3441 Pennsylvania Common Unit 10A Fremont, CA 94536

Centerville District NeighborhoodEstimated Value: $602,791 - $639,000

2

Beds

2

Baths

944

Sq Ft

$655/Sq Ft

Est. Value

About This Home

This home is located at 3441 Pennsylvania Common Unit 10A, Fremont, CA 94536 and is currently estimated at $617,948, approximately $654 per square foot. 3441 Pennsylvania Common Unit 10A is a home located in Alameda County with nearby schools including Tom Maloney Elementary School, Centerville Junior High School, and Washington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 5, 2012

Sold by

Yu Adam S K and Yu Eve Y

Bought by

Yu Adam S K and Yu Eve Y

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,200

Outstanding Balance

$125,598

Interest Rate

3.49%

Mortgage Type

New Conventional

Estimated Equity

$492,350

Purchase Details

Closed on

Aug 27, 2012

Sold by

Delmar Jeffrey W and Mangawang Diana R

Bought by

Yu Adam S K and Yu Eve Y

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,200

Outstanding Balance

$125,598

Interest Rate

3.49%

Mortgage Type

New Conventional

Estimated Equity

$492,350

Purchase Details

Closed on

Jul 17, 2006

Sold by

Lung Agnes Y

Bought by

Delmar Jeffrey W and Mangawang Diana R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$355,000

Interest Rate

6.57%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yu Adam S K | -- | Old Republic Title Company | |

| Yu Adam S K | $243,000 | Old Republic Title Company | |

| Delmar Jeffrey W | $398,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yu Adam S K | $182,200 | |

| Previous Owner | Delmar Jeffrey W | $355,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,965 | $299,224 | $89,767 | $209,457 |

| 2024 | $3,965 | $293,358 | $88,007 | $205,351 |

| 2023 | $3,845 | $287,607 | $86,282 | $201,325 |

| 2022 | $3,778 | $281,968 | $84,590 | $197,378 |

| 2021 | $3,694 | $276,441 | $82,932 | $193,509 |

| 2020 | $3,638 | $273,607 | $82,082 | $191,525 |

| 2019 | $3,599 | $268,244 | $80,473 | $187,771 |

| 2018 | $3,599 | $262,986 | $78,896 | $184,090 |

| 2017 | $3,509 | $257,830 | $77,349 | $180,481 |

| 2016 | $3,440 | $252,775 | $75,832 | $176,943 |

| 2015 | $3,383 | $248,980 | $74,694 | $174,286 |

| 2014 | $3,326 | $244,102 | $73,230 | $170,872 |

Source: Public Records

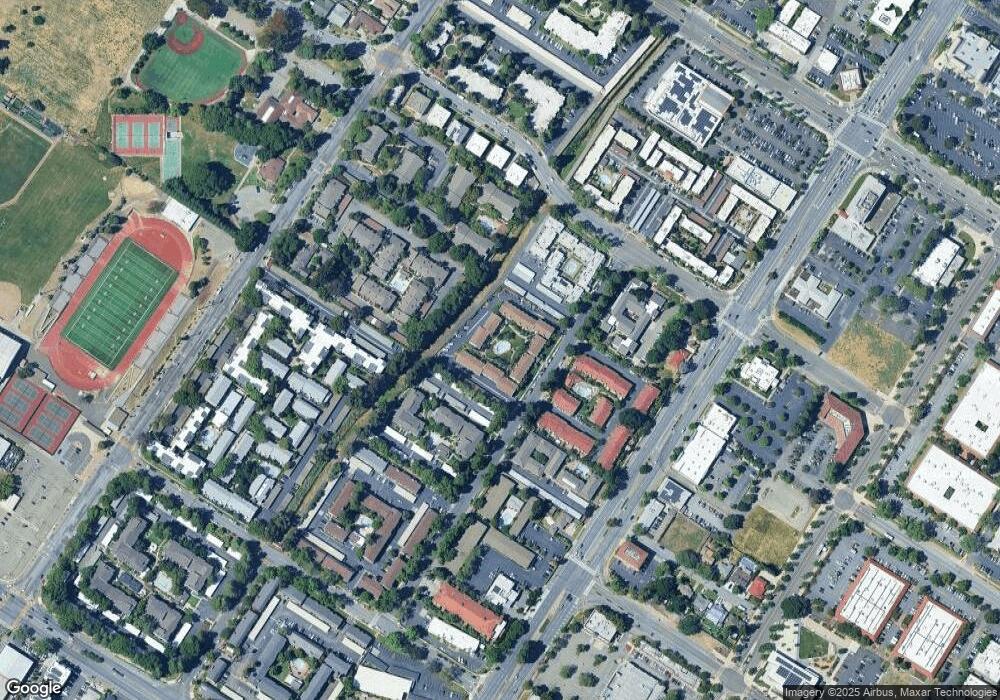

Map

Nearby Homes

- 3275 Capitol Ave

- 38500 Paseo Padre Pkwy Unit 306

- 39158 Declaration St

- 38837 Fremont Blvd

- 38455 Bronson St Unit 325

- 39134 Memorial St

- 38228 Paseo Padre Pkwy Unit 24

- 4208 Garland Dr

- 38012 Dover Common

- 38099 Miller Place

- 38043 Miller Place

- 3810 Burton Common

- 37993 Ponderosa Terrace

- 39090 Presidio Way Unit 233

- 39090 Presidio Way Unit 237

- 38101 Cambridge Ct

- 38605 Vancouver Common

- 3455 Gilman Common

- 38131 Acacia St

- 4403 Burke Way

- 3445 Pennsylvania Common Unit 10B

- 3447 Pennsylvania Common Unit 11A

- 3449 Pennsylvania Common Unit 11B

- 3439 Pennsylvania Common

- 3437 Pennsylvania Common

- 3451 Pennsylvania Common Unit CM

- 3451 Pennsylvania Common

- 3453 Pennsylvania Common Unit 12B

- 3433 Pennsylvania Common Unit 8A

- 3435 Pennsylvania Common Unit 8B

- 3455 Pennsylvania Common

- 3457 Pennsylvania Common Unit 13B

- 3413 Pennsylvania Common

- 3463 Pennsylvania Common Unit 15A

- 3459 Pennsylvania Common

- 3457 Pennsylvania Common

- 3403 Pennsylvania Common Unit 22B

- 3401 Pennsylvania Common Unit 22A

- 3431 Pennsylvania Common Unit 78

- 3429 Pennsylvania Common