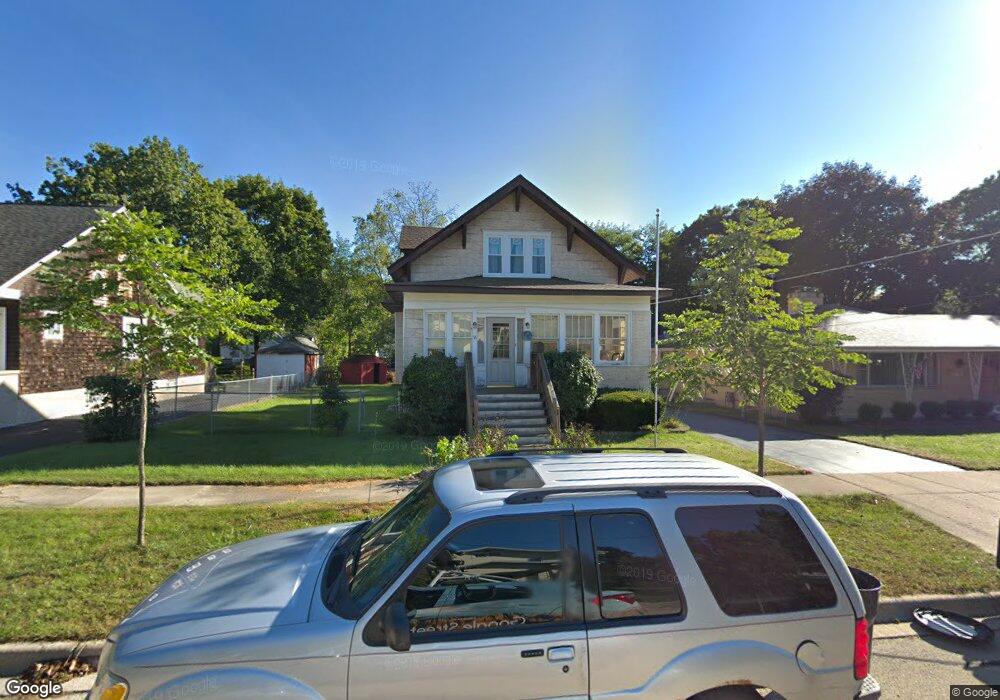

38 Center St Algonquin, IL 60102

Traube Fox River View NeighborhoodEstimated Value: $258,587 - $311,000

2

Beds

2

Baths

1,334

Sq Ft

$216/Sq Ft

Est. Value

About This Home

This home is located at 38 Center St, Algonquin, IL 60102 and is currently estimated at $287,647, approximately $215 per square foot. 38 Center St is a home located in McHenry County with nearby schools including Eastview Elementary School, Algonquin Middle School, and Dundee-Crown High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2001

Sold by

Merchut Carl and Merchut Diane

Bought by

Greer David and Greer Susan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,875

Outstanding Balance

$58,225

Interest Rate

7.28%

Mortgage Type

FHA

Estimated Equity

$229,422

Purchase Details

Closed on

Aug 28, 1998

Sold by

Springate Carla S and Knudsen Carls S

Bought by

Merchut Carl and Merchut Diane J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,800

Interest Rate

7.04%

Purchase Details

Closed on

Mar 30, 1997

Sold by

Springate Daniel C

Bought by

Springate Carla S

Purchase Details

Closed on

Jan 19, 1994

Sold by

Hayden Dale Allen

Bought by

Springate Daniel C and Springate Carla S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,925

Interest Rate

7.26%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Greer David | $150,000 | -- | |

| Merchut Carl | $121,000 | -- | |

| Springate Carla S | -- | -- | |

| Springate Daniel C | $111,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Greer David | $147,875 | |

| Previous Owner | Merchut Carl | $96,800 | |

| Previous Owner | Springate Daniel C | $105,925 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,892 | $78,535 | $20,506 | $58,029 |

| 2023 | $4,541 | $70,240 | $18,340 | $51,900 |

| 2022 | $3,650 | $53,561 | $11,523 | $42,038 |

| 2021 | $3,452 | $49,898 | $10,735 | $39,163 |

| 2020 | $3,334 | $48,132 | $10,355 | $37,777 |

| 2019 | $3,220 | $46,068 | $9,911 | $36,157 |

| 2018 | $3,484 | $42,557 | $9,156 | $33,401 |

| 2017 | $3,395 | $40,092 | $8,626 | $31,466 |

| 2016 | $3,323 | $37,602 | $8,090 | $29,512 |

| 2013 | -- | $47,365 | $7,548 | $39,817 |

Source: Public Records

Map

Nearby Homes

- 102 Center St

- 314 Washington St

- 0 River Dr N Unit MRD12473279

- 600 E Algonquin Rd

- 721 Brentwood Ct

- 420 N Harrison St

- 2 Sunset Ln

- 1245 Winaki Trail

- 0 Natoma Trail

- 1188 E Algonquin Rd

- lot 25 Wabican Trail

- 911 Old Oak Cir Unit 1

- 710 Sprucetree Ln

- 903 Old Oak Cir

- 920 Plymouth Ct

- 1 N Hubbard St

- SWC Talaga and Algonquin Rd

- 925 N River Rd

- 1235 Fairmont Ct

- 1114 Riverwood Dr Unit 1114