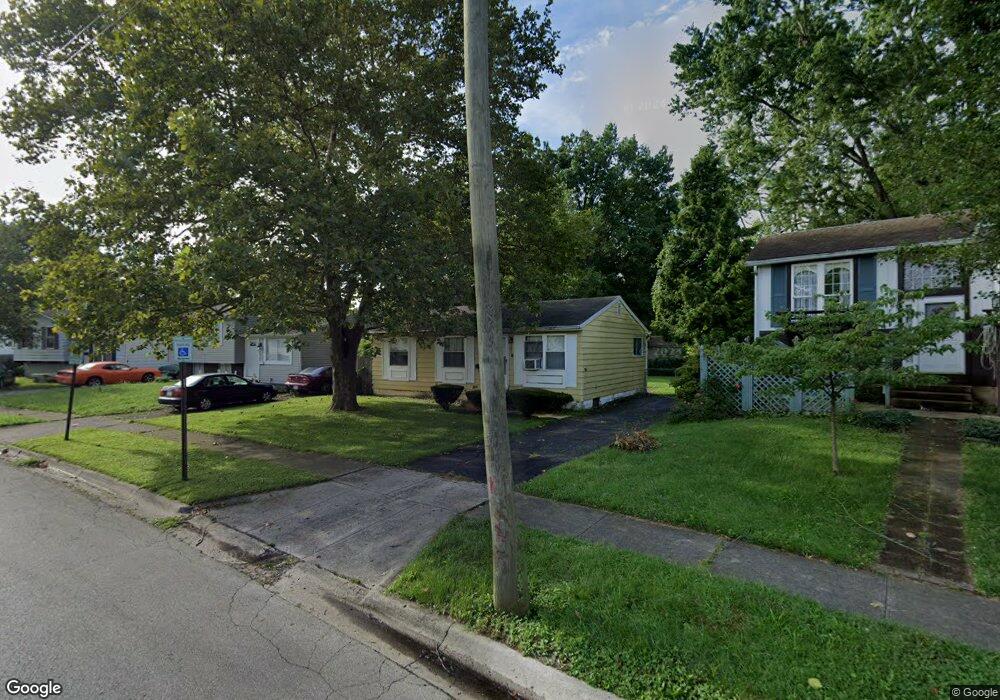

3395 Oakcrest Rd Columbus, OH 43232

Glenbrook NeighborhoodEstimated Value: $164,000 - $204,985

3

Beds

2

Baths

1,236

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 3395 Oakcrest Rd, Columbus, OH 43232 and is currently estimated at $186,246, approximately $150 per square foot. 3395 Oakcrest Rd is a home located in Franklin County with nearby schools including Easthaven Elementary School, Yorktown Middle School, and Independence High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 11, 2006

Sold by

Fannie Mae

Bought by

Peters James

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,000

Outstanding Balance

$43,001

Interest Rate

6.48%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$143,245

Purchase Details

Closed on

Aug 8, 2005

Sold by

Prince Sheila M

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Sep 29, 2003

Sold by

Estate Of Calvin Prince

Bought by

Prince Sheila M

Purchase Details

Closed on

Aug 24, 1998

Sold by

Prince Sheila M

Bought by

Prince Calvin and Prince Sheila M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,300

Interest Rate

7.03%

Purchase Details

Closed on

Aug 21, 1996

Sold by

Baier Thomas L

Bought by

Sheila M Prince

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,963

Interest Rate

8.47%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 20, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Peters James | $76,000 | Title First | |

| Federal National Mortgage Association | $47,000 | -- | |

| Prince Sheila M | -- | -- | |

| Prince Calvin | -- | -- | |

| Sheila M Prince | $62,000 | -- | |

| -- | $49,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Peters James | $76,000 | |

| Previous Owner | Prince Calvin | $69,300 | |

| Previous Owner | Sheila M Prince | $61,963 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,621 | $52,400 | $17,850 | $34,550 |

| 2024 | $2,621 | $52,400 | $17,850 | $34,550 |

| 2023 | $2,521 | $52,395 | $17,850 | $34,545 |

| 2022 | $1,266 | $21,000 | $7,210 | $13,790 |

| 2021 | $1,482 | $21,000 | $7,210 | $13,790 |

| 2020 | $1,345 | $21,000 | $7,210 | $13,790 |

| 2019 | $1,278 | $15,930 | $5,740 | $10,190 |

| 2018 | $1,284 | $15,930 | $5,740 | $10,190 |

| 2017 | $1,040 | $15,930 | $5,740 | $10,190 |

| 2016 | $1,532 | $21,810 | $5,010 | $16,800 |

| 2015 | $1,429 | $21,810 | $5,010 | $16,800 |

| 2014 | $1,315 | $21,810 | $5,010 | $16,800 |

| 2013 | $683 | $22,960 | $5,285 | $17,675 |

Source: Public Records

Map

Nearby Homes

- 2275 Cardston Ct

- 2251 Meridian Ct

- 3466 Westpoint Dr

- 0 Rotunda Dr Unit 271

- 3745 Wynds Dr

- 2278 Wadsworth Dr Unit D

- 3830 Charbonnett Ct Unit 6-A

- 3036 Wadsworth Ct

- 3038 Wadsworth Ct

- 1884 Barnett Ct W

- 2942 Arrowhead Ct

- 2970 Askins Rd

- 4375 Refugee Rd

- 3325 E Deshler Ave

- 2825 S Hampton Rd

- 2813 Kingsrowe Ct Unit 43

- 3428 LIV Moor Dr

- 3457 Roswell Dr

- 1679 Penfield Rd

- 3068 Marwick Rd

- 3389 Oakcrest Rd

- 3401 Oakcrest Rd

- 3407 Oakcrest Rd

- 3383 Oakcrest Rd

- 3386 Bruceton Ave

- 3380 Bruceton Ave

- 3394 Bruceton Ave

- 3374 Bruceton Ave

- 3400 Bruceton Ave

- 3413 Oakcrest Rd

- 3368 Bruceton Ave

- 3404 Oakcrest Rd

- 3396 Oakcrest Rd

- 3375 Oakcrest Rd

- 3406 Bruceton Ave

- 3388 Oakcrest Rd

- 3412 Oakcrest Rd

- 3419 Oakcrest Rd

- 3361 Kenaston Dr

- 3362 Bruceton Ave

Your Personal Tour Guide

Ask me questions while you tour the home.