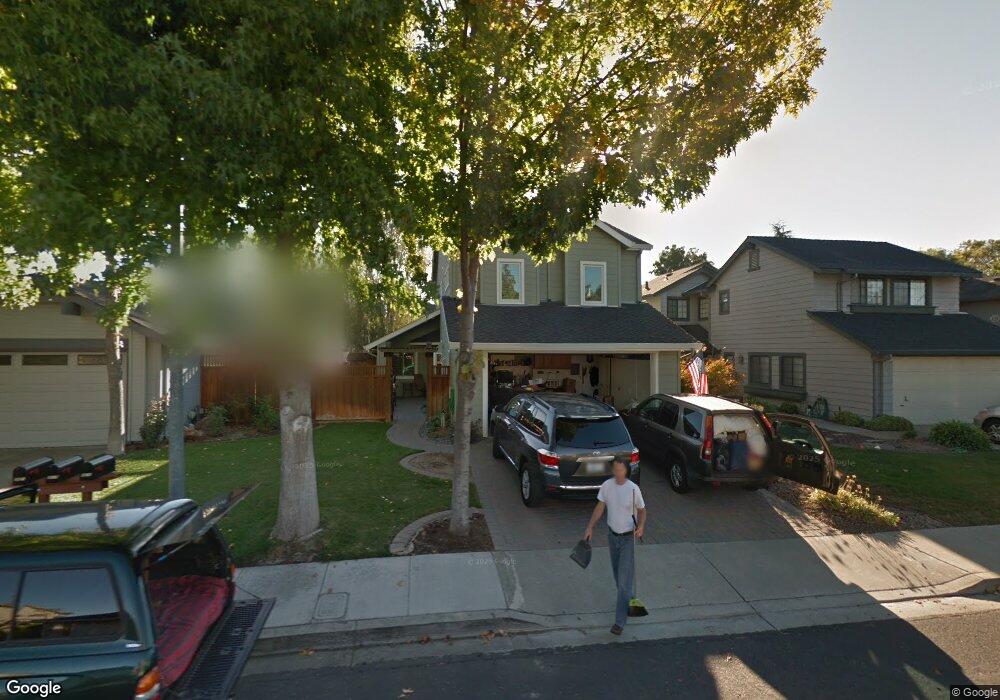

3517 Helen Dr Pleasanton, CA 94588

Amador Valley NeighborhoodEstimated Value: $1,399,000 - $1,740,000

4

Beds

3

Baths

1,950

Sq Ft

$835/Sq Ft

Est. Value

About This Home

This home is located at 3517 Helen Dr, Pleasanton, CA 94588 and is currently estimated at $1,627,605, approximately $834 per square foot. 3517 Helen Dr is a home located in Alameda County with nearby schools including Henry P. Mohr Elementary School, Harvest Park Middle School, and Amador Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2019

Sold by

Thompson Greg and Thompson Kathy

Bought by

Ma Congwen and Yan Fei

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$864,000

Outstanding Balance

$747,197

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$880,408

Purchase Details

Closed on

Sep 6, 2016

Sold by

Thompson Gregory J and Thompson Kathryn E

Bought by

Thompson Greg and Thompson Kathy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

3.43%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 25, 2014

Sold by

Thompson Gregory J and Thompson Kathryn E

Bought by

The Thompson Family Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ma Congwen | $1,080,000 | Fidelity National Title Co | |

| Thompson Greg | -- | Fidelity National Title Co | |

| Thompson Greg | -- | Accommodation | |

| Thompson Gregory J | -- | Fidelity National Title Co | |

| The Thompson Family Trust | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ma Congwen | $864,000 | |

| Previous Owner | Thompson Gregory J | $417,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,552 | $1,174,120 | $354,336 | $826,784 |

| 2024 | $13,552 | $1,150,964 | $347,389 | $810,575 |

| 2023 | $13,396 | $1,135,263 | $340,579 | $794,684 |

| 2022 | $12,689 | $1,106,004 | $333,901 | $779,103 |

| 2021 | $12,363 | $1,084,188 | $327,356 | $763,832 |

| 2020 | $12,205 | $1,080,000 | $324,000 | $756,000 |

| 2019 | $4,346 | $365,194 | $89,223 | $275,971 |

| 2018 | $4,258 | $358,034 | $87,474 | $270,560 |

| 2017 | $4,151 | $351,015 | $85,759 | $265,256 |

| 2016 | $3,829 | $344,134 | $84,078 | $260,056 |

| 2015 | $3,759 | $338,967 | $82,815 | $256,152 |

| 2014 | $3,825 | $332,328 | $81,193 | $251,135 |

Source: Public Records

Map

Nearby Homes

- 2058 Palmer Dr

- 2229 Delucchi Dr

- 5885 Bruce Dr

- 1817 Sinclair Dr

- 3778 Angus Way

- 1585 Poppybank Ct

- 4380 Diavila Ave

- 2474 Tanager Dr

- 4385 Diavila Ave

- 3958 W Las Positas Blvd

- 4425 Valley Ave

- 3491 Dorset Ct

- 3910 Rockingham Dr

- 4446 Seminole Way Unit 1

- 4374 Valley Ave Unit D1

- 3299 Runnymede Ct

- 3135 Gulfstream St

- 4832 Knox Gate Ct

- 4327 Fairlands Dr

- 3431 Windsor Ct