3329 Kimberly Way San Mateo, CA 94403

Los Prados NeighborhoodEstimated Value: $1,336,000 - $1,739,000

3

Beds

2

Baths

1,450

Sq Ft

$1,069/Sq Ft

Est. Value

About This Home

This home is located at 3329 Kimberly Way, San Mateo, CA 94403 and is currently estimated at $1,550,343, approximately $1,069 per square foot. 3329 Kimberly Way is a home located in San Mateo County with nearby schools including Parkside Montessori (PK-8), Bayside Academy, and Hillsdale High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2022

Sold by

Lau Julian

Bought by

Chau Lau Family Trust

Current Estimated Value

Purchase Details

Closed on

Jul 20, 2009

Sold by

Chau Christine W

Bought by

Lau Julian

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Interest Rate

5.17%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 20, 2002

Sold by

Lau Julian and Chay Christine Wing Yee

Bought by

Lau Julian

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,700

Interest Rate

6.16%

Purchase Details

Closed on

Oct 10, 2000

Sold by

Kathleen Kaufmann and Kathleen Warren A

Bought by

Kaufmann Warren A and Kaufmann Kathleen

Purchase Details

Closed on

Nov 20, 1998

Sold by

Kaufmann Warren A and Kaufmann Kathleen

Bought by

Lau Julian

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$368,000

Interest Rate

6.97%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chau Lau Family Trust | -- | -- | |

| Lau Julian | -- | Fidelity National Title Co | |

| Lau Julian | -- | Fidelity National Title | |

| Kaufmann Warren A | -- | -- | |

| Lau Julian | $567,272 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lau Julian | $272,000 | |

| Previous Owner | Lau Julian | $300,700 | |

| Previous Owner | Lau Julian | $368,000 | |

| Closed | Lau Julian | $75,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,343 | $855,864 | $427,932 | $427,932 |

| 2023 | $11,343 | $822,632 | $411,316 | $411,316 |

| 2022 | $10,857 | $806,502 | $403,251 | $403,251 |

| 2021 | $10,608 | $790,690 | $395,345 | $395,345 |

| 2020 | $10,134 | $782,584 | $391,292 | $391,292 |

| 2019 | $9,778 | $767,240 | $383,620 | $383,620 |

| 2018 | $9,247 | $752,198 | $376,099 | $376,099 |

| 2017 | $8,914 | $737,450 | $368,725 | $368,725 |

| 2016 | $8,867 | $722,992 | $361,496 | $361,496 |

| 2015 | $8,638 | $712,132 | $356,066 | $356,066 |

| 2014 | $8,346 | $698,184 | $349,092 | $349,092 |

Source: Public Records

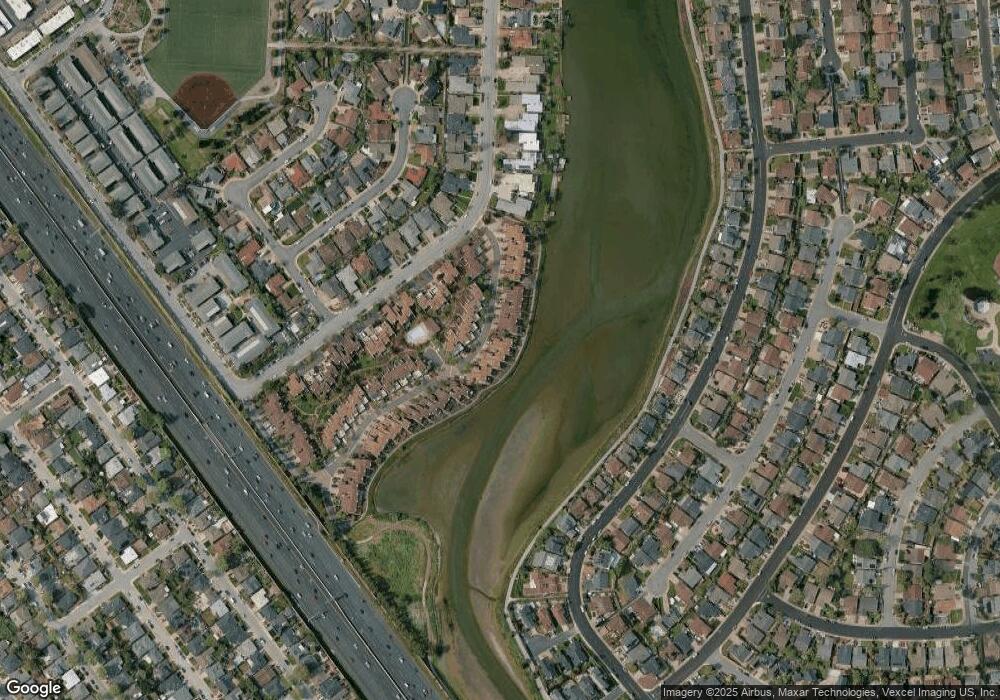

Map

Nearby Homes

- 3415 La Selva St

- 3221 Llano St

- 345 E 39th Ave

- 667 Sandy Hook Ct

- 3513 Casanova Dr

- 917 Laguna Cir

- 3045 Los Prados St Unit 218

- 3015 Los Prados St Unit 114

- 3001 Los Prados St Unit 104

- 194 Beach Park Blvd

- 366 Treasure Island Dr

- 94 E 39th Ave

- 801 Ram Ln

- 879 Carina Ln

- 101 Blossom Cir Unit H

- 619 Mystic Ln

- 58 E 39th Ave

- 53 E 39th Ave

- 2736 Foster St

- 739 Aries Ln

- 3327 Kimberly Way

- 3331 Kimberly Way

- 3333 Kimberly Way

- 3325 Kimberly Way

- 3335 Kimberly Way

- 3323 Kimberly Way

- 3337 Kimberly Way

- 3321 Kimberly Way

- 3316 Kimberly Way

- 3318 Kimberly Way

- 3314 Kimberly Way

- 3319 Kimberly Way

- 3320 Kimberly Way

- 3312 Kimberly Way

- 3322 Kimberly Way

- 3317 Kimberly Way

- 3310 Kimberly Way

- 3339 Kimberly Way

- 3315 Kimberly Way

- 3308 Kimberly Way