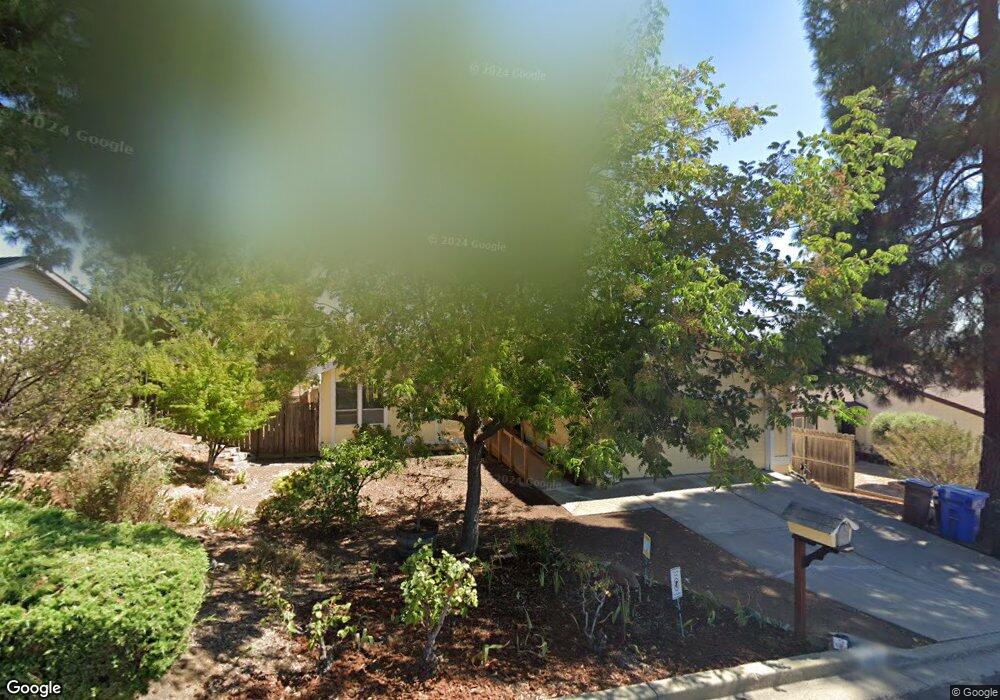

3651 Sun View Ct Concord, CA 94520

Sun Terrace NeighborhoodEstimated Value: $757,000 - $802,000

3

Beds

2

Baths

1,436

Sq Ft

$548/Sq Ft

Est. Value

About This Home

This home is located at 3651 Sun View Ct, Concord, CA 94520 and is currently estimated at $786,584, approximately $547 per square foot. 3651 Sun View Ct is a home located in Contra Costa County with nearby schools including Sun Terrace Elementary School, El Dorado Middle School, and Mt. Diablo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2025

Sold by

Marshall Allison Justin and Marshall Nicole Crowther

Bought by

Campos-Salas Miguel Angel and Mar Helen Man

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$518,100

Outstanding Balance

$514,906

Interest Rate

6.72%

Mortgage Type

New Conventional

Estimated Equity

$271,678

Purchase Details

Closed on

Mar 8, 2023

Sold by

Elinor J Rogers Trust

Bought by

Allison Justin Marshall and Crowther Laura Nicole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$697,500

Interest Rate

6.09%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 11, 2013

Sold by

Rogers Elinor J

Bought by

Rogers Elinor J

Purchase Details

Closed on

Dec 13, 2000

Sold by

Rogers Paul J and Rogers Elinor J

Bought by

Rogers Paul J and Rogers Elinor J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Campos-Salas Miguel Angel | $785,000 | Fidelity National Title Compan | |

| Allison Justin Marshall | $775,000 | Chicago Title | |

| Rogers Elinor J | -- | None Available | |

| Rogers Paul J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Campos-Salas Miguel Angel | $518,100 | |

| Previous Owner | Allison Justin Marshall | $697,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,663 | $806,310 | $468,180 | $338,130 |

| 2024 | $9,104 | $790,500 | $459,000 | $331,500 |

| 2023 | $9,104 | $740,000 | $500,000 | $240,000 |

| 2022 | $1,774 | $93,310 | $27,926 | $65,384 |

| 2021 | $1,707 | $91,481 | $27,379 | $64,102 |

| 2019 | $1,655 | $88,769 | $26,568 | $62,201 |

| 2018 | $1,575 | $87,030 | $26,048 | $60,982 |

| 2017 | $1,502 | $85,325 | $25,538 | $59,787 |

| 2016 | $1,493 | $83,653 | $25,038 | $58,615 |

| 2015 | $1,372 | $82,397 | $24,662 | $57,735 |

| 2014 | $1,312 | $80,784 | $24,179 | $56,605 |

Source: Public Records

Map

Nearby Homes

- 2361 Panoramic Dr

- 3577 Dumbarton St

- 2279 Saint George Dr

- 2225 Quebec St

- 3478 Esperanza Dr

- 3425 Dormer Ave

- 2626 Prestwick Ave

- 3412 Flamingo Dr

- 3453 Thunderbird Dr

- 3485 Hillsborough Dr

- 3439 Sanford St

- 3455 Halifax Way

- 3454 Halifax Way

- 3336 Claudia Dr

- 3545 Northwood Dr Unit F

- 3370 Northwood Dr Unit I

- 3025 Laurence Ct

- 2206 Gehringer Dr

- 3025 Gratton Way

- 2227 Dalis Dr Unit 159

- 3651 Sunview Ct

- 3631 Sunview Ct

- 3671 Sunview Ct

- 3621 Sunview Ct

- 3650 Sunview Ct

- 3670 Sunview Ct

- 3691 Sunview Ct

- 2490 Sunview Place

- 3611 Sunview Ct

- 3690 Sunview Ct

- 3655 Sunview Way

- 3651 Sunview Way

- 3651 Sun View Way

- 2637 Wellinton Ct

- 2474 Sunview Place

- 3661 Sunview Way

- 3601 Sunview Ct

- 2491 Sunview Terrace

- 2460 Sunview Place

- 2491 Sun View Terrace