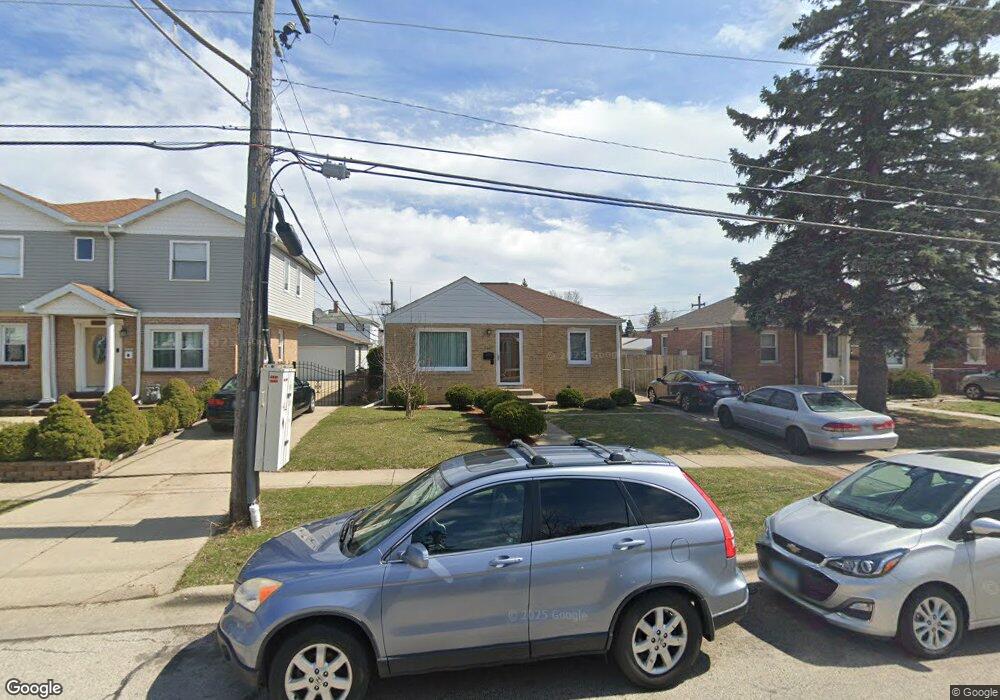

3447 Ruby St Unit 2 Franklin Park, IL 60131

Estimated Value: $250,000 - $323,000

2

Beds

1

Bath

721

Sq Ft

$398/Sq Ft

Est. Value

About This Home

This home is located at 3447 Ruby St Unit 2, Franklin Park, IL 60131 and is currently estimated at $286,824, approximately $397 per square foot. 3447 Ruby St Unit 2 is a home located in Cook County with nearby schools including North Elementary School, Hester Jr High School, and East Leyden High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2011

Sold by

Deutsche Bank National Trust Company

Bought by

Banaskiewicz Marek P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,150

Interest Rate

4.59%

Mortgage Type

Unknown

Purchase Details

Closed on

May 24, 2010

Sold by

Zolnierczyk Marcin

Bought by

Deutsche Bank National Trust Company

Purchase Details

Closed on

Nov 26, 2002

Sold by

Hatta Helen S and Hatta Steven J

Bought by

Zolnierczyk Marcin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

5.94%

Purchase Details

Closed on

Oct 21, 2002

Sold by

Hatta Helen S

Bought by

Hatta Helen S and Hatta Steven J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

5.94%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Banaskiewicz Marek P | $95,500 | Fnt | |

| Deutsche Bank National Trust Company | -- | None Available | |

| Zolnierczyk Marcin | $160,000 | Chicago Title Insurance Co | |

| Hatta Helen S | -- | Cti |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Banaskiewicz Marek P | $76,150 | |

| Previous Owner | Zolnierczyk Marcin | $152,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,353 | $24,000 | $4,400 | $19,600 |

| 2024 | $6,353 | $24,000 | $3,600 | $20,400 |

| 2023 | $6,522 | $24,000 | $3,600 | $20,400 |

| 2022 | $6,522 | $24,000 | $3,600 | $20,400 |

| 2021 | $4,411 | $14,468 | $2,600 | $11,868 |

| 2020 | $4,283 | $14,468 | $2,600 | $11,868 |

| 2019 | $4,476 | $16,349 | $2,600 | $13,749 |

| 2018 | $4,951 | $15,706 | $2,200 | $13,506 |

| 2017 | $4,904 | $15,706 | $2,200 | $13,506 |

| 2016 | $4,882 | $15,706 | $2,200 | $13,506 |

| 2015 | $4,515 | $14,187 | $2,000 | $12,187 |

| 2014 | $4,417 | $14,187 | $2,000 | $12,187 |

| 2013 | $4,073 | $14,187 | $2,000 | $12,187 |

Source: Public Records

Map

Nearby Homes

- 9741 Lonnquist Dr

- 3519 Lonnquist Dr

- 3706 Ruby St

- 3306 Rose St

- 3519 Louis St

- 9670 Franklin Ave Unit 505

- 9670 Franklin Ave Unit 411

- 3808 Ruby St Unit 2S

- 3639 Dora St

- 3021 Louis St

- 9821 Schiller Blvd

- 10123 Hartford Ct Unit GC

- 3313 Lincoln St

- 2920 Pearl St

- 2918 Louis St

- 10154 Hartford Ct Unit 3A

- 2843 Hawthorne St

- 2913 Sarah St

- 4137 Ruby St

- 3108 Lincoln St

- 3443 Ruby St

- 3449 Ruby St

- 3439 Ruby St

- 3503 Ruby St

- 3448 Lonnquist Dr Unit 2

- 3450 Lonnquist Dr

- 3446 Lonnquist Dr

- 3502 Lonnquist Dr

- 3435 Ruby St

- 3440 Lonnquist Dr

- 3505 Ruby St

- 3506 Lonnquist Dr

- 3436 Lonnquist Dr

- 3446 Ruby St

- 3446 Ruby St

- 3431 Ruby St

- 3509 Ruby St

- 3442 Ruby St

- 3504 Ruby St

- 3510 Lonnquist Dr