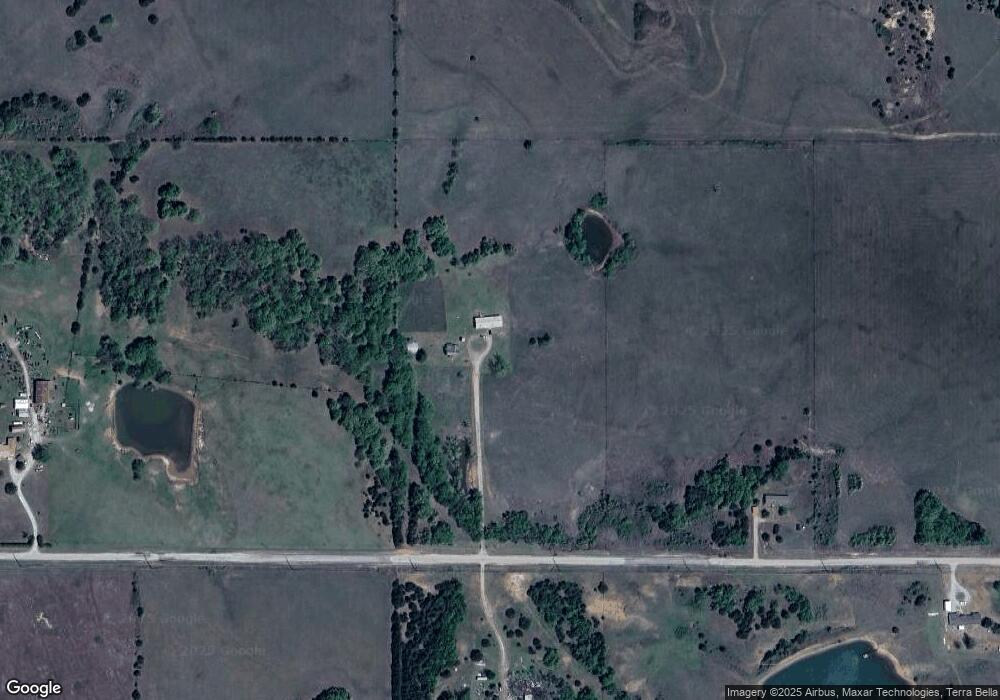

354636 E 750 Rd Cushing, OK 74023

Estimated Value: $227,000 - $358,000

4

Beds

2

Baths

2,624

Sq Ft

$107/Sq Ft

Est. Value

About This Home

This home is located at 354636 E 750 Rd, Cushing, OK 74023 and is currently estimated at $279,673, approximately $106 per square foot. 354636 E 750 Rd is a home located in Lincoln County with nearby schools including Parkview Elementary School, Stroud Middle School, and Stroud High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 21, 2013

Sold by

Mendonca Manuel V and Mendonca Marilyn S

Bought by

Hubbard Aaron and Hubbard Roberta

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,011

Outstanding Balance

$113,412

Interest Rate

3.44%

Mortgage Type

FHA

Estimated Equity

$166,261

Purchase Details

Closed on

Feb 16, 2010

Sold by

Hsbc Bank Usa Na

Bought by

Mendonca Manuel V and Mendonca Marilyn S

Purchase Details

Closed on

Apr 6, 2005

Sold by

Smith Robert M and Smith Shelly R

Bought by

Mendonca Manuel V and Mendonca Marilyn S

Purchase Details

Closed on

Sep 22, 2003

Sold by

Dist Ct Lin Co/Sullivanm

Bought by

Sullivan Kenneth

Purchase Details

Closed on

Apr 18, 2002

Sold by

Sullivan Kenneth Frances

Bought by

Whom It May Concern

Purchase Details

Closed on

Mar 11, 2002

Sold by

Salt Creek Properties Llc

Bought by

Grisham Rick D and Grisham Vicki K

Purchase Details

Closed on

Aug 31, 2001

Sold by

Sullivan Kenneth

Bought by

Salt Creek Properties Llc

Purchase Details

Closed on

Apr 8, 1999

Sold by

Sullivan Kenneth and Sullivan Lillian

Bought by

Sullivan Kenneth

Purchase Details

Closed on

Dec 9, 1968

Sold by

Johnson Carl

Bought by

Sullivan Kenneth and Sullivan Mildred

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hubbard Aaron | $165,000 | None Available | |

| Mendonca Manuel V | $46,000 | None Available | |

| Mendonca Manuel V | $89,000 | None Available | |

| Sullivan Kenneth | -- | -- | |

| Whom It May Concern | -- | -- | |

| Grisham Rick D | $52,000 | -- | |

| Salt Creek Properties Llc | $102,000 | -- | |

| Sullivan Kenneth | -- | -- | |

| Sullivan Kenneth | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hubbard Aaron | $162,011 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $890 | $9,948 | $193 | $9,755 |

| 2024 | $825 | $9,658 | $181 | $9,477 |

| 2023 | $825 | $9,376 | $283 | $9,093 |

| 2022 | $827 | $9,758 | $283 | $9,475 |

| 2021 | $864 | $10,135 | $283 | $9,852 |

| 2020 | $889 | $10,512 | $283 | $10,229 |

| 2019 | $937 | $10,888 | $283 | $10,605 |

| 2018 | $1,025 | $12,006 | $283 | $11,723 |

| 2017 | $1,051 | $11,953 | $283 | $11,670 |

| 2016 | $936 | $11,605 | $283 | $11,322 |

| 2015 | $1,003 | $12,090 | $283 | $11,807 |

| 2014 | $965 | $12,584 | $283 | $12,301 |

Source: Public Records

Map

Nearby Homes

- 740421 S Highway 99

- 354208 E 770 Rd

- 3714 E Eseco Rd

- 75060 S 3570 Rd

- 123

- 1141 Saint Andrews Cir

- 1139 Saint Andrews Cir

- 1135 Saint Andrews Cir

- 1111 Saint Andrews Cir

- 1120 Saint Andrews Cir

- 1109 Country Club Dr

- 1107 Country Club Dr

- 1001 Country Club Dr

- 919 Riviera Dr

- 917 Riviera Dr

- 000 E 760 Rd

- 0 County Road 3520 Rd Unit 2539913

- 1202 S Oak Grove Rd

- 1200 S Oak Grove Rd

- 2020 E Eseco Rd