372 Capistrano Ct Camarillo, CA 93010

Estimated Value: $653,969 - $694,000

3

Beds

2

Baths

1,244

Sq Ft

$545/Sq Ft

Est. Value

About This Home

This home is located at 372 Capistrano Ct, Camarillo, CA 93010 and is currently estimated at $677,742, approximately $544 per square foot. 372 Capistrano Ct is a home located in Ventura County with nearby schools including Dos Caminos Elementary School, Monte Vista Middle School, and Adolfo Camarillo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 13, 2011

Sold by

Johnson Marvin C and Johnson Gayle L

Bought by

Getman Damon and Camarillo Leslie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Outstanding Balance

$131,328

Interest Rate

4.84%

Mortgage Type

New Conventional

Estimated Equity

$546,414

Purchase Details

Closed on

Jan 4, 2005

Sold by

Johnson Marvin Cyrus and Johnson Gayle Lorraine

Bought by

Johnson Marvin C and Johnson Gayle L

Purchase Details

Closed on

Mar 31, 1998

Sold by

Moulopoulos Spyridon D

Bought by

Johnson Marvin Cyrus and Johnson Gayle Lorraine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,000

Interest Rate

7.13%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Getman Damon | $310,000 | Lawyers Title Company | |

| Johnson Marvin C | -- | -- | |

| Johnson Marvin Cyrus | $170,000 | Lawyers Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Getman Damon | $190,000 | |

| Previous Owner | Johnson Marvin Cyrus | $119,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,376 | $397,151 | $198,576 | $198,575 |

| 2024 | $4,376 | $389,364 | $194,682 | $194,682 |

| 2023 | $4,220 | $381,730 | $190,865 | $190,865 |

| 2022 | $4,207 | $374,246 | $187,123 | $187,123 |

| 2021 | $4,057 | $366,908 | $183,454 | $183,454 |

| 2020 | $4,042 | $363,148 | $181,574 | $181,574 |

| 2019 | $4,024 | $356,028 | $178,014 | $178,014 |

| 2018 | $3,950 | $349,048 | $174,524 | $174,524 |

| 2017 | $3,718 | $342,204 | $171,102 | $171,102 |

| 2016 | $3,630 | $335,496 | $167,748 | $167,748 |

| 2015 | $3,592 | $330,458 | $165,229 | $165,229 |

| 2014 | $3,508 | $323,988 | $161,994 | $161,994 |

Source: Public Records

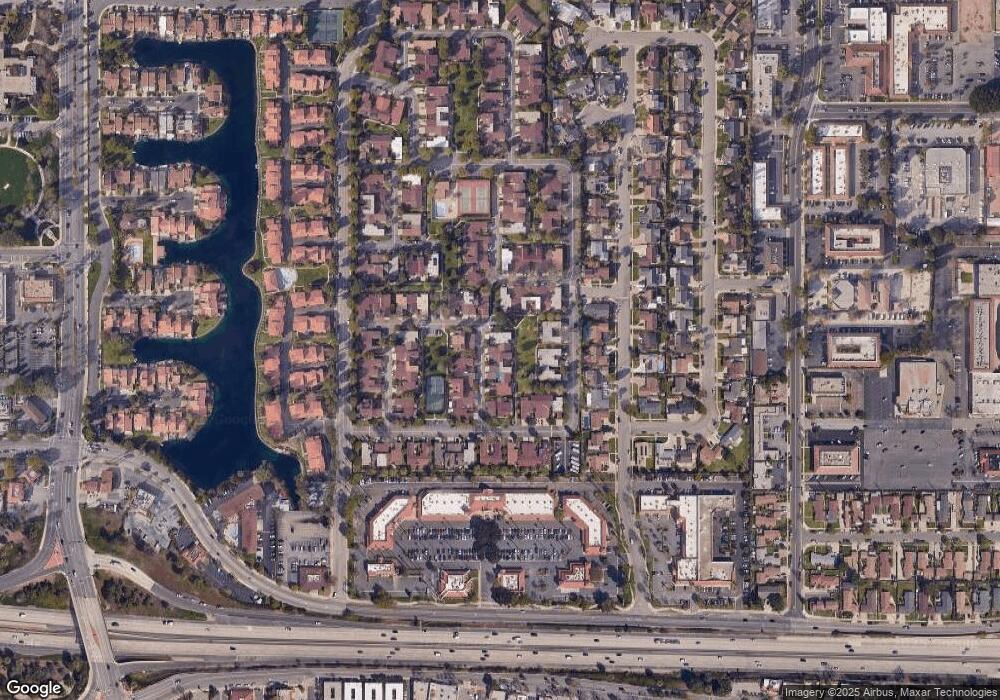

Map

Nearby Homes

- 2854 Via Monte Mar

- 560 Chapala Dr

- 1654 Edgewater Ln

- 1682 Darnell Ct

- 1623 Regent St

- 205 Marker Ave

- 1150 Ventura Blvd Unit 77

- 1150 Ventura Blvd Unit 109

- 1150 Ventura Blvd Unit 10

- 1150 Ventura Blvd Unit SPC 125

- 1150 Ventura Blvd Unit 110

- 1150 Ventura Blvd Unit 62

- 958 Palmer Ave

- 2174 Wilcox St

- 492 Graham Ave

- 1066 Pinehurst Place

- 1557 Prima Ct

- 527 Keyser Rondo

- 62 + Calleguas

- 2764 Petit St

- 360 Capistrano Ct

- 384 Capistrano Ct

- 348 Capistrano Ct

- 336 Capistrano Ct

- 373 Capistrano Ct

- 324 Capistrano Ct

- 385 Capistrano Ct

- 361 Capistrano Ct

- 349 Capistrano Ct

- 363 Viejo Dr

- 1795 Coronado Ct

- 377 Viejo Dr

- 444 Baja Ct

- 436 Baja Ct

- 349 Viejo Dr

- 337 Capistrano Ct

- 335 Viejo Dr

- 391 Viejo Dr

- 1789 Coronado Ct

- 316 Capistrano Ct

Your Personal Tour Guide

Ask me questions while you tour the home.