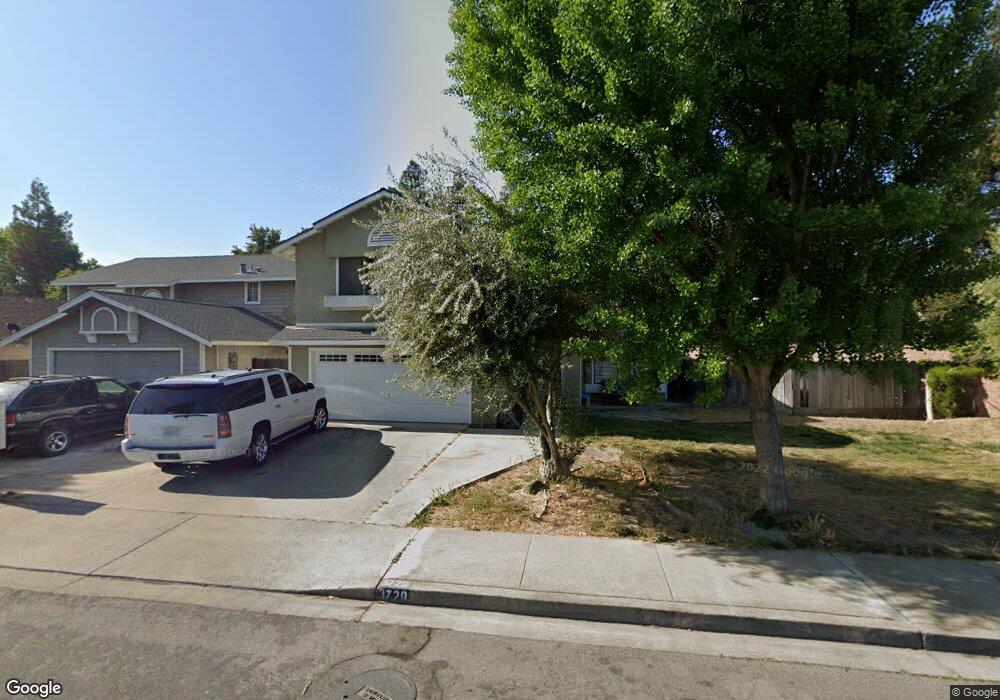

3720 Akeby Dr Modesto, CA 95356

Estimated Value: $456,000 - $545,000

4

Beds

3

Baths

1,810

Sq Ft

$271/Sq Ft

Est. Value

About This Home

This home is located at 3720 Akeby Dr, Modesto, CA 95356 and is currently estimated at $491,356, approximately $271 per square foot. 3720 Akeby Dr is a home located in Stanislaus County with nearby schools including Salida Elementary School, Salida Middle School - Vella Campus, and Joseph A. Gregori High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 1999

Sold by

Sammara Moyers

Bought by

Araujo Francisco and Araujo Maria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,400

Outstanding Balance

$31,102

Interest Rate

6.84%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$460,254

Purchase Details

Closed on

Jan 29, 1996

Sold by

Western Financial Svgs Bank

Bought by

Moyers Sammara

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,000

Interest Rate

7.04%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

May 1, 1995

Sold by

White Clemon W and White Gloria D

Bought by

Western Financial Svgs Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Araujo Francisco | $153,000 | Chicago Title Co | |

| Moyers Sammara | $124,000 | Fidelity National Title | |

| Western Financial Svgs Bank | $122,252 | North American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Araujo Francisco | $122,400 | |

| Previous Owner | Moyers Sammara | $104,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,665 | $239,837 | $50,155 | $189,682 |

| 2024 | $2,615 | $235,135 | $49,172 | $185,963 |

| 2023 | $2,569 | $230,525 | $48,208 | $182,317 |

| 2022 | $2,452 | $226,006 | $47,263 | $178,743 |

| 2021 | $2,419 | $221,576 | $46,337 | $175,239 |

| 2020 | $2,325 | $219,305 | $45,862 | $173,443 |

| 2019 | $2,301 | $215,006 | $44,963 | $170,043 |

| 2018 | $2,252 | $210,791 | $44,082 | $166,709 |

| 2017 | $2,200 | $206,659 | $43,218 | $163,441 |

| 2016 | $2,157 | $202,608 | $42,371 | $160,237 |

| 2015 | $2,130 | $199,566 | $41,735 | $157,831 |

| 2014 | $2,089 | $195,658 | $40,918 | $154,740 |

Source: Public Records

Map

Nearby Homes

- 3424 Vintage Dr Unit 244

- 3424 Vintage Dr Unit 152

- 3400 Sullivan Ct Unit 105

- 3400 Sullivan Ct Unit 106

- 3264 Showcase Way

- 4005 Honey Creek Rd

- 3129 Nightingale Dr

- 3913 Peacock Ln

- 3945 Sparrow Ct

- 4609 Sweet William Ct

- 3925 Dale Rd Unit C

- 3905 Alessandro Ln

- 4736 Carlson Way

- 4221 Legacy Ct

- 3913 Viader Dr

- 4009 Bella Tuscany Dr

- 0 Finney Rd

- 2612 Snyder Ave

- 2500 van Hoeks Cir

- 4524 Wessex Ln

- 3716 Akeby Dr

- 3712 Akeby Dr

- 4000 Timahoe Dr

- 3708 Akeby Dr

- 3936 Mesrob Ct

- 4001 Timahoe Dr

- 3713 Akeby Dr

- 3704 Akeby Dr

- 3709 Akeby Dr

- 3937 Mesrob Ct

- 4000 Ashfield Way

- 4005 Timahoe Dr

- 3932 Mesrob Ct

- 3705 Akeby Dr

- 4008 Timahoe Dr

- 3700 Akeby Dr

- 3712 Rosanne Ln

- 3708 Rosanne Ln

- 4004 Ashfield Way

- 3701 Akeby Dr