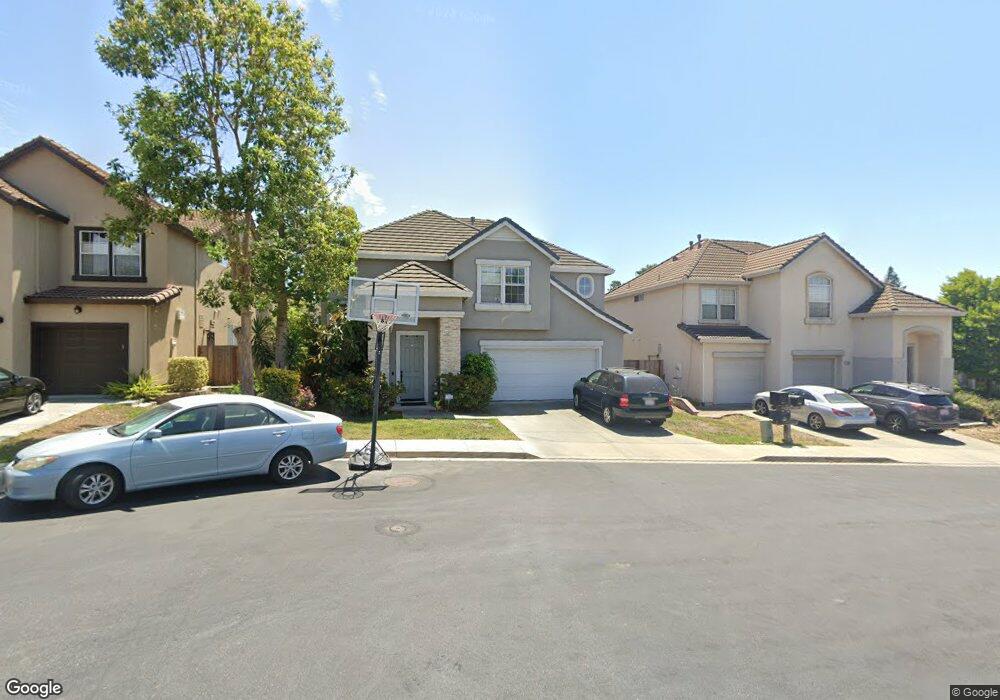

3210 Lakeport Ct San Jose, CA 95148

Murillo NeighborhoodEstimated Value: $1,899,000 - $2,496,000

4

Beds

3

Baths

2,445

Sq Ft

$920/Sq Ft

Est. Value

About This Home

This home is located at 3210 Lakeport Ct, San Jose, CA 95148 and is currently estimated at $2,248,532, approximately $919 per square foot. 3210 Lakeport Ct is a home located in Santa Clara County with nearby schools including Carolyn A. Clark Elementary School, Quimby Oak Middle School, and Evergreen Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 17, 2007

Sold by

Brennan James R and Brennan Monina Jovita Torres

Bought by

Brennan James Richard and Brennan Monina Jovita Torres

Current Estimated Value

Purchase Details

Closed on

May 8, 2001

Sold by

Brennan James R and Brennan Monina T

Bought by

Brennan James R and Brennan Monina T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,000

Interest Rate

6.87%

Purchase Details

Closed on

Sep 11, 1997

Sold by

Standard Pacific Corp

Bought by

Brennan James R and Torres Monina Jovita O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,000

Interest Rate

7.34%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brennan James Richard | -- | None Available | |

| Brennan James R | -- | None Available | |

| Brennan James R | -- | Alliance Title Company | |

| Brennan James R | $372,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brennan James R | $375,000 | |

| Previous Owner | Brennan James R | $297,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,716 | $593,491 | $223,534 | $369,957 |

| 2024 | $9,716 | $581,854 | $219,151 | $362,703 |

| 2023 | $9,503 | $570,446 | $214,854 | $355,592 |

| 2022 | $9,412 | $559,262 | $210,642 | $348,620 |

| 2021 | $9,217 | $548,297 | $206,512 | $341,785 |

| 2020 | $8,830 | $542,676 | $204,395 | $338,281 |

| 2019 | $8,596 | $532,037 | $200,388 | $331,649 |

| 2018 | $8,481 | $521,606 | $196,459 | $325,147 |

| 2017 | $8,335 | $511,379 | $192,607 | $318,772 |

| 2016 | $7,959 | $501,353 | $188,831 | $312,522 |

| 2015 | $7,845 | $493,823 | $185,995 | $307,828 |

| 2014 | $7,144 | $484,151 | $182,352 | $301,799 |

Source: Public Records

Map

Nearby Homes

- 3198 Vintage Crest Dr

- 3422 Glenprosen Ct

- 3508 Casabella Ct

- 3430 Maroun Place

- 3114 Pinot Grigio Place

- 3123 Oakgate Way

- 3948 Mosher Dr

- 4121 Horizon Ln

- 4072 Bouquet Park Ln

- 3176 Arcola Ct

- 3145 Chillum Ct

- 3668 Summit Ridge Ct

- 3858 Evangelho Cir

- 4117 Pinot Gris Way

- 0 Quimby Rd Unit 225125081

- 3216 Remington Way

- 4234 Chaboya Rd

- 2847 Norcrest Dr

- 2896 Rathmann Dr

- 2859 Broken Oak Ct

- 3204 Lakeport Ct

- 3216 Lakeport Ct

- 3213 Lakemore Ct

- 3207 Lakemore Ct

- 3923 Lake Ridge Ln

- 3219 Lakemore Ct

- 3217 Lakeport Ct

- 3211 Lakeport Ct

- 3937 Lake Ridge Ln

- 3917 Lake Ridge Ln

- 3931 Lake Ridge Ln

- 3943 Lake Ridge Ln

- 3218 Lakemore Ct

- 3925 Lake Ridge Ln

- 3949 Lake Ridge Ln

- 3955 Lake Ridge Ln

- 3206 Lakemore Ct

- 3919 Lake Ridge Ln

- 3212 Lakemore Ct

- 3961 Lake Ridge Ln