3544 Wescott Woodlands Saint Paul, MN 55123

Estimated Value: $1,000,000 - $1,831,440

5

Beds

6

Baths

3,750

Sq Ft

$368/Sq Ft

Est. Value

About This Home

This home is located at 3544 Wescott Woodlands, Saint Paul, MN 55123 and is currently estimated at $1,378,147, approximately $367 per square foot. 3544 Wescott Woodlands is a home located in Dakota County with nearby schools including Woodland Elementary School, Dakota Hills Middle School, and Eagan Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2021

Sold by

Bartelson Stacey

Bought by

Bartelson Stacey and Feldman Joshua A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,224,000

Outstanding Balance

$1,111,817

Interest Rate

3.25%

Mortgage Type

New Conventional

Estimated Equity

$266,330

Purchase Details

Closed on

Jan 17, 2020

Sold by

Vinge Dwight Tony and Vinge Lynn K

Bought by

Grunklee Michael J and Grunklee Holly M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

3.7%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bartelson Stacey | -- | Executive Title | |

| Grunklee Michael J | $276,000 | Premier Title | |

| Grunklee Michael J | $276,000 | Premier Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bartelson Stacey | $1,224,000 | |

| Closed | Grunklee Michael J | $240,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $15,370 | $1,403,400 | $265,200 | $1,138,200 |

| 2023 | $15,370 | $1,275,100 | $266,000 | $1,009,100 |

| 2022 | $568 | $549,700 | $241,100 | $308,600 |

| 2021 | $4,864 | $129,800 | $129,800 | $0 |

| 2020 | $4,670 | $419,000 | $134,600 | $284,400 |

Source: Public Records

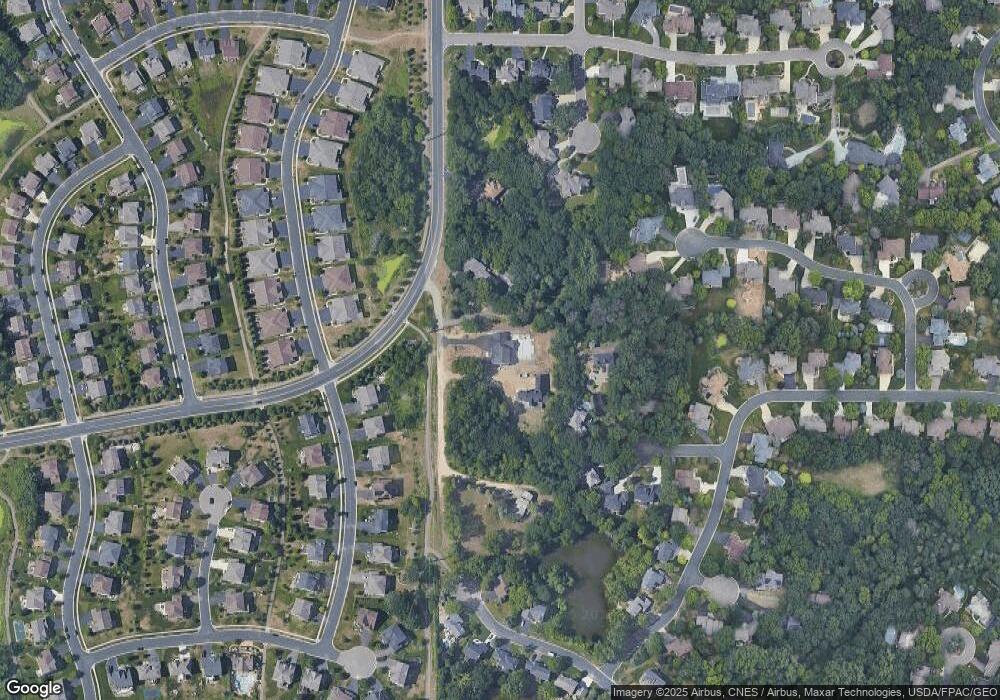

Map

Nearby Homes

- 3551 Blue Jay Way Unit 201

- 3675 Woodland Trail

- 3557 Blue Jay Way Unit 102

- 3557 Blue Jay Way Unit 200

- 3563 Blue Jay Way Unit 107

- 3566 Blue Jay Way Unit 207

- 3407 Chestnut Ln

- 3655 Falcon Way

- 1067 Hummingbird Ln

- 3569 Blue Jay Way Unit 201

- 3467 Trails End Rd

- 804 Great Oaks Trail

- 3424 Ivy Ct

- 832 Wescott Square

- 3424 Eagan Oaks Ct

- 3620 Saint Francis Way Unit B

- 3608 Saint Francis Way Unit A

- 1057 Kettle Creek Rd

- 826 Hidden Meadow Trail

- 3806 Bridgewater Dr

- 3570 Wescott Woodlands

- 877 Betty Ln

- 883 Betty Ln

- 3598 Woodland Ct

- 3536 Wescott Woodlands

- 871 Betty Ln

- 882 Betty Ln

- 3602 Woodland Ct

- 3590 Wescott Woodlands

- 3594 Woodland Ct

- 876 Betty Ln

- 3546 Woodland Trail

- 3603 Woodland Ct

- 3550 Woodland Trail

- 3600 Sawgrass Trail S

- 870 Betty Ln

- 3604 Sawgrass Trail S

- 3515 Thorwood Ct

- 3608 Sawgrass Trail S

- 3603 Sunwood Trail