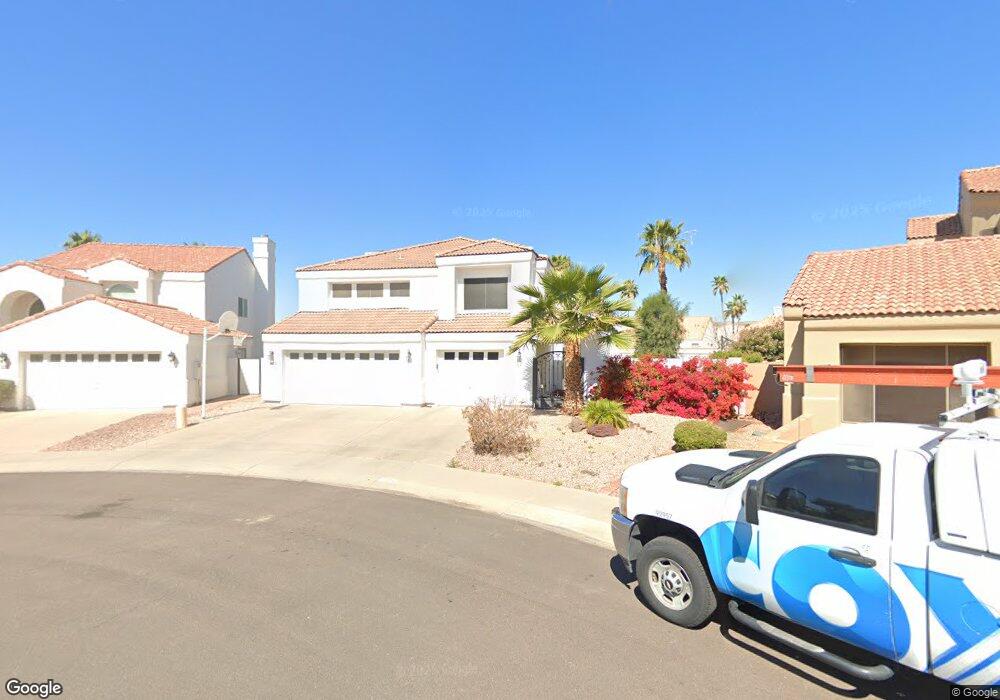

3822 E Nighthawk Way Phoenix, AZ 85048

Ahwatukee NeighborhoodEstimated Value: $613,069 - $710,000

Studio

4

Baths

2,489

Sq Ft

$268/Sq Ft

Est. Value

About This Home

This home is located at 3822 E Nighthawk Way, Phoenix, AZ 85048 and is currently estimated at $666,017, approximately $267 per square foot. 3822 E Nighthawk Way is a home located in Maricopa County with nearby schools including Kyrene de los Lagos School, Kyrene de la Estrella Elementary School, and Kyrene Akimel A-al Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 26, 2007

Sold by

Moore Travis D

Bought by

Labovitz Moore Erika Diane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$396,000

Outstanding Balance

$242,821

Interest Rate

6.87%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$423,196

Purchase Details

Closed on

May 2, 2006

Sold by

Labovitz Moore Erika D and Moore Travis D

Bought by

Moore Travis D and Labovitz Moore Erika D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,500

Interest Rate

6.29%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 8, 2001

Sold by

Price Allan H and Price Susan

Bought by

Moore Travis and Moore Erika

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,250

Interest Rate

7.09%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Labovitz Moore Erika Diane | -- | Westland Title Agency Of Az | |

| Moore Travis D | -- | Chicago Title Insurance Co | |

| Moore Travis | $242,500 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Labovitz Moore Erika Diane | $396,000 | |

| Previous Owner | Moore Travis D | $283,500 | |

| Previous Owner | Moore Travis | $218,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,538 | $39,321 | -- | -- |

| 2024 | $3,355 | $37,448 | -- | -- |

| 2023 | $3,355 | $47,520 | $9,500 | $38,020 |

| 2022 | $3,195 | $36,380 | $7,270 | $29,110 |

| 2021 | $3,333 | $34,850 | $6,970 | $27,880 |

| 2020 | $3,249 | $33,570 | $6,710 | $26,860 |

| 2019 | $3,146 | $32,210 | $6,440 | $25,770 |

| 2018 | $3,039 | $31,260 | $6,250 | $25,010 |

| 2017 | $2,900 | $31,060 | $6,210 | $24,850 |

| 2016 | $2,939 | $30,910 | $6,180 | $24,730 |

| 2015 | $2,631 | $28,580 | $5,710 | $22,870 |

Source: Public Records

Map

Nearby Homes

- 16601 S 38th St

- 16402 S 39th St

- 3925 E Wildwood Dr

- 3821 E Tanglewood Dr

- 3834 E Windsong Dr

- 16631 S 37th St

- 4021 E Amberwood Dr

- 16232 S 41st St

- 16857 S 36th Way

- 3655 E Redwood Ln

- 16840 S 36th Place

- 4043 E Mountain Vista Dr

- 16044 S 41st Place

- 15808 S 37th St

- 16830 S 42nd St

- 4114 E Muirwood Dr

- 3611 E Windmere Dr

- 3830 E Lakewood Pkwy E Unit 2162

- 3830 E Lakewood Pkwy E Unit 1038

- 3830 E Lakewood Pkwy E Unit 3079

- 16602 S 38th Way

- 3826 E Nighthawk Way

- 3830 E Nighthawk Way

- 16606 S 38th Way

- 3825 E Nighthawk Way

- 3849 E Frye Rd

- 3845 E Frye Rd

- 3834 E Nighthawk Way

- 3853 E Frye Rd

- 16610 S 38th Way

- 3829 E Nighthawk Way

- 16605 S 38th Place

- 16601 S 38th Place

- 16611 S 38th Place

- 3833 E Nighthawk Way

- 16611 S 38th Way

- 16431 S 38th Place

- 3902 E Nighthawk Way

- 3919 E Wildwood Dr

- 16614 S 38th Way