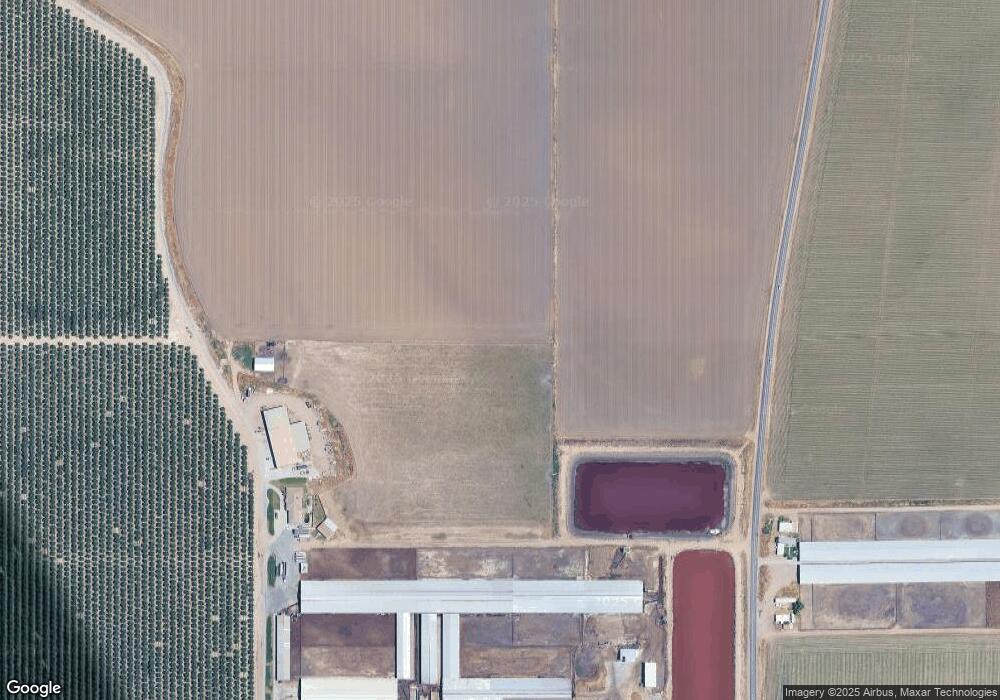

3513 Shiloh Rd Modesto, CA 95358

Estimated Value: $751,000 - $5,927,898

8

Beds

5

Baths

4,253

Sq Ft

$785/Sq Ft

Est. Value

About This Home

This home is located at 3513 Shiloh Rd, Modesto, CA 95358 and is currently estimated at $3,339,449, approximately $785 per square foot. 3513 Shiloh Rd is a home located in Stanislaus County with nearby schools including Westport Elementary School, Blaker-Kinser Junior High School, and Central Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2024

Sold by

Mmj Morris Partners Lp

Bought by

Turlock Irrigation District

Current Estimated Value

Purchase Details

Closed on

Apr 27, 2007

Sold by

Mmj Morris Partners Lp

Bought by

Mmj Morris Partners Lp

Purchase Details

Closed on

May 25, 2006

Sold by

Morris Manuel J

Bought by

Morris Manuel J and Morris Mary C

Purchase Details

Closed on

Feb 28, 2006

Sold by

Morris Manuel J

Bought by

Mmj Morris Lp

Purchase Details

Closed on

Dec 27, 2005

Sold by

Morris Manuel J

Bought by

Morris John Manuel

Purchase Details

Closed on

Jan 14, 2000

Sold by

Morris Manuel J

Bought by

Morris Manuel J and Morris Mary C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Turlock Irrigation District | -- | -- | |

| Mmj Morris Partners Lp | -- | Chicago Title Co | |

| Morris Manuel J | -- | None Available | |

| Mmj Morris Lp | -- | None Available | |

| Morris John Manuel | -- | None Available | |

| Morris John Manuel | -- | -- | |

| Morris Manuel J | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $80,803 | $6,732,372 | $892,993 | $5,839,379 |

| 2024 | $79,595 | $6,945,837 | $951,617 | $5,994,220 |

| 2023 | $79,445 | $6,993,320 | $963,651 | $6,029,669 |

| 2022 | $72,323 | $6,370,673 | $953,398 | $5,417,275 |

| 2021 | $67,673 | $5,892,631 | $914,694 | $4,977,937 |

| 2020 | $65,327 | $5,803,637 | $869,229 | $4,934,408 |

| 2019 | $64,514 | $5,652,456 | $829,449 | $4,823,007 |

| 2018 | $62,280 | $5,446,634 | $668,182 | $4,778,452 |

| 2017 | $59,473 | $5,146,146 | $613,720 | $4,532,426 |

| 2016 | $59,492 | $5,195,979 | $588,665 | $4,607,314 |

| 2015 | $62,922 | $5,484,094 | $586,723 | $4,897,371 |

| 2014 | $59,466 | $5,185,023 | $563,601 | $4,621,422 |

Source: Public Records

Map

Nearby Homes

- 2306 Young Rd

- 0 Hart Rd Unit 225010902

- 1713 Minnie St

- 8708 Wilson St

- 419 Burkhard Rd

- 2561 Michigan Ave

- 6613 Woodland Ave

- 10525 State Highway 33

- 12742 Elm Ave

- 2617 W Hatch Rd

- 3101 River Rd

- 0 Blue Gum Ave Unit 226013904

- 1415 Avondale Ave

- 2547 Parkdale Dr

- 4449 S Carpenter Rd Unit B12

- 4449 S Carpenter Rd

- 449 Center Rd

- 1630 Paradise Rd

- 2344 Regal Rd

- 4460 S Carpenter Rd

Your Personal Tour Guide

Ask me questions while you tour the home.