Estimated Value: $225,000 - $227,000

2

Beds

2

Baths

1,209

Sq Ft

$187/Sq Ft

Est. Value

About This Home

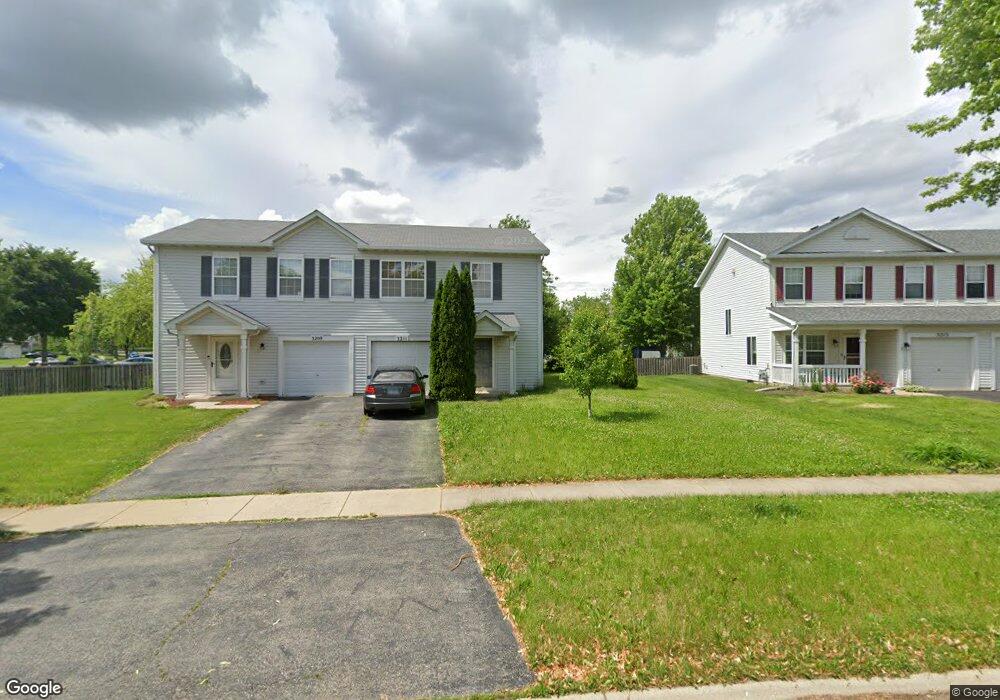

This home is located at 3211 Edward St, Plano, IL 60545 and is currently estimated at $225,894, approximately $186 per square foot. 3211 Edward St is a home located in Kendall County with nearby schools including P.H. Miller Elementary School, Emily G. Johns School, and Centennial Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2008

Sold by

Deutsche Bank National Trust Co

Bought by

Funk Josiah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,000

Interest Rate

6.36%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 24, 2007

Sold by

Hollins Jacqueline M

Bought by

Deutsche Bank National Trust Co

Purchase Details

Closed on

Mar 13, 2006

Sold by

Sanchez Yander and Sellman Sanchez Kristen

Bought by

Hollins Jacqueline M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$26,400

Interest Rate

6.38%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Jul 15, 2005

Sold by

Lakewood Springs Llc

Bought by

Sanchez Yander and Sellman Sanchez Kristen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,700

Interest Rate

5.66%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Funk Josiah | $115,000 | First American Title | |

| Deutsche Bank National Trust Co | -- | None Available | |

| Hollins Jacqueline M | $132,000 | Burnet Title Llc | |

| Sanchez Yander | $133,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Funk Josiah | $92,000 | |

| Previous Owner | Hollins Jacqueline M | $26,400 | |

| Previous Owner | Sanchez Yander | $106,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,126 | $54,561 | $6,264 | $48,297 |

| 2023 | $4,683 | $48,528 | $5,571 | $42,957 |

| 2022 | $4,683 | $44,277 | $5,083 | $39,194 |

| 2021 | $4,430 | $41,540 | $4,769 | $36,771 |

| 2020 | $4,421 | $40,726 | $4,676 | $36,050 |

| 2019 | $4,354 | $39,484 | $4,484 | $35,000 |

| 2018 | $4,032 | $35,134 | $4,270 | $30,864 |

| 2017 | $3,922 | $31,827 | $4,270 | $27,557 |

| 2016 | $3,641 | $27,234 | $4,270 | $22,964 |

| 2015 | $3,255 | $21,871 | $3,500 | $18,371 |

| 2014 | -- | $19,895 | $3,500 | $16,395 |

| 2013 | -- | $19,895 | $5,751 | $14,144 |

Source: Public Records

Map

Nearby Homes

- 3311 Edward St

- 3305 Paige St Unit 2A

- 2913 Alyssa St

- 308 Alyssa St

- 3304 Alyssa St Unit 2A

- 3863 Munson St Unit 7084

- 2824 Hoffman St

- 4118 Klatt St Unit 3A

- 4124 Dobbins St

- 11948 Andrew St

- 114 Schmidt Ct

- 4407 Klatt St

- Lot 11 Ashley Ln

- 706 Keller St

- 4132 Hoffman St

- 00 Lakewood Springs 7a

- 711 Osbron St

- 13090 River Rd

- 317 E Dearborn St

- 321 E Main St

- 3211 Edward St Unit 2

- 3213 Edward St

- 3209 Edward St

- 3117 Alyssa St

- 3215 Edward St

- 3115 Alyssa St

- 3217 Edward St

- 3110 Paige St

- 3112 Paige St

- 3114 Paige St

- 3113 Alyssa St

- 3108 Paige St Unit 2A

- 3219 Edward St

- 3202 Paige St

- 3423 Allen St

- 3204 Paige St Unit 2A

- 3111 Alyssa St

- 3309 Edward St

- 3206 Edward St

- 3206 Paige St

Your Personal Tour Guide

Ask me questions while you tour the home.