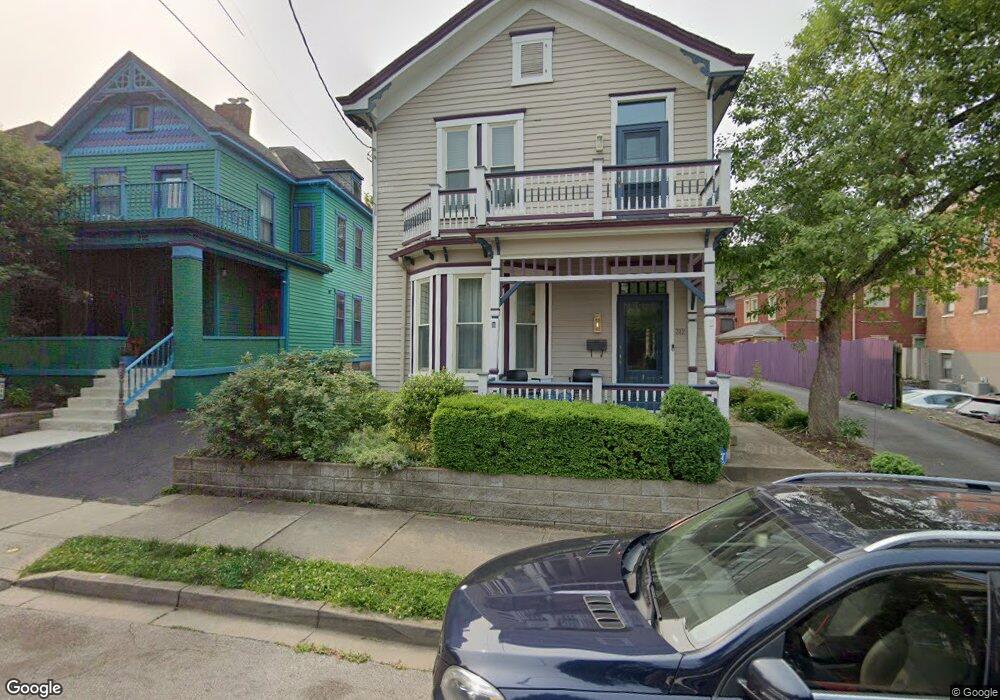

312 Tusculum Ave Cincinnati, OH 45226

Columbia Tusculum NeighborhoodEstimated Value: $358,000 - $403,000

3

Beds

2

Baths

1,720

Sq Ft

$220/Sq Ft

Est. Value

About This Home

This home is located at 312 Tusculum Ave, Cincinnati, OH 45226 and is currently estimated at $378,226, approximately $219 per square foot. 312 Tusculum Ave is a home located in Hamilton County with nearby schools including Clark Montessori High School, Withrow University High School, and Shroder High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 17, 2021

Sold by

Joosten Stanislaus and The Stanlslaus Joosten Revocab

Bought by

Sullivan Kevin Lee and Kevin Lee Sullivan Trust

Current Estimated Value

Purchase Details

Closed on

Apr 1, 2013

Sold by

Flora Daniel and Flora Sarah

Bought by

Joosten Stanislaus and Stanislaus Joosten Revocable Trust

Purchase Details

Closed on

May 28, 2008

Sold by

Kern David G and Kern Dorian

Bought by

Vonlehmden Sarah and Flora Daniel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,000

Interest Rate

5.37%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 18, 2003

Sold by

Dusablon Mary Anna

Bought by

Kern David G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Interest Rate

6.33%

Mortgage Type

Balloon

Purchase Details

Closed on

Nov 14, 2001

Sold by

Bailey Sean T

Bought by

Dusablon Mary Ann

Purchase Details

Closed on

Sep 19, 2001

Sold by

Bailey Sean T

Bought by

Dusablon Mary Anna

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sullivan Kevin Lee | $312,300 | None Available | |

| Joosten Stanislaus | $238,400 | Attorney | |

| Vonlehmden Sarah | $247,000 | Ltoc | |

| Kern David G | $160,000 | -- | |

| Dusablon Mary Ann | -- | -- | |

| Dusablon Mary Anna | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Vonlehmden Sarah | $247,000 | |

| Previous Owner | Kern David G | $128,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,189 | $86,916 | $13,489 | $73,427 |

| 2023 | $5,307 | $86,916 | $13,489 | $73,427 |

| 2022 | $4,886 | $71,764 | $12,978 | $58,786 |

| 2021 | $4,702 | $71,764 | $12,978 | $58,786 |

| 2020 | $4,840 | $71,764 | $12,978 | $58,786 |

| 2019 | $4,070 | $55,202 | $9,982 | $45,220 |

| 2018 | $4,076 | $55,202 | $9,982 | $45,220 |

| 2017 | $3,872 | $55,202 | $9,982 | $45,220 |

| 2016 | $4,671 | $65,671 | $10,882 | $54,789 |

| 2015 | $4,211 | $65,671 | $10,882 | $54,789 |

| 2014 | $4,241 | $65,671 | $10,882 | $54,789 |

| 2013 | $3,487 | $53,050 | $9,982 | $43,068 |

Source: Public Records

Map

Nearby Homes

- 3737 Eastern Ave

- 3732 Morris Place

- 218 Stanley Ave

- 407 Tusculum Ave

- 438 Tusculum Ave

- 420 Strafer St

- 3712 Sachem Ave

- 438 Strafer St

- 537 Tusculum Ave

- 3755 Sachem Ave

- 3441 Wool St

- 550 Tusculum Ave Unit 550

- 457 Strafer St

- 462 Stanley Ave

- 465 Stanley Ave

- 3942 Feemster St

- 3516 Handman Ave

- 251 Mccullough St

- 3554 Handman Ave

- 3556 Handman Ave

- 312 Tusculum Ave

- 322 Tusculum Ave

- 3700 Eastern Ave

- 3704 Eastern Ave Unit 7

- 3704 Eastern Ave

- 3704 Eastern Ave Unit 3

- 3711 Morris Place

- 317 Tusculum Ave

- 315 Tusculum Ave

- 22 Morris Place

- 325 Tusculum Ave

- 3646 Eastern Ave

- 3648 Eastern Ave

- 311 Tusculum Ave

- 328 Tusculum Ave

- 3644 Eastern Ave

- 3717 Morris Place

- 332 Tusculum Ave

- 3635 Morris Place

- 3724 Eastern Ave