3321 Printemps Dr Modesto, CA 95356

Estimated Value: $897,000 - $1,418,000

4

Beds

3

Baths

3,633

Sq Ft

$316/Sq Ft

Est. Value

About This Home

This home is located at 3321 Printemps Dr, Modesto, CA 95356 and is currently estimated at $1,146,768, approximately $315 per square foot. 3321 Printemps Dr is a home located in Stanislaus County with nearby schools including Salida Elementary School, Salida Middle School - Vella Campus, and Joseph A. Gregori High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 16, 2006

Sold by

Obrien Charles M and Obrien Kristi L

Bought by

Obrien Charles Mitchell and Obrien Kristi Leann

Current Estimated Value

Purchase Details

Closed on

Aug 4, 1998

Sold by

Obrien Charles M

Bought by

Obrien Charles M and Obrien Kristi L

Purchase Details

Closed on

Apr 8, 1998

Sold by

Barzan Richard and Barzan Lelia June

Bought by

Obrien Charles M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$488,000

Interest Rate

7.13%

Purchase Details

Closed on

Jun 25, 1997

Sold by

Silicon Valley Bank

Bought by

Barzan Richard and Barzan Lelia June

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Obrien Charles Mitchell | -- | None Available | |

| Obrien Charles M | -- | -- | |

| Obrien Charles M | $465,000 | Chicago Title Co | |

| Barzan Richard | -- | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Obrien Charles M | $488,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,644 | $784,796 | $159,668 | $625,128 |

| 2024 | $8,481 | $769,409 | $156,538 | $612,871 |

| 2023 | $8,329 | $754,323 | $153,469 | $600,854 |

| 2022 | $7,949 | $739,533 | $150,460 | $589,073 |

| 2021 | $7,841 | $725,033 | $147,510 | $577,523 |

| 2020 | $7,535 | $717,600 | $145,998 | $571,602 |

| 2019 | $7,453 | $703,531 | $143,136 | $560,395 |

| 2018 | $7,294 | $689,737 | $140,330 | $549,407 |

| 2017 | $7,125 | $676,214 | $137,579 | $538,635 |

| 2016 | $6,983 | $662,956 | $134,882 | $528,074 |

| 2015 | $6,894 | $652,998 | $132,856 | $520,142 |

| 2014 | $6,761 | $640,208 | $130,254 | $509,954 |

Source: Public Records

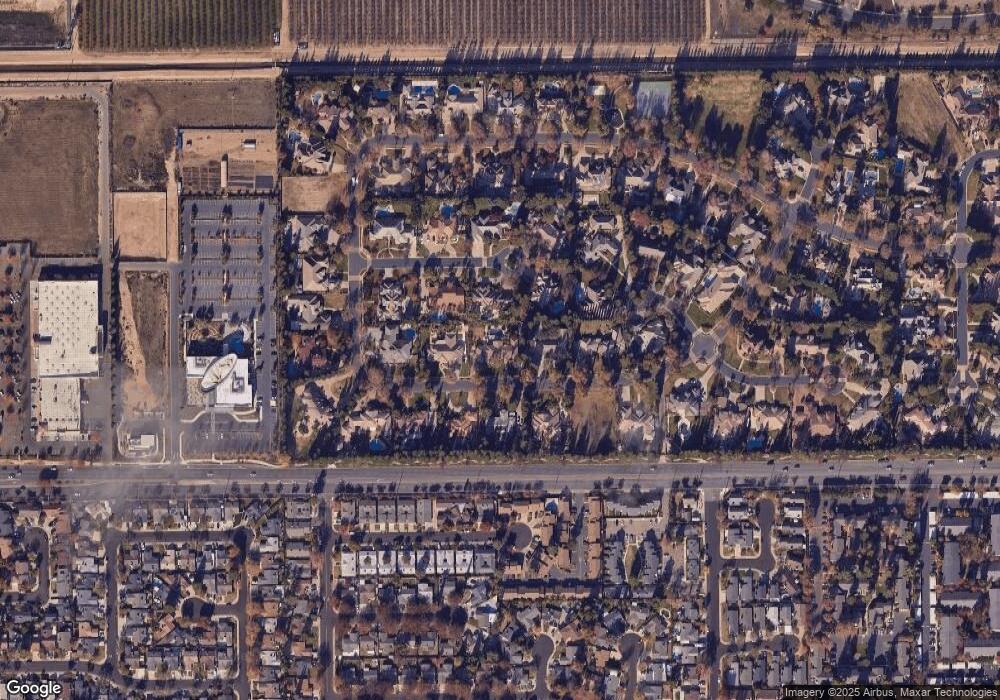

Map

Nearby Homes

- 3308 Printemps Dr

- 4005 Honey Creek Rd

- 4133 Gagos Dr

- 4045 Dale Rd Unit C

- 1517 Luminous St

- 1500 Aspire Way

- 1540 Aspire Way

- 4368 Icon Ave

- 4005 Dale Rd Unit D

- 3913 Peacock Ln

- 3937 Dale Rd Unit A

- 3921 Mesrob Ct

- 3221 Showcase Way

- 3264 Showcase Way

- 3628 Landmark Cir

- 3424 Vintage Dr Unit 152

- 3424 Vintage Dr Unit 238

- 3400 Sullivan Ct Unit 120

- 3400 Sullivan Ct Unit 105

- 3733 Beachler Dr

- 3204 Papillon Ct

- 3325 Printemps Dr

- 3317 Printemps Dr

- 3208 Papillon Ct

- 3200 Papillon Ct

- 3320 Printemps Dr

- 3324 Printemps Dr

- 3316 Printemps Dr

- 3329 Printemps Dr

- 3312 Printemps Dr

- 3313 Printemps Dr

- 3328 Printemps Dr

- 3212 Bouquet Ct

- 4208 Papillon Dr

- 3205 Papillon Ct

- 3201 Papillon Ct

- 3209 Papillon Ct

- 3213 Bouquet Ct

- 3332 Printemps Dr

- 3200 Bouquet Ct