33108 Village 33 Unit 33 Camarillo, CA 93012

Estimated Value: $573,202 - $663,000

2

Beds

2

Baths

951

Sq Ft

$635/Sq Ft

Est. Value

About This Home

This home is located at 33108 Village 33 Unit 33, Camarillo, CA 93012 and is currently estimated at $604,051, approximately $635 per square foot. 33108 Village 33 Unit 33 is a home located in Ventura County with nearby schools including Tierra Linda Elementary School, Las Colinas Middle School, and Adolfo Camarillo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 6, 2010

Sold by

King Eva Maria and Eva King Revocable Trust

Bought by

King Eva and The Eva King Living Trust

Current Estimated Value

Purchase Details

Closed on

Jan 28, 2010

Sold by

Epstein Mona Golden and The Anne R Golden Living Trust

Bought by

King Eva Maria and Eva M King Revocable Trust

Purchase Details

Closed on

Jun 27, 2006

Sold by

Golden Anne R

Bought by

Golden Anne R and Anne R Golden Trust

Purchase Details

Closed on

Dec 20, 2002

Sold by

Golden Anne R and Golden Carol J

Bought by

Golden Anne R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,000

Interest Rate

5.96%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King Eva | -- | None Available | |

| King Eva Maria | $235,000 | First American Title | |

| Golden Anne R | -- | None Available | |

| Golden Anne R | $4,000 | Lawyers Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Golden Anne R | $38,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,389 | $222,524 | $71,435 | $151,089 |

| 2024 | $2,389 | $218,161 | $70,034 | $148,127 |

| 2023 | $2,303 | $213,884 | $68,661 | $145,223 |

| 2022 | $2,295 | $209,691 | $67,315 | $142,376 |

| 2021 | $2,211 | $205,580 | $65,995 | $139,585 |

| 2020 | $2,203 | $203,473 | $65,319 | $138,154 |

| 2019 | $2,192 | $199,485 | $64,039 | $135,446 |

| 2018 | $2,150 | $195,575 | $62,784 | $132,791 |

| 2017 | $2,023 | $191,741 | $61,553 | $130,188 |

| 2016 | $1,974 | $187,983 | $60,347 | $127,636 |

| 2015 | $1,952 | $185,162 | $59,442 | $125,720 |

| 2014 | $1,906 | $181,537 | $58,279 | $123,258 |

Source: Public Records

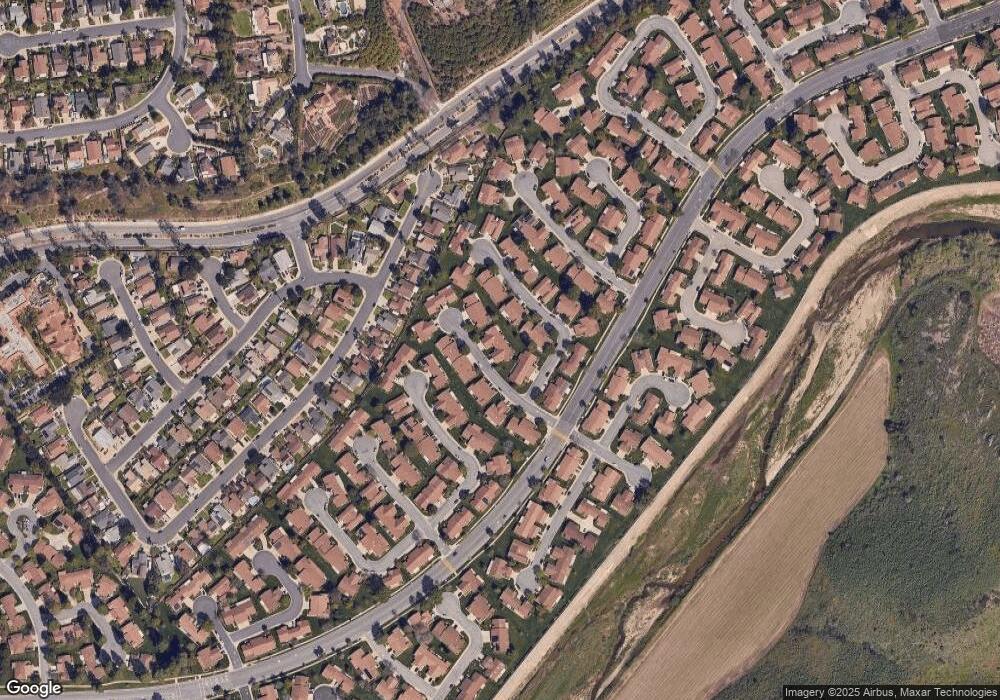

Map

Nearby Homes

- 31328 Village 31

- 33229 Village 33

- 31310 Village 31 Unit 31

- 33208 Village 33 Unit 33

- 34135 Village 34

- 35205 Village 35

- 35124 Village 35

- 29221 Village 29

- 37203 Village 37

- 40036 Village 40 Unit 40

- 15122 Village 15 Unit 15

- 15413 Village 15

- 6169 Arabian Place

- 42025 Village 42 Unit 42

- 1460 Frazier St

- 25126 Village 25

- 41045 Village 41

- 11225 Village 11

- 23132 Village 23

- 1575 Frazier St

- 33106 Village 33

- 33110 Village 33

- 33112 Village 33

- 33203 Village 33

- 33201 Village 33

- 33114 Leisure Village Dr

- 33217 Village 33 Unit 33

- 33219 Village 33

- 33113 Village 33 Unit 33

- 33113 Village 33

- 33111 Village 33

- 33221 Village 33 Unit 33

- 33115 Village 33

- 33215 Village 33 Unit 33

- 33109 Village 33 Unit 33

- 33109 Village 33

- 33117 Village 33

- 33116 Village 33 Unit 33

- 33223 Village 33

- 33107 Village 33