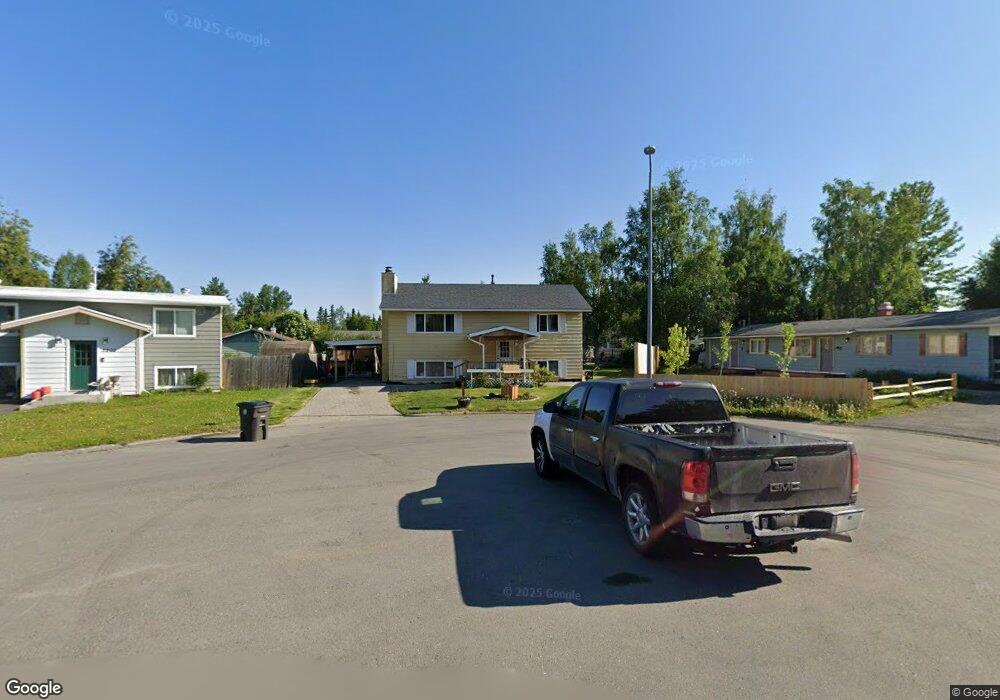

3215 E 18th Cir Anchorage, AK 99508

Airport Heights NeighborhoodEstimated Value: $203,000 - $407,968

4

Beds

2

Baths

1,872

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 3215 E 18th Cir, Anchorage, AK 99508 and is currently estimated at $311,492, approximately $166 per square foot. 3215 E 18th Cir is a home located in Anchorage Municipality with nearby schools including Airport Heights Elementary School, Wendler Middle School, and Bettye Davis East Anchorage High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2006

Sold by

Rhymer Larry

Bought by

Atiifale Osa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$263,000

Outstanding Balance

$187,997

Interest Rate

10.3%

Mortgage Type

Balloon

Estimated Equity

$123,496

Purchase Details

Closed on

Jun 29, 2006

Sold by

Acg Llc

Bought by

Rhymer Larry

Purchase Details

Closed on

Dec 7, 1988

Sold by

Pierce Samuel R and Secretary/Housing & Urban Dev

Bought by

Cottrell Roy E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,556

Interest Rate

10.29%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Atiifale Osa | -- | First American Title Ins Co | |

| Rhymer Larry | -- | Alyeska Title Guaranty Agenc | |

| Acg Llc | -- | Alyeska Title Guaranty Agenc | |

| Cottrell Roy E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Atiifale Osa | $263,000 | |

| Previous Owner | Cottrell Roy E | $72,556 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,538 | $365,400 | $85,600 | $279,800 |

| 2024 | $5,538 | $343,000 | $85,600 | $257,400 |

| 2023 | $5,238 | $307,600 | $85,600 | $222,000 |

| 2022 | $5,081 | $301,700 | $85,600 | $216,100 |

| 2021 | $4,849 | $269,100 | $85,600 | $183,500 |

| 2020 | $4,454 | $262,000 | $85,600 | $176,400 |

| 2019 | $4,250 | $259,800 | $85,600 | $174,200 |

| 2018 | $4,228 | $257,800 | $85,600 | $172,200 |

| 2017 | $4,263 | $272,200 | $85,600 | $186,600 |

| 2016 | $3,480 | $264,300 | $82,700 | $181,600 |

| 2015 | $3,480 | $254,300 | $82,700 | $171,600 |

| 2014 | $3,480 | $241,900 | $66,100 | $175,800 |

Source: Public Records

Map

Nearby Homes

- 1524 Rosemary St

- 3401 E 15th Ave

- 1536 Valarian St

- 1703 Alder Dr

- 1414 Airport Heights Dr

- 3714 E 17th Ave

- 1701 Aleutian St

- 000 Tr A Thurston

- 3964 Reka Dr Unit D3

- 4010 Reka Dr Unit F6

- 1715 Katrina Cir

- 1760 Eastridge Dr

- 1711 Russian Jack Dr Unit B4

- 2007 Parkview Cir

- 2068 Cliffside Dr Unit 11

- 4011 San Roberto Ave

- 1655 Sitka St Unit 103

- 4660 Reka Dr Unit D8

- 2124 Sorbus Way

- 4333 San Ernesto Ave Unit 207A

- 3225 E 18th Cir

- 3205 E 18th Cir

- 3216 E 17th Ave

- 3226 E 17th Ave

- 3206 E 17th Ave

- 3226 E 18th Cir

- 3155 E 18th Cir

- 3236 E 17th Ave

- 3136 E 17th Ave

- 3306 E 17th Ave

- 3149 E 18th Cir

- 1724 Rosemary St

- 3206 E 18th Cir

- 3216 E 18th Cir

- 3126 E 17th Ave

- 3154 E 18th Cir

- 1806 Rosemary St

- 1710 Rosemary St

- 3137 E 18th Cir

- 3215 E 17th Ave