square foot. 287 New Ct is a home located in Stanislaus County with nearby schools including Fair Oaks Elementary School, Oakdale Junior High School, and East Stanislaus High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 7, 2005

Sold by

Walsh John M and Walsh Mary E

Bought by

Walsh John M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,000

Outstanding Balance

$73,713

Interest Rate

5.75%

Mortgage Type

New Conventional

Estimated Equity

$444,366

Purchase Details

Closed on

Jul 19, 2004

Sold by

Shelton Bennie Donald and Shelton Margaret R

Bought by

Walsh John M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$264,000

Outstanding Balance

$128,857

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$389,222

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Walsh John M | -- | Chicago Title | |

| Walsh John M | -- | -- | |

| Walsh John M | $330,000 | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Walsh John M | $146,000 | |

| Open | Walsh John M | $264,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,056 | $459,973 | $125,444 | $334,529 |

| 2024 | $4,793 | $450,955 | $122,985 | $327,970 |

| 2023 | $4,690 | $442,114 | $120,574 | $321,540 |

| 2022 | $4,609 | $433,446 | $118,210 | $315,236 |

| 2021 | $4,531 | $424,948 | $115,893 | $309,055 |

| 2020 | $3,743 | $352,500 | $110,000 | $242,500 |

| 2019 | $3,760 | $352,500 | $110,000 | $242,500 |

| 2018 | $3,613 | $337,000 | $130,000 | $207,000 |

| 2017 | $3,396 | $316,500 | $110,000 | $206,500 |

| 2016 | $3,288 | $306,000 | $110,000 | $196,000 |

| 2015 | $3,308 | $307,000 | $58,500 | $248,500 |

| 2014 | $2,847 | $262,500 | $50,000 | $212,500 |

Source: Public Records

Map

Nearby Homes

- 8400 Crane Rd

- 2337 Rainwood Ln

- The Skyline Plan at Saddlewood

- The Pinnacle Plan at Saddlewood

- The Vantage Plan at Saddlewood

- 2295 Pontiac St

- 311 Carriage Ln

- 2306 W F St

- 1972 Sugar Pine Dr

- 1948 Sugar Pine Dr

- 2908 Westport Cir

- 15 Willowood Dr

- 2532 Laurel Ridge Ct

- 2272 Tori Way

- 1625 Valmor Ct

- 2319 Tori Way

- 549 Fresian Dr

- 2376 Shire Way

- 491 Nicholas Ct

- 2201 Mustang Dr