2913 Antonio Dr Unit 201 Camarillo, CA 93010

Estimated Value: $479,000 - $522,000

2

Beds

2

Baths

1,022

Sq Ft

$483/Sq Ft

Est. Value

About This Home

This home is located at 2913 Antonio Dr Unit 201, Camarillo, CA 93010 and is currently estimated at $494,076, approximately $483 per square foot. 2913 Antonio Dr Unit 201 is a home located in Ventura County with nearby schools including Camarillo Heights Elementary School, Monte Vista Middle School, and Adolfo Camarillo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 28, 2011

Sold by

Revelez Fernando

Bought by

Revelez Fernando

Current Estimated Value

Purchase Details

Closed on

Oct 1, 2008

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Revelez Fernando

Purchase Details

Closed on

May 19, 2008

Sold by

Mcconnell Ryan

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Jun 9, 2006

Sold by

Toews Richard E

Bought by

Mcconnell Ryan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,700

Interest Rate

6.25%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Feb 25, 1999

Sold by

Brisas Camarillo Inc

Bought by

Toews Richard E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,100

Interest Rate

7.1%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Revelez Fernando | -- | None Available | |

| Revelez Fernando | $245,000 | Fidelity National Title | |

| Federal Home Loan Mortgage Corporation | $279,000 | First American Title Ins Co | |

| Mcconnell Ryan | $438,500 | Alliance Title | |

| Toews Richard E | $160,000 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mcconnell Ryan | $87,700 | |

| Previous Owner | Mcconnell Ryan | $350,800 | |

| Previous Owner | Toews Richard E | $155,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,491 | $315,483 | $204,745 | $110,738 |

| 2024 | $3,491 | $309,298 | $200,731 | $108,567 |

| 2023 | $3,367 | $303,234 | $196,795 | $106,439 |

| 2022 | $3,356 | $297,289 | $192,937 | $104,352 |

| 2021 | $3,236 | $291,460 | $189,154 | $102,306 |

| 2020 | $3,225 | $288,473 | $187,215 | $101,258 |

| 2019 | $3,210 | $282,818 | $183,545 | $99,273 |

| 2018 | $3,152 | $277,274 | $179,947 | $97,327 |

| 2017 | $2,967 | $271,838 | $176,419 | $95,419 |

| 2016 | $2,896 | $266,509 | $172,960 | $93,549 |

| 2015 | $2,866 | $262,508 | $170,363 | $92,145 |

| 2014 | $2,800 | $257,368 | $167,027 | $90,341 |

Source: Public Records

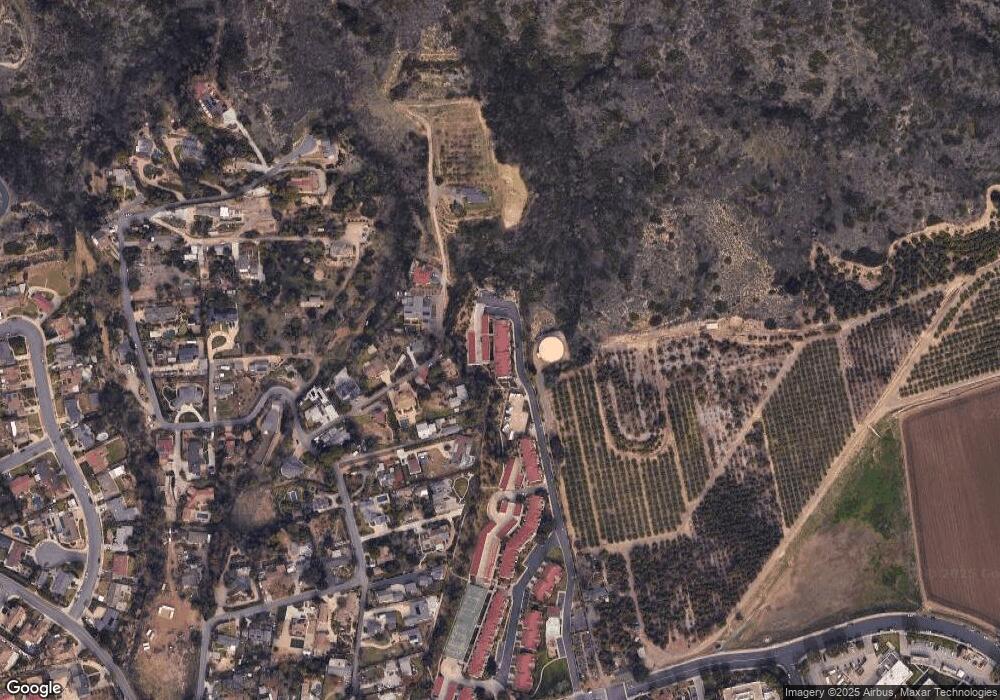

Map

Nearby Homes

- 2803 Antonio Dr Unit 102

- 2713 Antonio Dr Unit 105

- 2713 Antonio Dr Unit 312

- 2713 Antonio Dr Unit 210

- 2722 Antonio Dr

- 590 Alosta Dr

- 3425 Rio Hato Ct

- 511 Beverly Cir

- 3359 Ridden St

- 390 Highland Hills Dr

- 1783 Fenmore Ave

- 2255 Placita San Rufino

- 1874 Munson St

- 1772 Weston Cir

- 2496 Parkway Dr

- 1669 Dewayne Ave

- 520 E Highland Dr

- 3582 E Barca St

- 2008 Las Estrellas Ct

- 2251 Camilar Dr

- 2913 Antonio Dr

- 2913 Antonio Dr Unit 301

- 2913 Antonio Dr Unit 302

- 2913 Antonio Dr Unit 303

- 2913 Antonio Dr Unit 304

- 2913 Antonio Dr Unit 305

- 2913 Antonio Dr Unit 306

- 2913 Antonio Dr Unit 307

- 2913 Antonio Dr Unit 308

- 2913 Antonio Dr Unit 208

- 2913 Antonio Dr Unit 207

- 2913 Antonio Dr Unit 206

- 2913 Antonio Dr Unit 205

- 2913 Antonio Dr Unit 203

- 2913 Antonio Dr Unit 202

- 2913 Antonio Dr Unit 101

- 2913 Antonio Dr Unit 102

- 2913 Antonio Dr Unit 103

- 2913 Antonio Dr Unit 104

- 2913 Antonio Dr Unit 105