Estimated Value: $427,000 - $453,000

2

Beds

2

Baths

1,264

Sq Ft

$351/Sq Ft

Est. Value

About This Home

This home is located at 37 Forge Ln, Coram, NY 11727 and is currently estimated at $444,082, approximately $351 per square foot. 37 Forge Ln is a home located in Suffolk County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 13, 2010

Sold by

Spillman Maretta

Bought by

Martin Carol Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Outstanding Balance

$105,440

Interest Rate

4.17%

Mortgage Type

Unknown

Estimated Equity

$338,642

Purchase Details

Closed on

Dec 11, 2008

Sold by

Malsich Jeffrey

Bought by

Spillman Maretta

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

6.17%

Purchase Details

Closed on

Mar 29, 2004

Sold by

Malsich Dolores

Bought by

Malsich Jeffrey and Mandell Joyce

Purchase Details

Closed on

Sep 28, 1995

Sold by

Applebaum Leon B

Bought by

Malsich Dolores

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martin Carol Ann | $229,000 | -- | |

| Spillman Maretta | $220,000 | Philip Aulbach | |

| Malsich Jeffrey | -- | Commonwealth | |

| Malsich Dolores | $105,000 | Ticor Title Guarantee Compan |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Martin Carol Ann | $160,000 | |

| Previous Owner | Spillman Maretta | $110,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,253 | $1,675 | $130 | $1,545 |

| 2023 | $5,253 | $1,675 | $130 | $1,545 |

| 2022 | $4,553 | $1,675 | $130 | $1,545 |

| 2021 | $4,553 | $1,675 | $130 | $1,545 |

| 2020 | $4,702 | $1,675 | $130 | $1,545 |

| 2019 | $4,702 | $0 | $0 | $0 |

| 2018 | $4,437 | $1,675 | $130 | $1,545 |

| 2017 | $4,437 | $1,675 | $130 | $1,545 |

| 2016 | $4,448 | $1,675 | $130 | $1,545 |

| 2015 | -- | $1,675 | $130 | $1,545 |

| 2014 | -- | $1,675 | $130 | $1,545 |

Source: Public Records

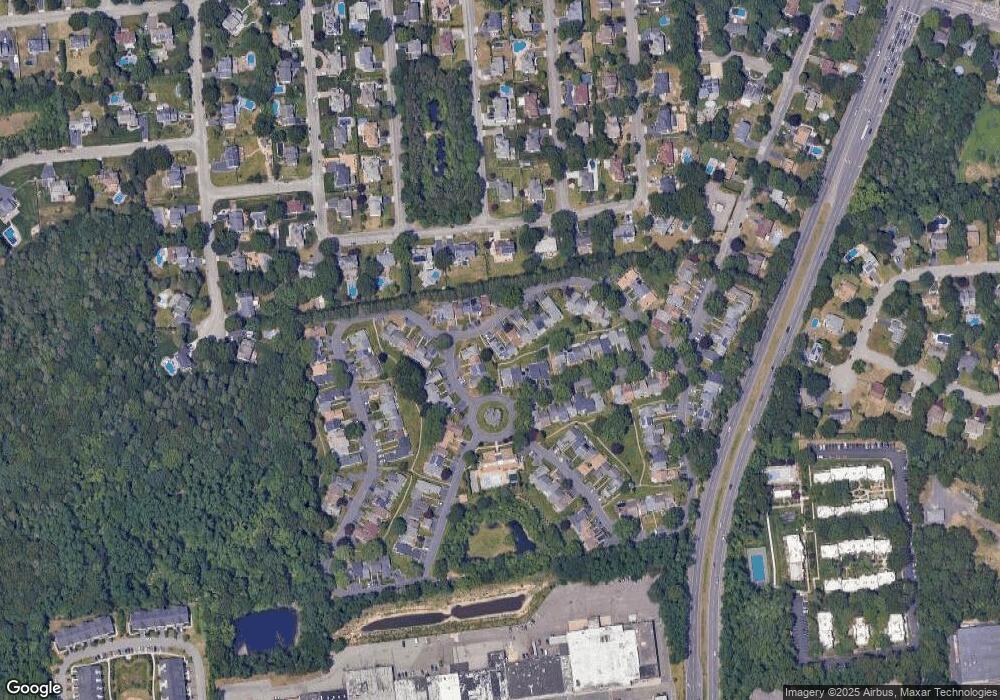

Map

Nearby Homes

- 53 Freedom Ln

- 24 Embassy Rd

- 1066 Old Town Rd

- 655 Middle Country Rd Unit 4D1

- 655 Middle Country Rd Unit 7B1

- 4 Hillsdale Ln

- 7 Filmore Ave

- 3 Embassy Rd

- 84 Wyona Ave

- 111 Wyona Ave

- 24 New Ln

- 22 Harford Dr

- 5 Haiti Ln

- 151 Pauls Path

- 4 Prospect St

- 4 Rd

- 981 Old Town Rd

- 652 Hawkins Rd E

- 110 Dare Rd

- 177 N Bicycle Path

Your Personal Tour Guide

Ask me questions while you tour the home.