30013 SE Lusted Rd Gresham, OR 97080

Sandy River NeighborhoodEstimated Value: $624,000 - $780,000

4

Beds

3

Baths

2,480

Sq Ft

$287/Sq Ft

Est. Value

About This Home

This home is located at 30013 SE Lusted Rd, Gresham, OR 97080 and is currently estimated at $711,149, approximately $286 per square foot. 30013 SE Lusted Rd is a home located in Multnomah County with nearby schools including East Orient Elementary School, West Orient Middle School, and Sam Barlow High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2020

Sold by

Martin Jonathan and Martin Laura Jane

Bought by

Hernandez Ryan H and Hernandez Shaun N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$508,250

Outstanding Balance

$449,528

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$261,621

Purchase Details

Closed on

Apr 13, 2004

Sold by

Wagner Robert C

Bought by

Martin Jonathan and Martin Laura Jane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,550

Interest Rate

5.57%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hernandez Ryan H | $535,000 | First American | |

| Martin Jonathan | $279,000 | Lawyers Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hernandez Ryan H | $508,250 | |

| Previous Owner | Martin Jonathan | $125,550 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,890 | $362,530 | -- | -- |

| 2024 | $6,587 | $351,980 | -- | -- |

| 2023 | $6,442 | $341,730 | $0 | $0 |

| 2022 | $6,278 | $331,780 | $0 | $0 |

| 2021 | $6,109 | $322,120 | $0 | $0 |

| 2020 | $5,749 | $312,740 | $0 | $0 |

| 2019 | $5,604 | $303,640 | $0 | $0 |

| 2018 | $5,342 | $294,800 | $0 | $0 |

| 2017 | $5,133 | $286,220 | $0 | $0 |

| 2016 | $4,528 | $277,890 | $0 | $0 |

Source: Public Records

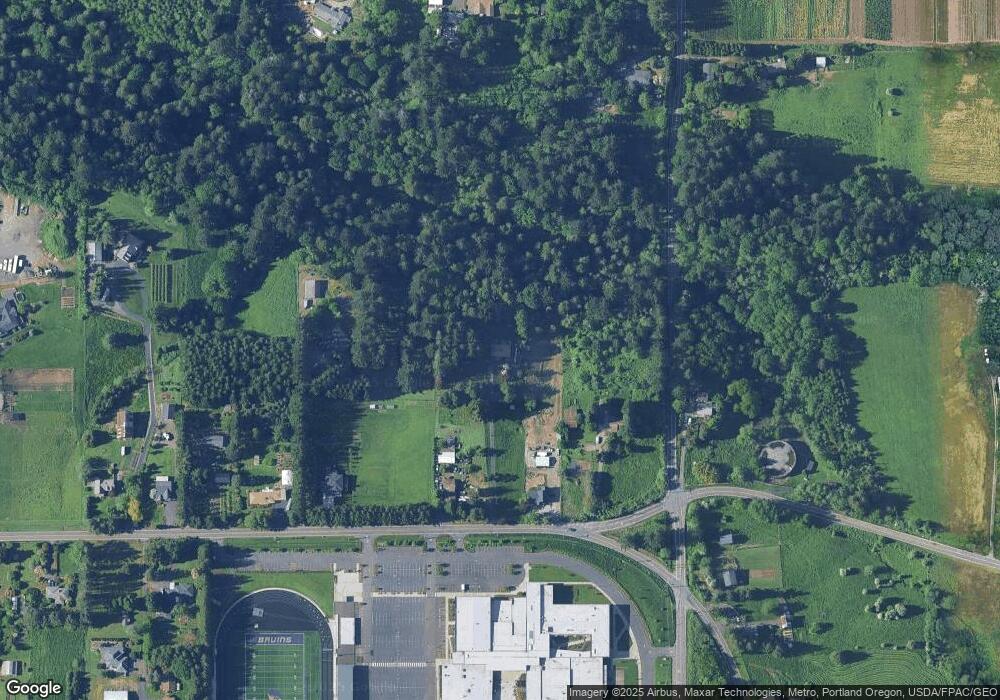

Map

Nearby Homes

- 30945 SE Lusted Rd

- 6192 SE 15th St

- 6187 SE 16th St

- 6171 SE 16th St

- 1490 SE Pheasant Ave

- 1494 SE Pheasant Ave

- 1478 SE Pheasant Ave

- 6115 SE 16th St

- 6109 SE 16th St

- 6103 SE 16th St

- 6443 SE 22nd St

- 6421 SE 22nd St

- 6433 SE 23rd St

- 31616 SE Pipeline Rd

- Pepperwood Plan at The Vineyards at Blue Pearl

- Glacier Plan at The Vineyards at Blue Pearl

- 5856 SE Woodland Dr

- 1649 SE Night Heron Way

- 5827 SE 16th Loop

- 31563 SE Lusted Rd

- 30121 SE Pipeline Rd

- 30035 SE Lusted Rd

- 29943 SE Lusted Rd

- 29833 SE Lusted Rd

- 29801 SE Lusted Rd

- 0 SE 302nd Ave

- 30219 SE Pipeline Rd

- 29737 SE Lusted Rd

- 29677 SE Lusted Rd

- 4515 SE 302nd Ave

- 4423 SE 302nd Ave

- 30233 SE Lusted Rd

- 29639 SE Lusted Rd

- 4425 SE 302nd Ave

- 4441 SE 302nd Ave

- 29627 SE Lusted Rd

- 4510 SE 302nd Ave

- 29603 SE Lusted Rd

- 29640 SE Lusted Rd

- 29620 SE Lusted Rd