338 Modesta Rd Columbus, OH 43213

East Broad NeighborhoodEstimated Value: $330,000 - $381,000

3

Beds

3

Baths

2,376

Sq Ft

$149/Sq Ft

Est. Value

About This Home

This home is located at 338 Modesta Rd, Columbus, OH 43213 and is currently estimated at $352,886, approximately $148 per square foot. 338 Modesta Rd is a home located in Franklin County with nearby schools including Lincoln Elementary School, Gahanna South Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 14, 2016

Sold by

Jimenez Sandra and Hernandez Jose

Bought by

Nunez Morales Norberto

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,000

Outstanding Balance

$135,678

Interest Rate

3.42%

Mortgage Type

New Conventional

Estimated Equity

$217,208

Purchase Details

Closed on

Sep 9, 2010

Sold by

Secretary Of Housing & Urban Development

Bought by

Jimenez Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,103

Interest Rate

4.5%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 20, 2010

Sold by

King Krysta M and The Krysta M King Trust

Bought by

Flagstar Bank Fsb

Purchase Details

Closed on

Dec 28, 2009

Sold by

Flagstar Bank Fsb

Bought by

Secretary Of Housing & Urban Development

Purchase Details

Closed on

Nov 30, 2007

Sold by

M/I Homes Of Central Ohio Llc

Bought by

King Krysta M and The Krysta M King Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,914

Interest Rate

6.31%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nunez Morales Norberto | $178,000 | None Available | |

| Jimenez Sandra | $142,356 | Lakeside Ti | |

| Flagstar Bank Fsb | $108,000 | Attorney | |

| Secretary Of Housing & Urban Development | -- | Ohio Title | |

| King Krysta M | $179,800 | Transohio |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nunez Morales Norberto | $169,000 | |

| Previous Owner | Jimenez Sandra | $140,103 | |

| Previous Owner | King Krysta M | $176,914 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,646 | $111,770 | $29,760 | $82,010 |

| 2023 | $5,566 | $111,755 | $29,750 | $82,005 |

| 2022 | $4,810 | $76,480 | $13,130 | $63,350 |

| 2021 | $4,817 | $76,480 | $13,130 | $63,350 |

| 2020 | $4,771 | $76,480 | $13,130 | $63,350 |

| 2019 | $3,754 | $61,190 | $10,510 | $50,680 |

| 2018 | $3,427 | $61,190 | $10,510 | $50,680 |

| 2017 | $3,262 | $61,190 | $10,510 | $50,680 |

| 2016 | $3,131 | $51,630 | $11,310 | $40,320 |

| 2015 | $3,133 | $51,630 | $11,310 | $40,320 |

| 2014 | $3,104 | $51,630 | $11,310 | $40,320 |

| 2013 | $45 | $1,505 | $1,505 | $0 |

Source: Public Records

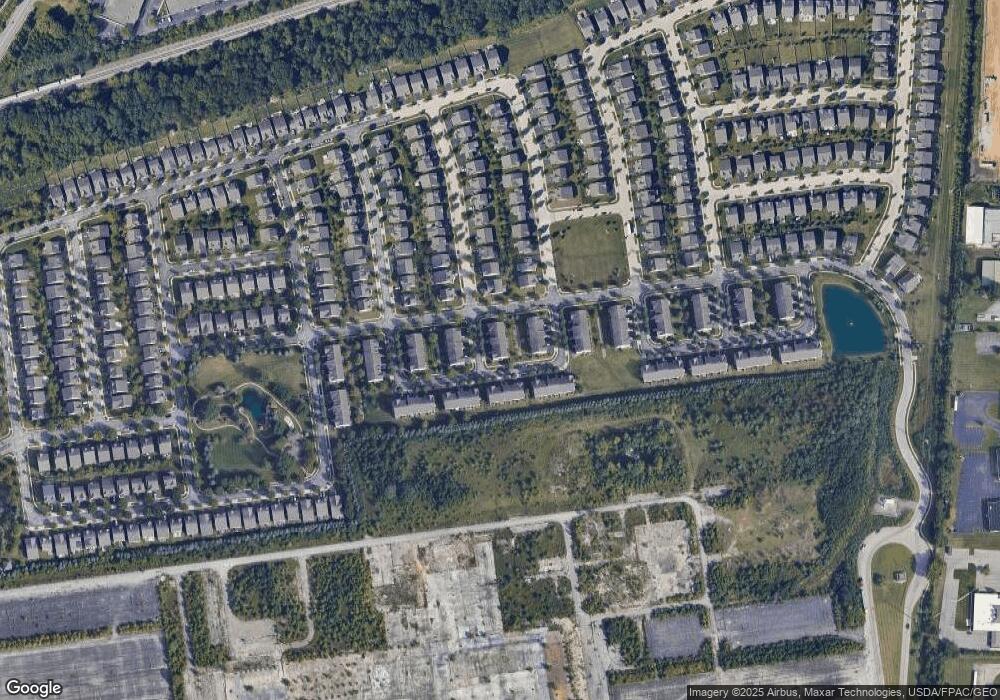

Map

Nearby Homes

- 6115 Pasqual Ave

- 414 Junction Crossing Dr

- 6396 Hoffman Trace Dr

- 875 Taylor Station Rd

- 970 Claycraft Rd

- 152 Stornoway Dr E

- 187 McNaughten Rd

- 6299 McNaughten Place Ln Unit 30

- 134 Villamere Dr Unit 7

- 6534 Timbermill Way

- 6400 Firethorn Ave

- 6503 Flaxton Ct

- 5882 Timber Dr

- 6924 Shady Rock Ln

- 5966 Whitman Rd

- 6610 Olivetree Ct

- 6355 Taylor Rd

- 489 Stone Shadow Dr

- 6377 Hilltop Ave

- 6073 Nicholas Glen

- 340 Modesta Rd

- 336 Modesta Rd

- 342 Modesta Rd

- 344 Modesta Rd

- 335 Giovanna Ave

- 333 Giovanna Ave

- 331 Giovanna Ave

- 331 Giovanna Ave Unit 158

- 337 Giovanna Ave

- 339 Modesta Rd

- 343 Modesta Rd

- 339 Giovanna Ave

- 341 Modesta Rd

- 279 Modesta Rd

- 337 Modesta Rd

- 6189 Cenpac Ave

- 6187 Cenpac Ave

- 6185 Cenpac Ave

- 6193 Cenpac Ave

- 345 Modesta Rd