3821 Bill of Rights Square Unit 156 Columbus, OH 43207

Williams Creek NeighborhoodEstimated Value: $223,000 - $233,000

3

Beds

3

Baths

1,356

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 3821 Bill of Rights Square Unit 156, Columbus, OH 43207 and is currently estimated at $227,570, approximately $167 per square foot. 3821 Bill of Rights Square Unit 156 is a home located in Franklin County with nearby schools including Groveport Madison High School, South Scioto Academy, and Summit Academy Community School-Columbus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 29, 2020

Sold by

Hearns Stacy Renee and Hearns Robert

Bought by

Hernandez Alex Y Zambrano and Hepburn Alejandrina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,315

Outstanding Balance

$120,355

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$107,215

Purchase Details

Closed on

Mar 12, 2009

Sold by

Starcher Daniel J and Starcher Felicia

Bought by

Jones Stacy R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,514

Interest Rate

5.09%

Mortgage Type

FHA

Purchase Details

Closed on

May 13, 2002

Sold by

Dominion Homes Inc

Bought by

Starcher Daniel J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,600

Interest Rate

7.07%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hernandez Alex Y Zambrano | $140,000 | Chase Title And Escrow Svcs | |

| Jones Stacy R | $82,000 | Talon Group | |

| Starcher Daniel J | $120,400 | Alliance Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hernandez Alex Y Zambrano | $135,315 | |

| Previous Owner | Jones Stacy R | $80,514 | |

| Previous Owner | Starcher Daniel J | $117,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,685 | $63,320 | $12,250 | $51,070 |

| 2023 | $2,659 | $63,315 | $12,250 | $51,065 |

| 2022 | $1,960 | $38,820 | $4,410 | $34,410 |

| 2021 | $1,966 | $38,820 | $4,410 | $34,410 |

| 2020 | $1,969 | $38,820 | $4,410 | $34,410 |

| 2019 | $1,572 | $27,720 | $3,150 | $24,570 |

| 2018 | $1,566 | $27,720 | $3,150 | $24,570 |

| 2017 | $1,560 | $27,720 | $3,150 | $24,570 |

| 2016 | $1,533 | $24,470 | $3,640 | $20,830 |

| 2015 | $1,550 | $24,470 | $3,640 | $20,830 |

| 2014 | $1,567 | $24,470 | $3,640 | $20,830 |

| 2013 | $675 | $25,200 | $4,550 | $20,650 |

Source: Public Records

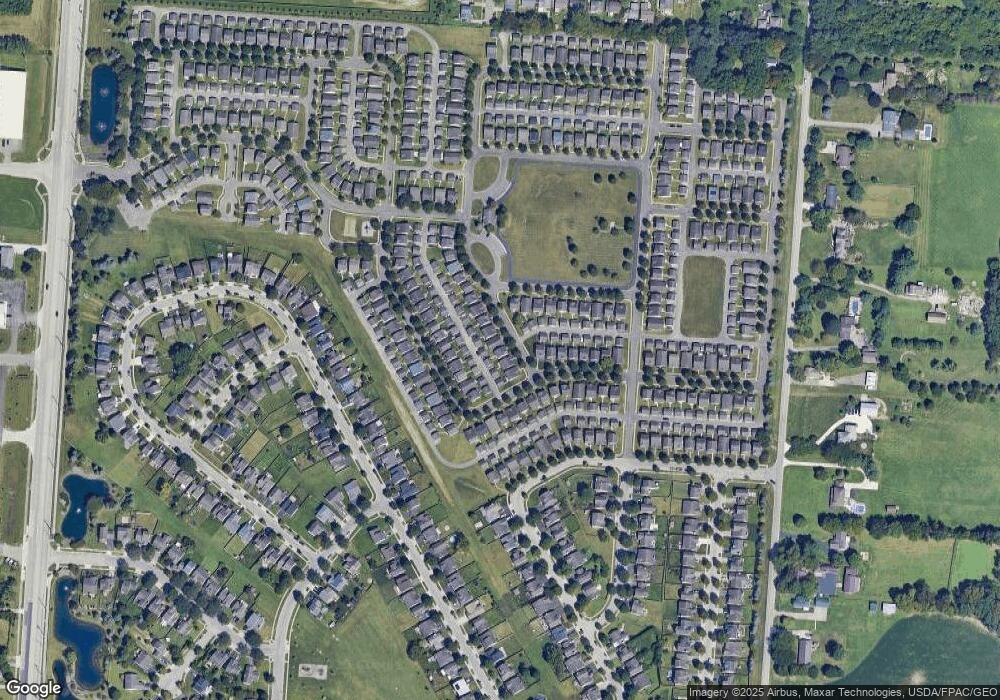

Map

Nearby Homes

- 3724 Revolutionary Dr Unit 111

- 3622 Pendent Ln

- 2587 Winningwillow Dr

- 2629 Patrick Henry Ave Unit 40

- 3865 Pendent Ln

- 2681 Meigs Dr

- 2685 Meigs Dr

- 2689 Meigs Dr

- 2693 Meigs Dr

- 2697 Meigs Dr

- 3242 Mackinac Dr

- 2674 Meigs Dr

- 2682 Meigs Dr

- 2686 Meigs Dr

- 2670 Meigs Dr

- 2690 Meigs Dr

- 2585 Millview Dr

- 2711 Mchenry Dr

- 2715 Mchenry Dr

- 2723 Mchenry Dr

- 3811 Bill of Rights Square Unit 157

- 3831 Bill of Rights Square Unit 155

- 3801 Bill of Rights Square Unit 158

- 3841 Bill of Rights Square Unit 154

- 3824 Revolutionary Dr Unit 178

- 3791 Bill of Rights Square Unit 158

- 2916 Representation Terrace Unit 184

- 3844 Revolutionary Dr Unit 180

- 3781 Bill of Rights Square Unit 160

- 3834 Revolutionary Dr Unit 179

- 2926 Representation Terrace Unit 185

- 3864 Revolutionary Dr Unit 182

- 2903 Francis Scott Key Way Unit 201

- 3874 Revolutionary Dr Unit 183

- 2913 Francis Scott Key Way Unit 200

- 2905 Representation Terrace Unit 133

- 2895 Representation Terrace Unit 132

- 3771 Bill of Rights Square Unit 161

- 2915 Representation Terrace Unit 134

- 2936 Representation Terrace Unit 186