316 Covert Ln Billings, MT 59105

Billings Heights NeighborhoodEstimated Value: $269,840 - $292,000

2

Beds

2

Baths

1,207

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 316 Covert Ln, Billings, MT 59105 and is currently estimated at $276,710, approximately $229 per square foot. 316 Covert Ln is a home located in Yellowstone County with nearby schools including Bench School, Medicine Crow Middle School, and Skyview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2013

Sold by

Faber Manfred

Bought by

Roesler Debra A and Roesler Ladonna

Current Estimated Value

Purchase Details

Closed on

Apr 23, 2008

Sold by

Dawson Mark

Bought by

Faber Manfred

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,000

Interest Rate

6.11%

Mortgage Type

VA

Purchase Details

Closed on

Feb 27, 2007

Sold by

Bts Inc

Bought by

Dawson Mark

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,500

Interest Rate

6.21%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roesler Debra A | -- | None Available | |

| Faber Manfred | -- | None Available | |

| Dawson Mark | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Faber Manfred | $124,000 | |

| Previous Owner | Dawson Mark | $108,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,224 | $296,500 | $38,120 | $258,380 |

| 2024 | $2,224 | $231,700 | $25,688 | $206,012 |

| 2023 | $2,222 | $231,700 | $25,688 | $206,012 |

| 2022 | $1,891 | $200,300 | $0 | $0 |

| 2021 | $2,072 | $200,300 | $0 | $0 |

| 2020 | $1,796 | $163,800 | $0 | $0 |

| 2019 | $1,714 | $163,800 | $0 | $0 |

| 2018 | $1,759 | $165,800 | $0 | $0 |

| 2017 | $1,708 | $165,800 | $0 | $0 |

| 2016 | $1,542 | $150,700 | $0 | $0 |

| 2015 | $1,504 | $150,700 | $0 | $0 |

| 2014 | $1,546 | $82,945 | $0 | $0 |

Source: Public Records

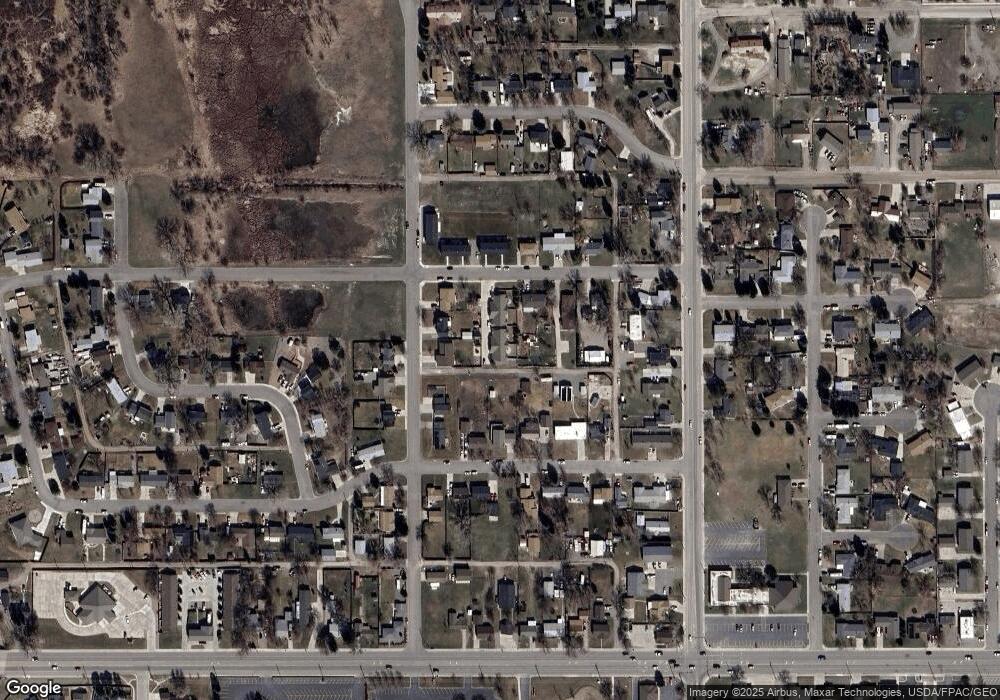

Map

Nearby Homes

- 1703 Cody Dr

- 1707 Broadview Dr

- 2303 Lake Elmo Dr

- 1636 Kelby Dr

- 1628 Kelby Dr

- 130 132 Stillwater Ln

- 1612 Kelby Dr

- 1643 Kelby Dr

- 1635 Kelby Dr

- 1627 Kelby Dr

- 104 Stillwater Ln

- 1621 Kelby Dr

- 1937 Lake Elmo Dr

- 511 Winged Foot Dr

- 2004 Lake Elmo Dr

- TBD Gayle Blk 10 Lot 5 Dr

- TBD Sharron Block 14 Lot8 Ln

- 1409 Twin Oaks Dr

- 2030 Gayle Dr

- TBD Saint Andrews Dr