Estimated Value: $532,000 - $719,000

3

Beds

2

Baths

1,856

Sq Ft

$332/Sq Ft

Est. Value

About This Home

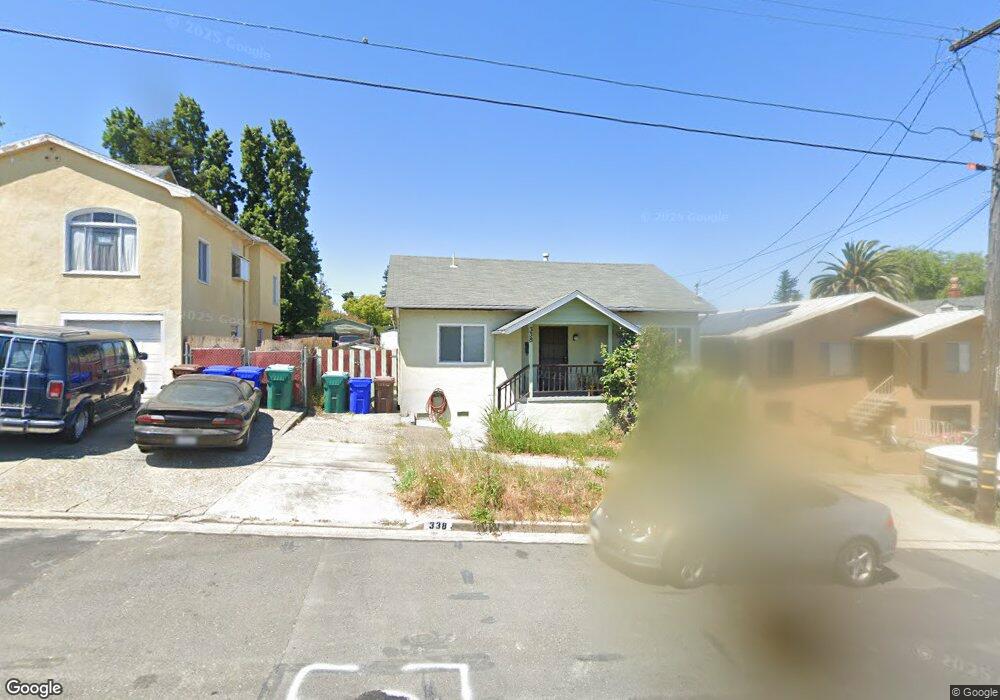

This home is located at 338 Lake Ave, Rodeo, CA 94572 and is currently estimated at $615,859, approximately $331 per square foot. 338 Lake Ave is a home located in Contra Costa County with nearby schools including Rodeo Hills Elementary School, Carquinez Middle School, and John Swett High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 28, 2001

Sold by

West Bay Development Inc

Bought by

Zeng Jia Li and Liang Anita Run Xian

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Outstanding Balance

$68,735

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$547,124

Purchase Details

Closed on

Jul 18, 2001

Sold by

Childers Susan Bobette

Bought by

West Bay Development Inc

Purchase Details

Closed on

Aug 27, 1999

Sold by

Fern Villalobos

Bought by

Villalobos Fern

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,750

Interest Rate

7.47%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zeng Jia Li | $215,000 | First American Title Guarant | |

| West Bay Development Inc | $134,000 | First American Title Guarant | |

| Villalobos Fern | -- | Fidelity National Title Co | |

| Villalobos Fern | -- | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zeng Jia Li | $172,000 | |

| Previous Owner | Villalobos Fern | $114,750 | |

| Closed | Zeng Jia Li | $21,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,822 | $375,026 | $228,971 | $146,055 |

| 2024 | $5,761 | $367,674 | $224,482 | $143,192 |

| 2023 | $5,761 | $360,466 | $220,081 | $140,385 |

| 2022 | $5,626 | $353,399 | $215,766 | $137,633 |

| 2021 | $5,522 | $346,471 | $211,536 | $134,935 |

| 2019 | $5,387 | $336,196 | $205,262 | $130,934 |

| 2018 | $5,244 | $329,605 | $201,238 | $128,367 |

| 2017 | $5,150 | $323,143 | $197,293 | $125,850 |

| 2016 | $4,738 | $316,808 | $193,425 | $123,383 |

| 2015 | $4,698 | $312,050 | $190,520 | $121,530 |

| 2014 | $4,069 | $256,000 | $156,299 | $99,701 |

Source: Public Records

Map

Nearby Homes

- 343 Rodeo Ave

- 201 Lake Ave

- 150 Rodeo Ave

- 808 4th St

- 220 Vaqueros Ave

- 544 Napa Ave

- 715 Mariposa Ave

- 60 Railroad Ave

- 832 Mariposa Ave

- 1124 Mahoney St

- 725 Vaqueros Ave

- 1186 Waverly Cir

- 836 Hawthorne Dr

- 867 Hawthorne Dr

- 1006 Chelsea

- 943 Coral Ridge Cir

- 802 Dover

- 817 Ketch Ct

- 1861 Shasta Ln

- 996 Coral Ridge Cir