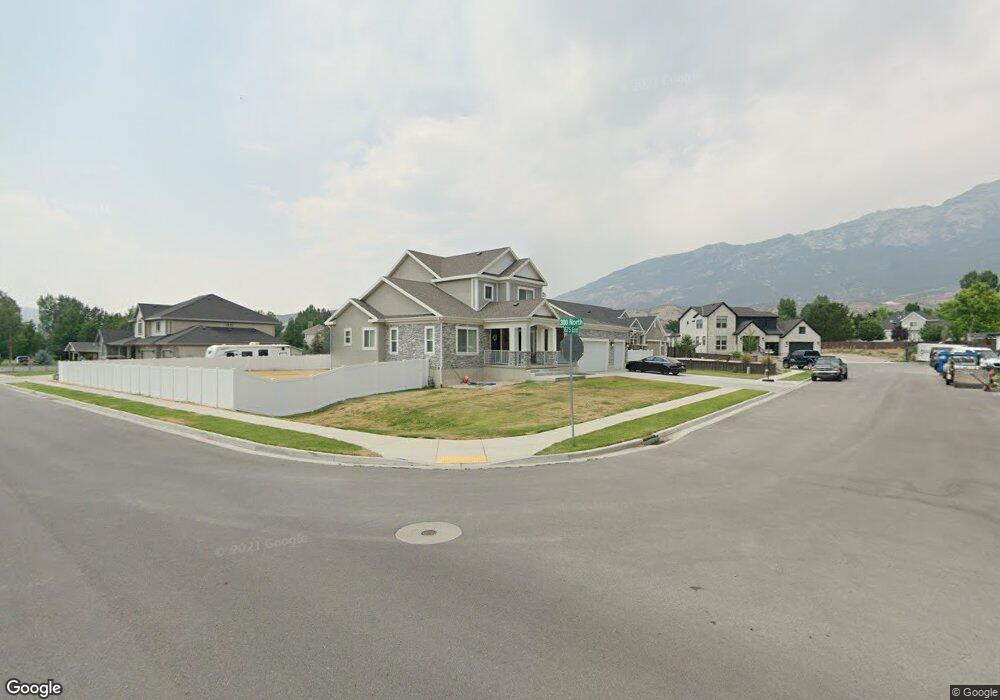

325 N 675 E Alpine, UT 84004

Estimated Value: $1,420,000 - $1,483,000

6

Beds

5

Baths

4,441

Sq Ft

$326/Sq Ft

Est. Value

About This Home

This home is located at 325 N 675 E, Alpine, UT 84004 and is currently estimated at $1,446,112, approximately $325 per square foot. 325 N 675 E is a home located in Utah County with nearby schools including Alpine School, Timberline Middle School, and Lone Peak High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 25, 2022

Sold by

Jonathan Orton

Bought by

Orton Jonathan and Orton Tammy Jeanne

Current Estimated Value

Purchase Details

Closed on

Apr 20, 2022

Sold by

Roberts Aaron D

Bought by

Orton Jonathan and Orton Tammy Jeanne

Purchase Details

Closed on

Mar 30, 2022

Sold by

Aaron Roberts

Bought by

Terramichelle Homes Inc

Purchase Details

Closed on

Mar 10, 2020

Sold by

Ivory Homes Lt

Bought by

Roberts Aaron D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$625,500

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 31, 2019

Sold by

Ivory Development Llc

Bought by

Ivory Homes Ltd

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Orton Jonathan | -- | Gt Title Services | |

| Orton Jonathan | -- | None Listed On Document | |

| Terramichelle Homes Inc | -- | Gt Title Services | |

| Roberts Aaron D | -- | Cottonwood Title | |

| Ivory Homes Ltd | -- | Cottonwood Ttl Ins Agcy Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Roberts Aaron D | $625,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,347 | $711,040 | -- | -- |

| 2024 | $4,883 | $623,205 | $0 | $0 |

| 2023 | $4,883 | $610,995 | $0 | $0 |

| 2022 | $4,609 | $560,120 | $0 | $0 |

| 2021 | $4,209 | $794,500 | $367,500 | $427,000 |

| 2020 | $3,765 | $695,500 | $319,600 | $375,900 |

| 2019 | $3,013 | $319,600 | $319,600 | $0 |

| 2018 | $2,744 | $287,600 | $287,600 | $0 |

Source: Public Records

Map

Nearby Homes

- 887 E Village Way

- 475 Grove Dr

- 202 E Alpine Dr

- 1063 E Alpine Dr

- 512 Eastridge Cir

- 48 N 100 E

- 30 S Main St

- 986 N Sunbrook Cir

- 76 N Bald Mountain Dr

- 151 Glacier Lily Dr

- 381 E Watkins Cir Unit 28

- 463 Heritage Hills Dr

- 382 E Heritage Hills Dr

- 196 Holly Dr

- 250 S Main St Unit 25

- 250 S Main St Unit 20

- 250 S Main St Unit 9

- 250 S Main St Unit 7

- 19 E Elk Ct

- 1319 N Eastview Ln Unit 214

Your Personal Tour Guide

Ask me questions while you tour the home.