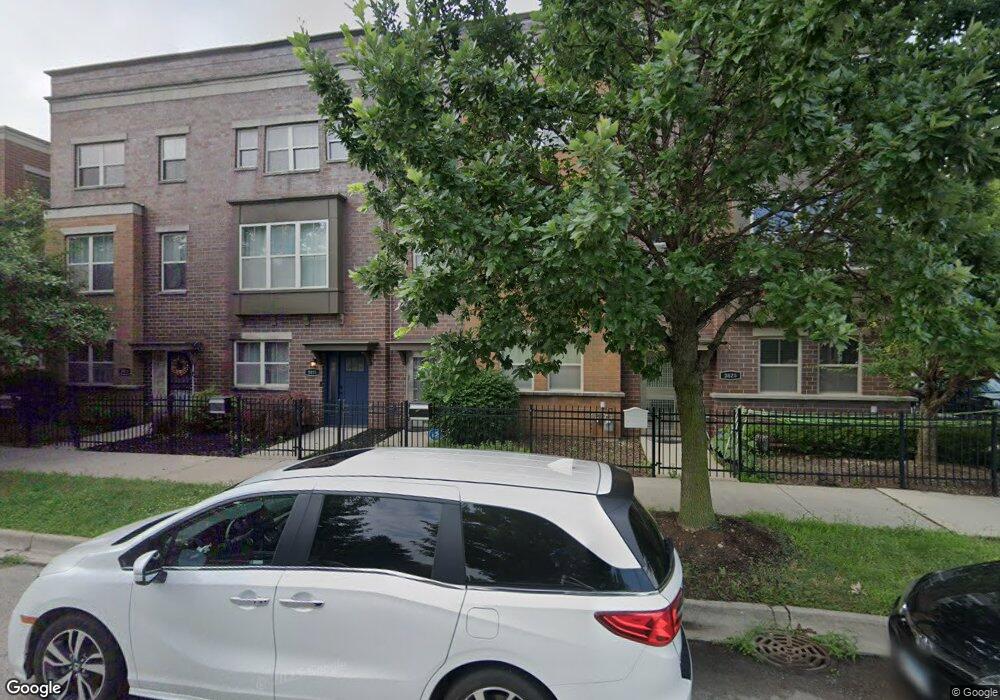

3623 W 50th Place Unit 37B Chicago, IL 60632

West Elsdon NeighborhoodEstimated Value: $342,000 - $410,000

3

Beds

3

Baths

2,411

Sq Ft

$154/Sq Ft

Est. Value

About This Home

This home is located at 3623 W 50th Place Unit 37B, Chicago, IL 60632 and is currently estimated at $371,082, approximately $153 per square foot. 3623 W 50th Place Unit 37B is a home located in Cook County with nearby schools including Sandoval Elementary School, Hernandez Middle School, and Curie Metropolitan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2019

Sold by

Harris Justin Michael

Bought by

Wang Bo and Liu Miao

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,000

Outstanding Balance

$147,585

Interest Rate

4.37%

Mortgage Type

New Conventional

Estimated Equity

$223,497

Purchase Details

Closed on

Oct 30, 2013

Sold by

Secretary Of Housing & Urban Development

Bought by

Harris Justin Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,895

Interest Rate

4.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 23, 2013

Sold by

Bravo

Bought by

The Secretary Of Hud

Purchase Details

Closed on

Sep 15, 2008

Sold by

5007 Lawndale Corp

Bought by

Bravo Julia and Herrera Jesse

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$334,747

Interest Rate

6.57%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wang Bo | $239,000 | Landtrust National Ttl Svcs | |

| Harris Justin Michael | -- | First American Title | |

| The Secretary Of Hud | -- | None Available | |

| Bravo Julia | $340,000 | Git |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wang Bo | $165,000 | |

| Previous Owner | Harris Justin Michael | $143,895 | |

| Previous Owner | Bravo Julia | $334,747 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,731 | $31,000 | $1,285 | $29,715 |

| 2023 | $3,616 | $21,000 | $1,028 | $19,972 |

| 2022 | $3,616 | $21,000 | $1,028 | $19,972 |

| 2021 | $3,553 | $21,000 | $1,028 | $19,972 |

| 2020 | $4,295 | $19,278 | $1,028 | $18,250 |

| 2019 | $3,712 | $21,907 | $1,028 | $20,879 |

| 2018 | $3,649 | $21,907 | $1,028 | $20,879 |

| 2017 | $5,166 | $23,999 | $925 | $23,074 |

| 2016 | $4,807 | $23,999 | $925 | $23,074 |

| 2015 | $4,398 | $23,999 | $925 | $23,074 |

| 2014 | $3,762 | $20,274 | $873 | $19,401 |

| 2013 | $3,687 | $20,274 | $873 | $19,401 |

Source: Public Records

Map

Nearby Homes

- 3642 W 51st St

- 5044 S Ridgeway Ave

- 5142 S Hamlin Ave

- 5205 S Hamlin Ave

- 5121 S Trumbull Ave

- 5130 S Christiana Ave

- 3444 W 53rd Place

- 3615 W 54th St

- 3415 W 53rd Place

- 5348 S Christiana Ave

- 5314 S Harding Ave

- 5336 S Harding Ave

- 5030 S Archer Ave

- 3820 W 47th St

- 5032 S Archer Ave

- 5009-15 S Homan Ave

- 4229 S Archer Ave

- 5359 S Sawyer Ave

- 5145 S Troy St

- 5151 S Troy St

- 3623 W 50th Place

- 3623 W 50th Place

- 3621 W 50th Place

- 3621 W 50th Place Unit 36-A

- 3619 W 50th Place

- 3619 W 50th Place Unit 35

- 3619 W 50th Place

- 3619 W 50th Place Unit 35-A

- 3619 W 50th Place Unit 32

- 3625 W 50th Place

- 3617 W 50th Place

- 3617 W 50th Place Unit 34-D

- 3609 W 50th Place

- 3609 W 50th Place

- 3609 W 50th Place Unit 3615

- 3620 W 51st St

- 3615 W 50th Place

- 3618 W 51st St

- 3611 W 50th Place

- 3614 W 51st Place