3521 Nordic Way Placerville, CA 95667

Estimated Value: $421,000 - $574,000

3

Beds

2

Baths

1,612

Sq Ft

$315/Sq Ft

Est. Value

About This Home

This home is located at 3521 Nordic Way, Placerville, CA 95667 and is currently estimated at $508,166, approximately $315 per square foot. 3521 Nordic Way is a home located in El Dorado County with nearby schools including El Dorado High School, Country Day Montessori, and El Dorado Adventist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2022

Sold by

Lyman Brent W and Lyman Kathlyn L

Bought by

Lyman Kathryn L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,500

Outstanding Balance

$60,173

Interest Rate

4.85%

Mortgage Type

New Conventional

Estimated Equity

$447,993

Purchase Details

Closed on

Jan 18, 2000

Sold by

Adams Kathryn L and Lyman Brent W

Bought by

Lyman Brent W and Lyman Kathryn L

Purchase Details

Closed on

Apr 25, 1997

Sold by

Piazza James D and Piazza Michelle

Bought by

Adams Kathryn L and Lyman Brent W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,150

Interest Rate

7.96%

Purchase Details

Closed on

Dec 3, 1996

Sold by

Canevaro Joseph F and Canevaro Irene A

Bought by

Piazza James D and Piazza Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,980

Interest Rate

7.86%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lyman Kathryn L | -- | Atlas Title Company | |

| Lyman Brent W | -- | -- | |

| Adams Kathryn L | $186,500 | Fidelity National Title | |

| Piazza James D | $33,000 | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lyman Kathryn L | $70,500 | |

| Previous Owner | Adams Kathryn L | $177,150 | |

| Previous Owner | Piazza James D | $121,980 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,211 | $314,469 | $95,259 | $219,210 |

| 2024 | $3,211 | $308,304 | $93,392 | $214,912 |

| 2023 | $3,172 | $302,260 | $91,561 | $210,699 |

| 2022 | $3,126 | $296,334 | $89,766 | $206,568 |

| 2021 | $3,090 | $290,524 | $88,006 | $202,518 |

| 2020 | $3,043 | $287,546 | $87,104 | $200,442 |

| 2019 | $3,005 | $281,909 | $85,397 | $196,512 |

| 2018 | $2,914 | $276,382 | $83,723 | $192,659 |

| 2017 | $2,855 | $270,964 | $82,082 | $188,882 |

| 2016 | $2,810 | $265,652 | $80,473 | $185,179 |

| 2015 | $2,680 | $261,664 | $79,265 | $182,399 |

| 2014 | $2,680 | $256,540 | $77,713 | $178,827 |

Source: Public Records

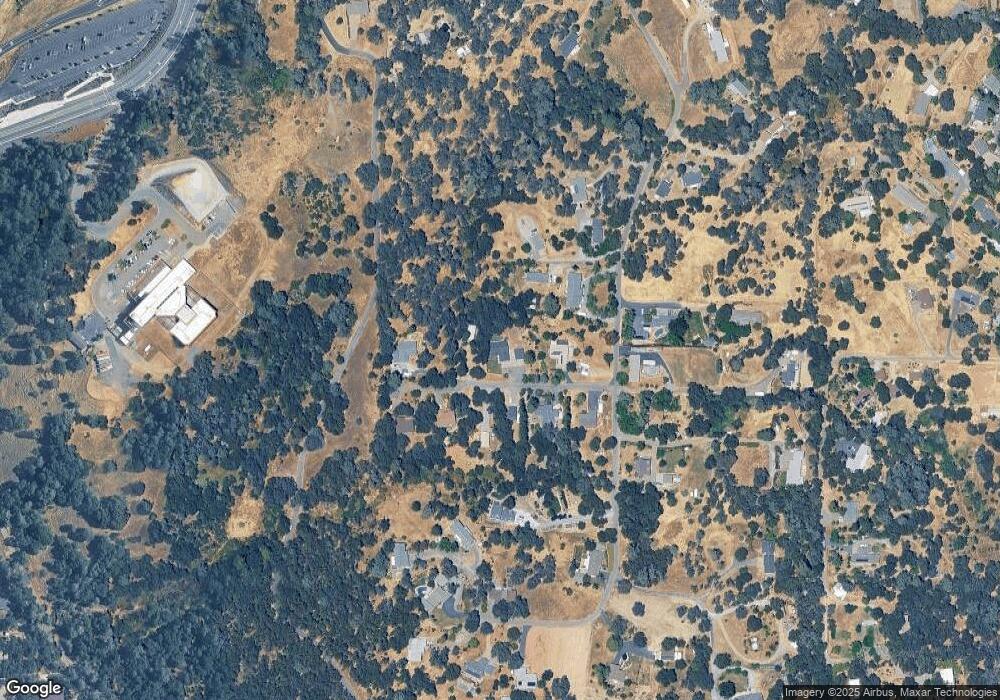

Map

Nearby Homes

- 3075 Gold Nugget Way

- 3330 Gold Nugget Ct

- 3109 Briw Ridge Rd

- 3391 California 49

- 0 Ray Lawyer Dr Unit 225065793

- 3458 Coon Hollow Rd

- 691 Wentworth Ct

- 0 Placerville Dr Unit 225115338

- 645 Myrtle Ave

- 636 Canal St

- 3340 Forni Rd

- 3440 Forni Rd

- 2820 Sleepy Hollow Ct

- 201 New Morning Ct

- 2850 Hidden Springs Cir

- 2846 Hidden Springs Cir

- 2968 Coloma St

- 2830 Coloma St

- 2832 Hidden Springs Cir

- 2854 Hidden Springs Cir

- 3501 Nordic Way

- 3541 Nordic Way

- 3520 Nordic Way

- 3510 Nordic Way

- 3530 Nordic Way

- 3350 Excalibar Rd

- 3500 Nordic Way

- 3337 Excalibar Rd

- 3370 Excalibar Rd

- 3327 Excalibar Rd

- 3442 Excalibar Rd

- 3320 Excalibar Rd

- 3363 Excalibar Rd

- 3440 Excalibar Rd

- 3455 Excalibar Rd

- 3380 Excalibar Rd Unit 1929

- 757 Cherry Ln

- 3429 Excalibar Rd

- 410 Magic Place

- 3341 Excalibar Rd