Estimated Value: $193,369 - $200,000

4

Beds

2

Baths

893

Sq Ft

$220/Sq Ft

Est. Value

About This Home

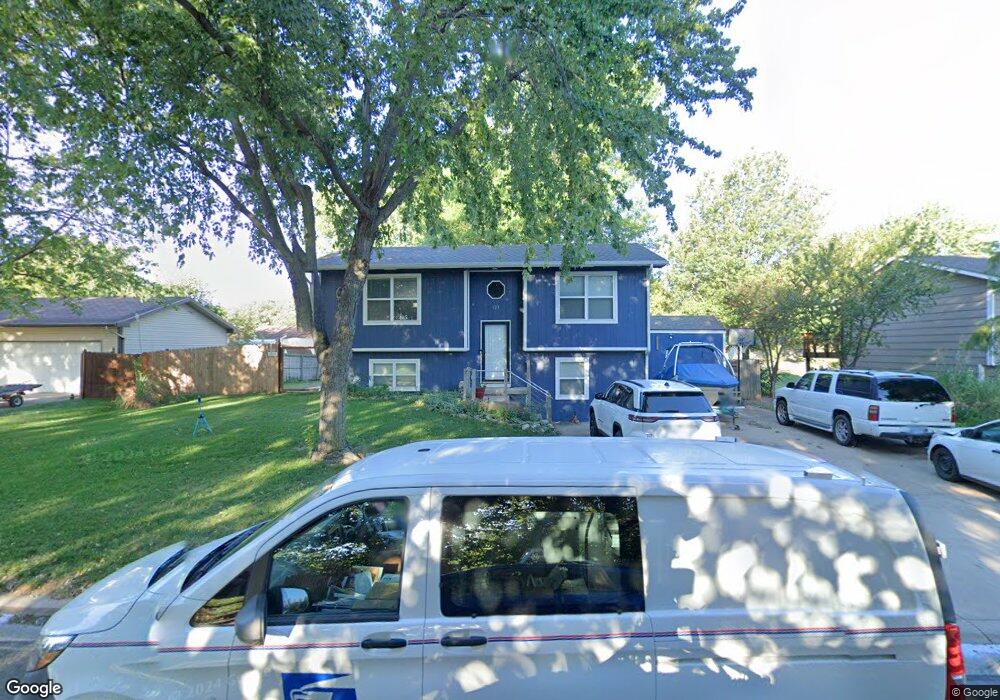

This home is located at 323 Shon St, Maize, KS 67101 and is currently estimated at $196,685, approximately $220 per square foot. 323 Shon St is a home located in Sedgwick County with nearby schools including Maize Middle School and Maize High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 16, 2018

Sold by

Deberry Jason and Deberry Misti

Bought by

Deberry Jason L and Deberry Misti

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,579

Outstanding Balance

$82,703

Interest Rate

5.62%

Mortgage Type

FHA

Estimated Equity

$113,982

Purchase Details

Closed on

Oct 6, 2006

Sold by

Blanton Cahrles L

Bought by

Deberry Jason and Deberry Jessica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,200

Interest Rate

6.47%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 17, 2000

Sold by

Blanton Kimberly K

Bought by

Blanton Charles L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deberry Jason L | -- | Security 1St Title Llc | |

| Deberry Jason | -- | None Available | |

| Blanton Charles L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Deberry Jason L | $92,579 | |

| Closed | Deberry Jason | $79,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,571 | $19,493 | $5,014 | $14,479 |

| 2023 | $2,571 | $15,825 | $2,289 | $13,536 |

| 2022 | $2,207 | $14,789 | $2,162 | $12,627 |

| 2021 | $2,133 | $14,088 | $2,162 | $11,926 |

| 2020 | $1,987 | $13,168 | $2,162 | $11,006 |

| 2019 | $1,925 | $12,788 | $2,162 | $10,626 |

| 2018 | $1,820 | $12,064 | $1,553 | $10,511 |

| 2017 | $1,830 | $0 | $0 | $0 |

| 2016 | $1,756 | $0 | $0 | $0 |

| 2015 | $1,676 | $0 | $0 | $0 |

| 2014 | $1,659 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 319 Jonathan St

- 415 S Sweetwater Rd

- 432 S Sweetwater Rd

- 403 S Sweetwater Rd

- 429 S Longbranch Dr

- 721 High Plains Cir

- 300 W Albert St Unit 4

- 10730 W 53rd St N

- 613 S Sweetwater Cir

- 11.6+/- Acres W 45th St N

- 634 S Sweetwater Rd

- 907 S James Ct

- 903 Stetson Cir

- 5463 Brisk Bay Ct

- 5468 N Briskbay Ct

- 5591 Wandering Way

- 5561 Wandering Way

- 5465 Brisk Bay Ct

- 628 S Longbranch Dr

- 5563 Wandering Way

Your Personal Tour Guide

Ask me questions while you tour the home.