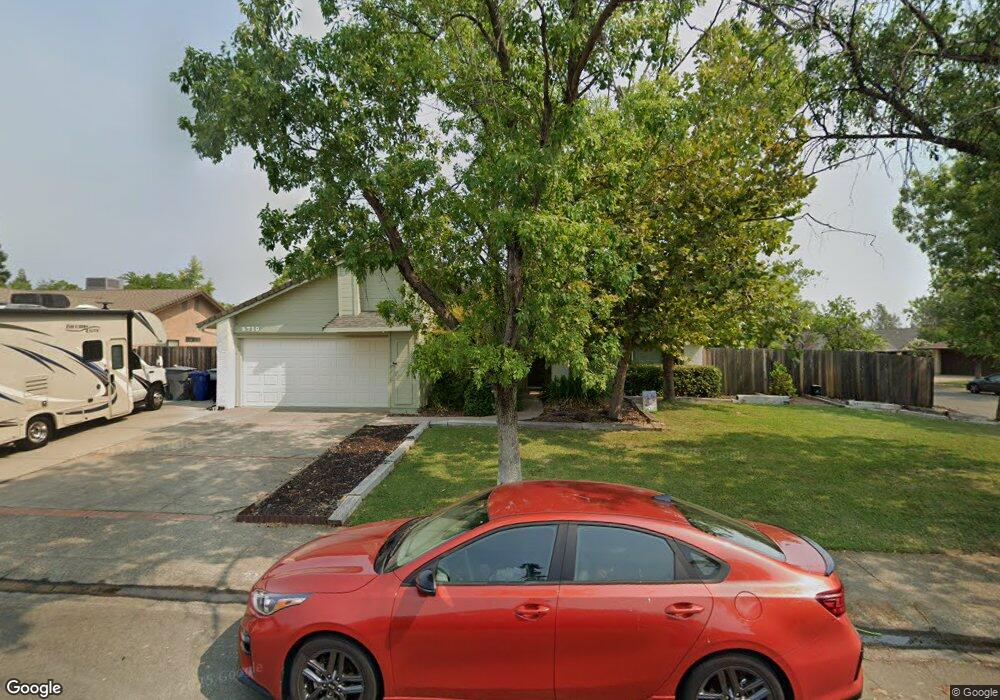

3710 Wasatch Dr Redding, CA 96001

Ridgeview NeighborhoodEstimated Value: $402,234 - $456,000

4

Beds

2

Baths

1,888

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 3710 Wasatch Dr, Redding, CA 96001 and is currently estimated at $432,059, approximately $228 per square foot. 3710 Wasatch Dr is a home located in Shasta County with nearby schools including Manzanita Elementary School, Sequoia Middle School, and Shasta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2019

Sold by

Howell Dana R and Howell April L

Bought by

Howell Dana R and Howell April L

Current Estimated Value

Purchase Details

Closed on

Mar 6, 2000

Sold by

Dahlberg Christopher A and Dahlberg Deanna L

Bought by

Howell Dana R and Howell April L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$54,339

Interest Rate

9.25%

Estimated Equity

$377,720

Purchase Details

Closed on

Jul 6, 1999

Sold by

Telegan Dale A and Telegan Gloria S

Bought by

Dahlberg Christopher A and Dahlberg Deanna L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,000

Interest Rate

7.82%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Howell Dana R | -- | None Available | |

| Howell Dana R | $150,000 | Chicago Title Co | |

| Dahlberg Christopher A | $145,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Howell Dana R | $150,000 | |

| Previous Owner | Dahlberg Christopher A | $116,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,681 | $256,374 | $46,095 | $210,279 |

| 2024 | $2,637 | $251,348 | $45,192 | $206,156 |

| 2023 | $2,637 | $246,420 | $44,306 | $202,114 |

| 2022 | $2,592 | $241,589 | $43,438 | $198,151 |

| 2021 | $2,571 | $236,853 | $42,587 | $194,266 |

| 2020 | $2,601 | $234,426 | $42,151 | $192,275 |

| 2019 | $2,471 | $229,830 | $41,325 | $188,505 |

| 2018 | $2,489 | $225,324 | $40,515 | $184,809 |

| 2017 | $2,473 | $220,907 | $39,721 | $181,186 |

| 2016 | $2,395 | $216,577 | $38,943 | $177,634 |

| 2015 | $2,330 | $213,325 | $38,359 | $174,966 |

| 2014 | $2,344 | $209,147 | $37,608 | $171,539 |

Source: Public Records

Map

Nearby Homes

- 3882 Fujiyama Way

- 3811 Andes Dr

- 3672 Rosita Dr

- 4125 Oro St

- 3380 Placer St

- 4160 Travona Ct

- 2358 Cumberland Dr

- 1700 Wisconsin Ave

- 1695 Kildare Dr

- 4395 Carlow Way

- 1783 Record Ln

- 2318 Crescent Moon Ct

- 1675 Lakeside Dr

- 1756 Mary Lake Dr

- 1355 Bambury Ct

- 2166 Wicklow St

- 4519 Nantucket Dr

- 3821 Pebble Dr

- 1430 Ridge Dr

- 2925 Aspen Glow Ln

- 3730 Wasatch Dr

- 3741 Fujiyama Way Unit 1

- 3741 Fujiyama Way

- 3750 Wasatch Dr

- 3702 Fujiyama Way

- 3702 Fujiyama Way

- 3765 Fujiyama Way Unit 1

- 3765 Fujiyama Way

- 3711 Wasatch Dr

- 3747 Wasatch Dr

- 3691 Wasatch Dr

- 3738 Fujiyama Way Unit 1

- 3738 Fujiyama Way

- 3726 Fujiyama Way

- 3765 Wasatch Dr

- 3770 Wasatch Dr

- 3750 Fujiyama Way

- 3777 Fujiyama Way

- 3762 Fujiyama Way

- 3680 Wasatch Dr Unit SFR