3310 Stewart Rd Oswego, IL 60543

South Oswego NeighborhoodEstimated Value: $578,000 - $668,840

4

Beds

4

Baths

2,582

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 3310 Stewart Rd, Oswego, IL 60543 and is currently estimated at $633,460, approximately $245 per square foot. 3310 Stewart Rd is a home located in Kendall County with nearby schools including Grande Park Elementary School, Murphy Junior High School, and Oswego East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2024

Sold by

Dunne Revocable Living Trust and Dunne Patrick

Bought by

Dunne Anna

Current Estimated Value

Purchase Details

Closed on

May 11, 2007

Sold by

Dunne Robert E and Dunne Mary J

Bought by

Dunne Robert E and Dunne Mary J

Purchase Details

Closed on

Feb 17, 2006

Sold by

Conlin Patricia

Bought by

Harmony Land Development Inc

Purchase Details

Closed on

Jan 13, 2004

Sold by

Conlin C Barry and Conlin Patricia

Bought by

Patricia Conlin Living Trust

Purchase Details

Closed on

Jun 21, 1997

Sold by

Mary J Dunne Trust

Bought by

Mary J Dunne Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dunne Anna | $600,000 | None Listed On Document | |

| Dunne Robert E | -- | None Available | |

| Dunne Robert E | -- | None Available | |

| Dunne Mary J | -- | None Available | |

| Harmony Land Development Inc | -- | None Available | |

| Patricia Conlin Living Trust | -- | Chicago Title Insurance Co | |

| Conlin C Barry | $380,000 | Chicago Title Insurance Co | |

| Mary J Dunne Trust | -- | Chicago Title Insurance Co |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,231 | $144,743 | $25,728 | $119,015 |

| 2023 | $11,403 | $144,553 | $25,538 | $119,015 |

| 2022 | $11,403 | $144,373 | $25,358 | $119,015 |

| 2021 | $10,952 | $134,964 | $23,642 | $111,322 |

| 2020 | $11,157 | $130,994 | $22,873 | $108,121 |

| 2019 | $11,797 | $130,874 | $22,753 | $108,121 |

| 2018 | $11,223 | $130,031 | $22,504 | $107,527 |

| 2017 | $11,009 | $125,025 | $21,579 | $103,446 |

| 2016 | $5,254 | $118,544 | $20,417 | $98,127 |

| 2015 | $10,199 | $110,854 | $19,054 | $91,800 |

| 2014 | -- | $107,104 | $18,780 | $88,324 |

| 2013 | -- | $108,027 | $18,825 | $89,202 |

Source: Public Records

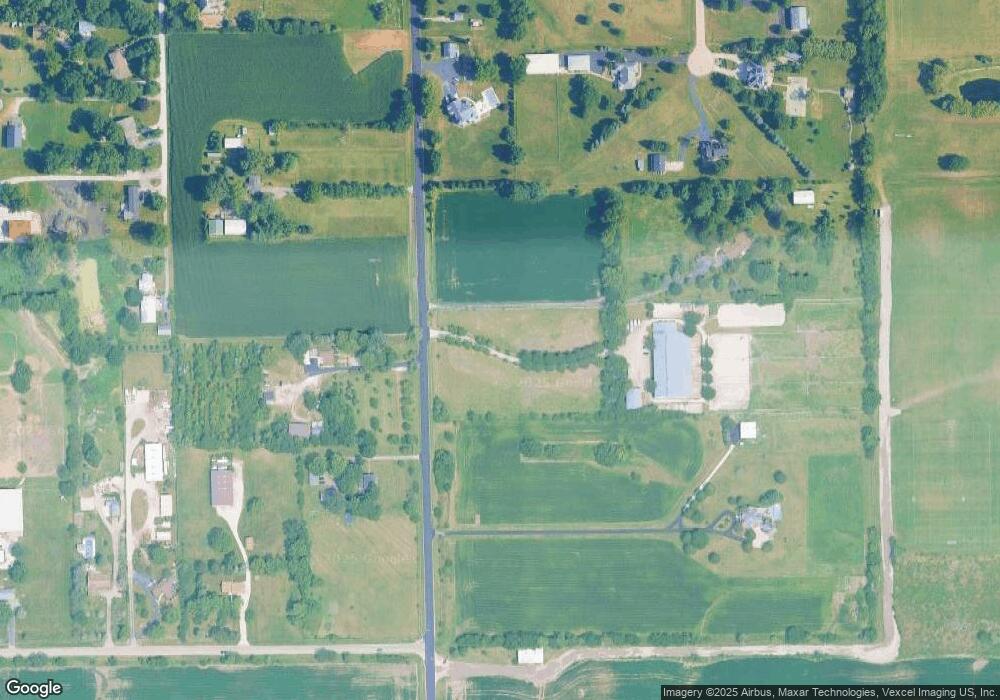

Map

Nearby Homes

- 171 Henderson St

- 169 Henderson St

- 167 Henderson St

- 608 Murdock Place

- 606 Murdock Place

- 604 Murdock Place

- 163 Henderson St

- 613 Murdock Place

- 611 Murdock Place

- 609 Murdock Place

- 607 Murdock Place

- 159 Henderson St

- 603 Murdock Place

- Ontario Plan at Hudson Pointe - II - Landmark Series

- Galveston Plan at Hudson Pointe - II - Landmark Series

- Raleigh Plan at Hudson Pointe - II - Landmark Series

- Siena II Plan at Hudson Pointe - II - Landmark Series

- Brooklyn Plan at Hudson Pointe - II - Landmark Series

- Ridgefield Plan at Hudson Pointe - II - Landmark Series

- Westbury Plan at Hudson Pointe - II - Landmark Series

Your Personal Tour Guide

Ask me questions while you tour the home.