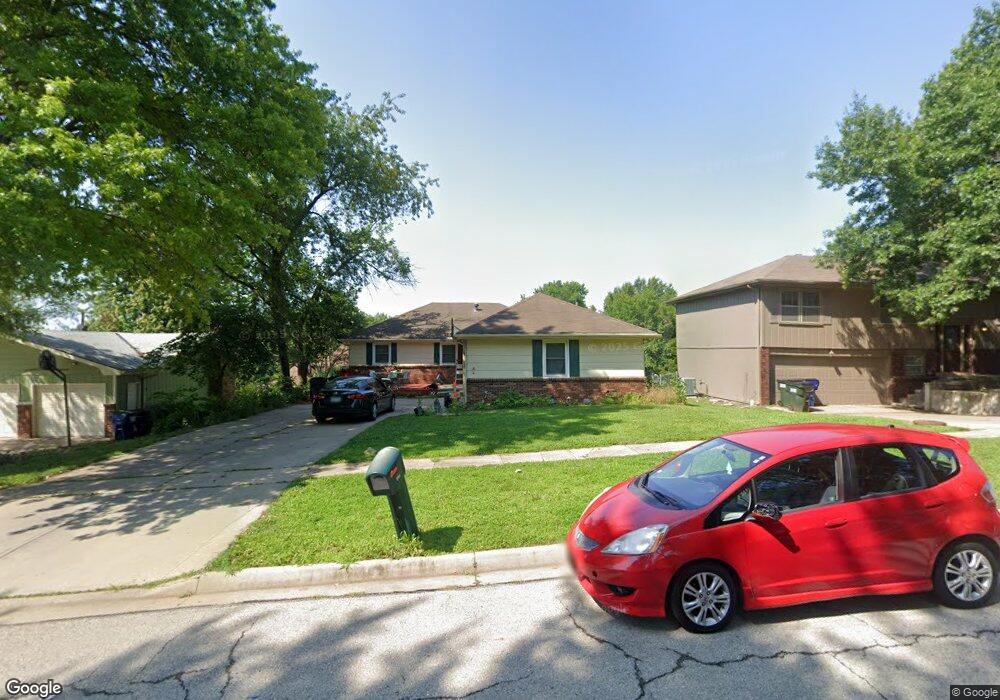

3017 Flint Dr Lawrence, KS 66047

Prairie Meadows NeighborhoodEstimated Value: $349,371 - $369,000

5

Beds

3

Baths

2,683

Sq Ft

$134/Sq Ft

Est. Value

About This Home

This home is located at 3017 Flint Dr, Lawrence, KS 66047 and is currently estimated at $358,843, approximately $133 per square foot. 3017 Flint Dr is a home located in Douglas County with nearby schools including Schwegler Elementary School, Billy Mills Middle School, and Lawrence High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2019

Sold by

Fagerlund Kathleen A and Fagerlund Edward A

Bought by

Bricker Andrew

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,000

Outstanding Balance

$127,816

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$231,027

Purchase Details

Closed on

Jun 10, 2009

Sold by

Stanwix Verna Mae

Bought by

Fagerlund Kathleen A and Fagerlund Edward A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,160

Interest Rate

4.83%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bricker Andrew | -- | Lawyers Title Of Kansas Inc | |

| Fagerlund Kathleen A | -- | Capital Title Ins Company Lc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bricker Andrew | $145,000 | |

| Previous Owner | Fagerlund Kathleen A | $132,160 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,232 | $42,148 | $7,475 | $34,673 |

| 2024 | $5,181 | $41,722 | $7,475 | $34,247 |

| 2023 | $4,783 | $37,214 | $5,520 | $31,694 |

| 2022 | $4,473 | $34,581 | $5,060 | $29,521 |

| 2021 | $3,784 | $28,359 | $4,830 | $23,529 |

| 2020 | $3,609 | $27,198 | $4,830 | $22,368 |

| 2019 | $3,509 | $26,485 | $4,830 | $21,655 |

| 2018 | $3,162 | $23,725 | $4,600 | $19,125 |

| 2017 | $3,069 | $22,782 | $4,600 | $18,182 |

| 2016 | $2,728 | $21,183 | $4,602 | $16,581 |

| 2015 | $2,700 | $20,964 | $4,602 | $16,362 |

| 2014 | $2,675 | $20,976 | $4,602 | $16,374 |

Source: Public Records

Map

Nearby Homes

- 2709 Lawrence Ave

- 3018 Topeka Ln

- 2700 Meadow Place

- 2728 Chipperfield Rd

- 2404 Brush Creek Dr

- 3621 Brush Creek Dr

- 2139 Quail Creek Dr

- 3009 W 19th Ct

- 2566 Ridge Ct

- 2635 Knollbrook Ct

- 4142 Blackjack Oak Dr

- 3700 Quail Creek Ct

- 2018 Crossgate Dr

- 2615 Red Cedar Dr

- 4215 Wimbledon Dr

- 1908 Crossgate Dr

- 1704 W 20th St

- 1633 W 20th St

- 4404 W 24th Place

- 4412 Gretchen Ct