3722 Mulvahill Rd Duluth, MN 55803

Estimated Value: $230,000 - $352,000

3

Beds

2

Baths

1,120

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 3722 Mulvahill Rd, Duluth, MN 55803 and is currently estimated at $274,478, approximately $245 per square foot. 3722 Mulvahill Rd is a home located in St. Louis County with nearby schools including Homecroft Elementary School, Ordean East Middle School, and East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 29, 2017

Sold by

Descombaz Michael and Nelson Heather

Bought by

Carlson Kathy and Brooks Robert

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,000

Outstanding Balance

$22,887

Interest Rate

3.9%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$251,591

Purchase Details

Closed on

Oct 31, 2013

Sold by

Johnson David A

Bought by

Descombaz Michael and Nelson Heather

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,800

Interest Rate

4.24%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 29, 2006

Sold by

Johnson Tammy J and Pfeffer Tammy J

Bought by

Johnson David A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carlson Kathy | $110,000 | Stewart Title Company | |

| Descombaz Michael | $94,000 | Natl Title Duluth | |

| Johnson David A | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carlson Kathy | $88,000 | |

| Previous Owner | Descombaz Michael | $65,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2023 | $2,060 | $149,200 | $87,400 | $61,800 |

| 2022 | $882 | $143,200 | $87,400 | $55,800 |

| 2021 | $818 | $81,300 | $37,900 | $43,400 |

| 2020 | $830 | $77,700 | $36,200 | $41,500 |

| 2019 | $774 | $77,700 | $36,200 | $41,500 |

| 2018 | $680 | $73,500 | $32,400 | $41,100 |

| 2017 | $1,544 | $69,100 | $30,800 | $38,300 |

| 2016 | $1,534 | $97,800 | $44,100 | $53,700 |

| 2015 | $1,452 | $95,400 | $44,100 | $51,300 |

| 2014 | $1,452 | $91,300 | $42,400 | $48,900 |

Source: Public Records

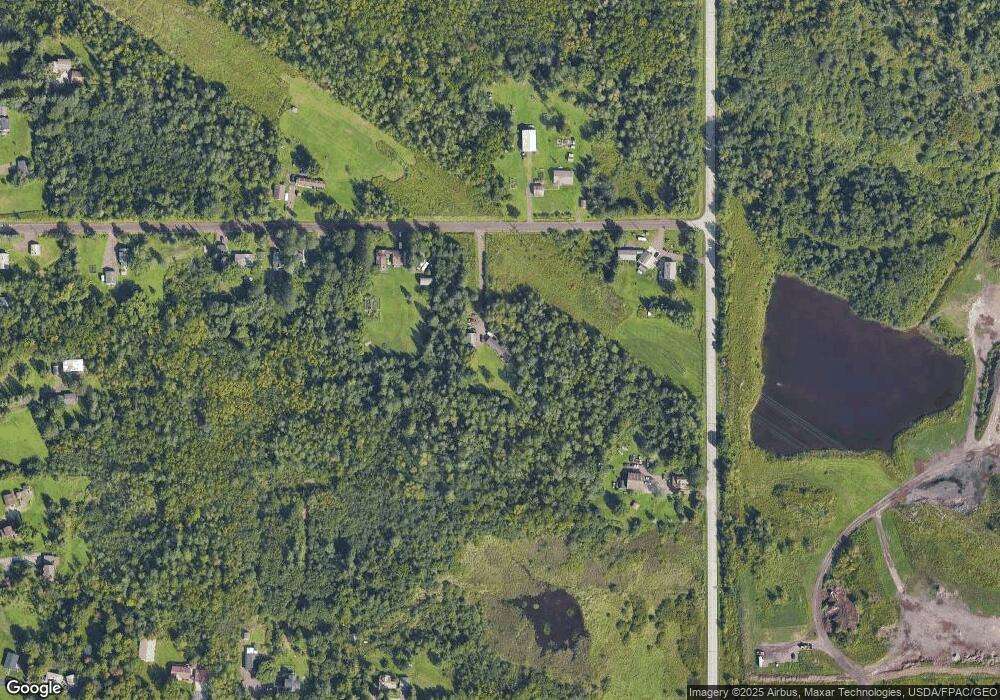

Map

Nearby Homes

- 3748 Mulvahill Rd Unit Mulvahill Road

- 3744 Riley Rd

- 417 Elk St

- 0 Pleasant View Rd

- xxx Amity Dr

- 3537 Martin Rd

- 320 E Chisholm St

- 310 E Chisholm St

- 110 E Chisholm St

- 31 E Calvary Rd

- 204 W Faribault St

- 214 W Owatonna St

- 316 W Faribault St

- 301 W Winona St

- 18 E Wabasha St

- 540 W Redwing St

- 44xx Vermilion Rd

- 5230 Jean Duluth Rd

- 4095 E Calvary Rd

- Lot 13 Hartley Hills Dr

- 3730 Mulvahill Rd

- 3730 Mulvahill Rd

- 3713 Mulvahill Rd

- 4945 Eagle Lake Rd

- 3738 Mulvahill Rd

- 4923 Eagle Lake Rd

- 3742 Mulvahill Rd

- 3741 Mulvahill Rd

- 3748 Mulvahill Rd

- 3735 Martin Rd

- 3758 Mulvahill Rd

- 3747 Martin Rd

- 4930 Woodland Ave

- 4979 Eagle Lake Rd

- 3751 Martin Rd

- 4914 Woodland Ave

- 4942 Woodland Ave

- 4918 Woodland Ave

- 4964 Woodland Ave

- 3714 Riley Rd