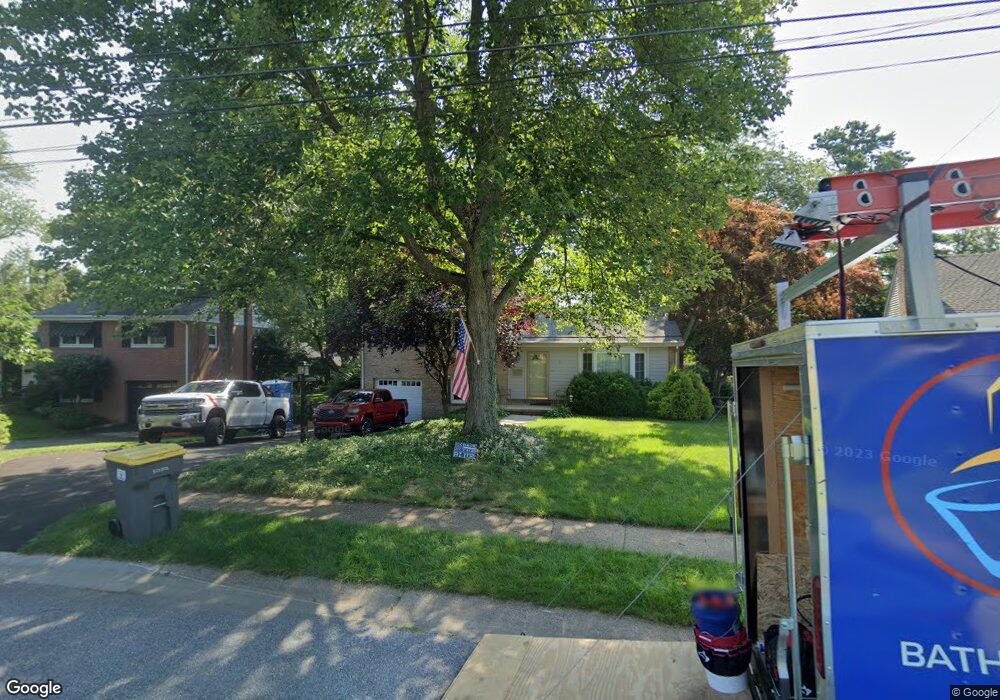

30 Wayne Dr Wilmington, DE 19809

Estimated Value: $417,000 - $472,000

3

Beds

3

Baths

1,380

Sq Ft

$324/Sq Ft

Est. Value

About This Home

This home is located at 30 Wayne Dr, Wilmington, DE 19809 and is currently estimated at $447,586, approximately $324 per square foot. 30 Wayne Dr is a home located in New Castle County with nearby schools including Maple Lane Elementary School, Pierre S. Dupont Middle School, and Mount Pleasant High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2011

Sold by

Gibson David J and Gibson Ellen C

Bought by

Conroy John B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,800

Outstanding Balance

$84,108

Interest Rate

4.52%

Mortgage Type

New Conventional

Estimated Equity

$363,478

Purchase Details

Closed on

Oct 29, 2004

Sold by

Ingman Jeffrey L and Ingman Karin E

Bought by

Gibson David J and Gibson Ellen C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,300

Interest Rate

5.71%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Conroy John B | $263,500 | None Available | |

| Gibson David J | $250,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Conroy John B | $210,800 | |

| Previous Owner | Gibson David J | $252,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,527 | $66,400 | $15,300 | $51,100 |

| 2023 | $2,310 | $66,400 | $15,300 | $51,100 |

| 2022 | $2,349 | $66,400 | $15,300 | $51,100 |

| 2021 | $2,349 | $66,400 | $15,300 | $51,100 |

| 2020 | $2,349 | $66,400 | $15,300 | $51,100 |

| 2019 | $2,474 | $66,400 | $15,300 | $51,100 |

| 2018 | $2,245 | $66,400 | $15,300 | $51,100 |

| 2017 | $2,210 | $66,400 | $15,300 | $51,100 |

| 2016 | $2,209 | $66,400 | $15,300 | $51,100 |

| 2015 | $2,032 | $66,400 | $15,300 | $51,100 |

| 2014 | $2,031 | $66,400 | $15,300 | $51,100 |

Source: Public Records

Map

Nearby Homes

- 1810 Garfield Ave

- 1904 Garfield Ave

- 1400 Carson Rd

- 512 Eskridge Dr

- 1425 Bucknell Rd

- 0 Bell Hill Rd

- 409 Rowland Park Blvd

- 302 Baynard Blvd

- 707 Parkside Blvd

- 1607 Silverside Rd

- 1507 Spring Ln

- 1224 Grinnell Rd

- 814 Naudain Ave

- 200 Churchill Dr

- 1900 Beechwood Dr

- 2603 Lincoln Ave

- 1213 Talley Rd

- 1300 Hillside Blvd

- 607 Brighton Rd

- 731 Governor House Cir Unit 74

- 28 Wayne Dr

- 32 Wayne Dr

- 412 W Clearview Ave

- 1207 Hillside Rd

- 26 Wayne Dr

- 1205 Hillside Rd

- 1210 Carr Rd

- 1209 Hillside Rd

- 410 W Clearview Ave

- 1212 Carr Rd

- 17 Wayne Dr

- 15 Wayne Dr

- 1203 Hillside Rd

- 24 Wayne Dr

- 408 W Clearview Ave

- 1208 Carr Rd

- 13 Wayne Dr

- 1109 Hillside Ave

- 1109 Hillside Rd

- 1208 Hillside Rd