Estimated Value: $69,000 - $212,000

3

Beds

1

Bath

1,134

Sq Ft

$129/Sq Ft

Est. Value

About This Home

This home is located at 3579 County Road 9, Bryan, OH 43506 and is currently estimated at $146,320, approximately $129 per square foot. 3579 County Road 9 is a home with nearby schools including Edgerton Elementary School and Edgerton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2021

Sold by

Motter Rebeca A and Thiel Donald E

Bought by

Thiel Donald E and Motter Rebeca A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Outstanding Balance

$28,583

Interest Rate

3.1%

Mortgage Type

Credit Line Revolving

Estimated Equity

$117,737

Purchase Details

Closed on

Sep 8, 2017

Sold by

Mcmilian Sonja Motter

Bought by

Motter Rebeca A

Purchase Details

Closed on

Jul 14, 2006

Sold by

Hodapp Michael L and Harris Michele L

Bought by

Motter Sonja

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,600

Interest Rate

7.12%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Jan 1, 1990

Bought by

Hodapp Michael L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thiel Donald E | -- | None Available | |

| Motter Rebeca A | -- | None Available | |

| Motter Sonja | $34,000 | None Available | |

| Hodapp Michael L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thiel Donald E | $50,000 | |

| Closed | Motter Sonja | $30,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $627 | $17,780 | $2,170 | $15,610 |

| 2024 | $627 | $17,780 | $2,170 | $15,610 |

| 2023 | $658 | $13,900 | $2,000 | $11,900 |

| 2022 | $567 | $13,900 | $2,000 | $11,900 |

| 2021 | $567 | $13,900 | $2,000 | $11,900 |

| 2020 | $534 | $12,640 | $1,820 | $10,820 |

| 2019 | $533 | $12,640 | $1,820 | $10,820 |

| 2018 | $534 | $12,640 | $1,820 | $10,820 |

| 2017 | $552 | $12,950 | $1,820 | $11,130 |

| 2016 | $521 | $12,950 | $1,820 | $11,130 |

| 2015 | $542 | $12,950 | $1,820 | $11,130 |

| 2014 | $542 | $12,950 | $1,820 | $11,130 |

| 2013 | $558 | $12,950 | $1,820 | $11,130 |

Source: Public Records

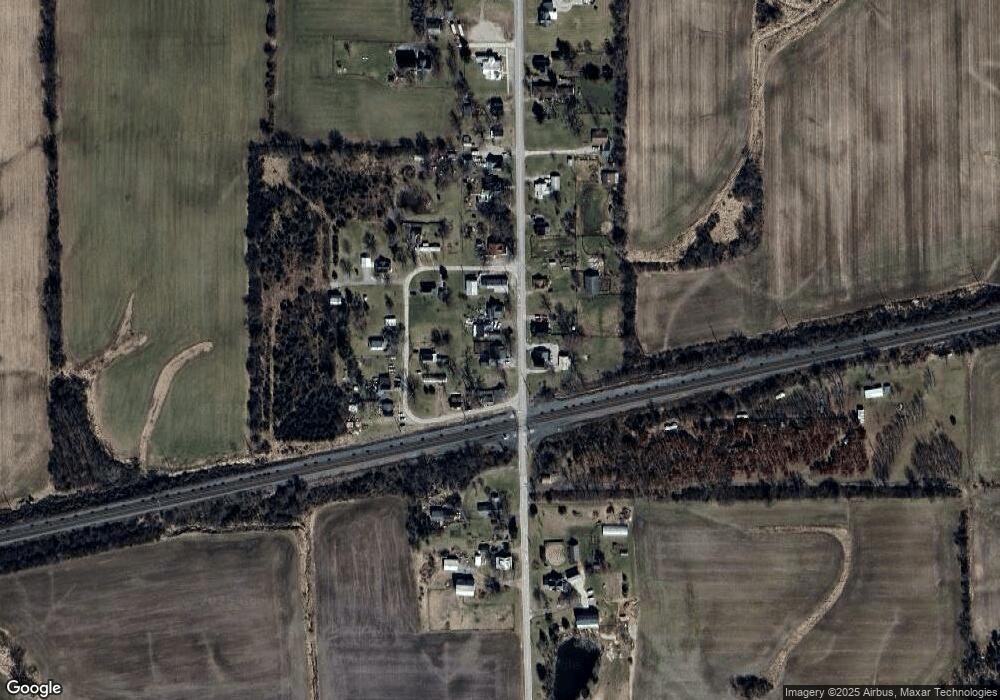

Map

Nearby Homes

- 3631 Lake St

- 3741 County Road 9

- 10258 County Road D

- 322 Dublin Ln

- 324 Dublin Ln

- 101 Westview St

- 202 Belfast Ln

- 0 Saint Andrews Dr

- 00 Troon Ct

- 125 Turnberry Dr

- 12341 County Road C

- 144 Deerfield Cir

- 206 Brown Dr

- 205 Indiana Dr

- 1001 Greystone Dr

- 817 Oakwood Ave

- 726 Crestview Ave

- 630 Center Ridge Rd

- 115 N Lebanon St

- 00 County Road 4-50

- 3561 County Road 9

- 3598 Lake St

- 9 Rd Rd

- 36100 Lake St

- 3629 Walnut Rd

- 3629 Walnut Rd Unit C

- 000 County Road 9

- 3629 Walnut St

- 3601 Lake St

- 3577 Lake St

- 3641 County Road 9

- 3631 Lake St

- 3557 Lake St

- 3652 County Road 9

- 3497 County Road 9

- 3673 County Road 9

- 3483 County Road 9

- 3670 County Road 9

- 3687 County Road 9

- 3469 County Road 9