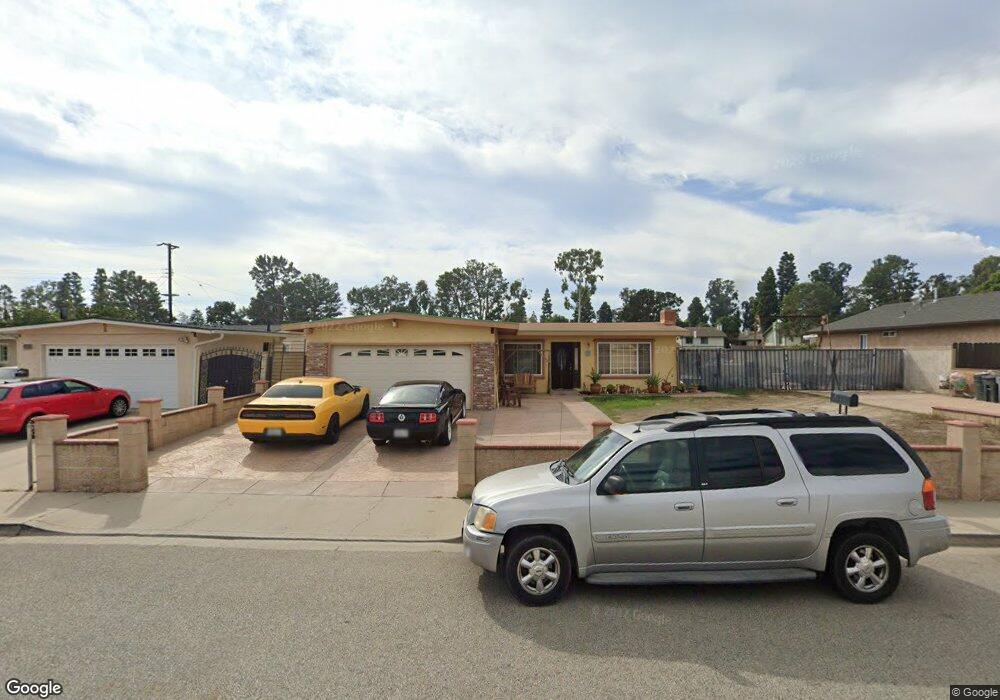

3461 Sutter Dr Oxnard, CA 93033

Diamond Bar NeighborhoodEstimated Value: $634,519 - $713,000

3

Beds

2

Baths

1,150

Sq Ft

$580/Sq Ft

Est. Value

About This Home

This home is located at 3461 Sutter Dr, Oxnard, CA 93033 and is currently estimated at $667,130, approximately $580 per square foot. 3461 Sutter Dr is a home located in Ventura County with nearby schools including Channel Islands High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2002

Sold by

Garcia Antonio B and Garcia Lisa A

Bought by

Garcia Antonio B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,000

Outstanding Balance

$88,879

Interest Rate

6.16%

Estimated Equity

$578,251

Purchase Details

Closed on

May 17, 2000

Sold by

Abel Martinez and Abel Brenda S

Bought by

Garcia B Antonio and Garcia Lisa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,389

Interest Rate

8.63%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garcia Antonio B | -- | Lawyers Title Company | |

| Garcia B Antonio | $200,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Garcia Antonio B | $212,000 | |

| Previous Owner | Garcia B Antonio | $195,389 | |

| Closed | Garcia B Antonio | $9,850 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,402 | $301,340 | $120,535 | $180,805 |

| 2024 | $3,402 | $295,432 | $118,172 | $177,260 |

| 2023 | $3,459 | $289,640 | $115,855 | $173,785 |

| 2022 | $3,253 | $283,961 | $113,583 | $170,378 |

| 2021 | $3,252 | $278,394 | $111,356 | $167,038 |

| 2020 | $3,344 | $275,541 | $110,215 | $165,326 |

| 2019 | $3,218 | $270,139 | $108,054 | $162,085 |

| 2018 | $3,177 | $264,843 | $105,936 | $158,907 |

| 2017 | $3,096 | $259,651 | $103,859 | $155,792 |

| 2016 | $2,954 | $254,561 | $101,823 | $152,738 |

| 2015 | $2,991 | $250,740 | $100,295 | $150,445 |

| 2014 | $2,927 | $245,830 | $98,331 | $147,499 |

Source: Public Records

Map

Nearby Homes

- 3426 Olds Rd

- 3700 Olds Rd Unit 86

- 2178 Thrush Ave Unit J

- 2136 Thrush Ave Unit 2136

- 2143 Cardinal Ave Unit 2143

- 4061 Canary Ln Unit 4061

- 2177 Robin Ave Unit 2177A

- 1645 Lime Ave Unit 91

- 2140 Robin Ave Unit 2140A

- 1928 San Benito St

- 2374 Nash Ln

- 2400 E Pleasant Valley Rd Unit 108

- 3630 Dallas Dr

- 2021 E Bard Rd

- 4108 Ranchita Ln

- 1630 Nelson Place

- 1036 Cheyenne Way

- 4614 Concord Way

- 4340 Highland Ave

- 840 Morro Way