3906 Appian St Pleasanton, CA 94588

Stoneridge NeighborhoodEstimated Value: $1,060,166 - $1,232,000

2

Beds

2

Baths

1,156

Sq Ft

$1,007/Sq Ft

Est. Value

About This Home

This home is located at 3906 Appian St, Pleasanton, CA 94588 and is currently estimated at $1,164,292, approximately $1,007 per square foot. 3906 Appian St is a home located in Alameda County with nearby schools including Donlon Elementary School, Thomas S. Hart Middle School, and Foothill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 18, 2012

Sold by

Salmeron Rigoberto Leyva

Bought by

Li Zhihua

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$440,000

Outstanding Balance

$304,848

Interest Rate

3.37%

Mortgage Type

New Conventional

Estimated Equity

$859,444

Purchase Details

Closed on

Dec 12, 2012

Sold by

Mcgovern Joseph P and Mcgovern Christine

Bought by

Li Zhihua

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$440,000

Outstanding Balance

$304,848

Interest Rate

3.37%

Mortgage Type

New Conventional

Estimated Equity

$859,444

Purchase Details

Closed on

Apr 30, 1997

Sold by

Signature Properties Inc

Bought by

Mcgovern Joseph P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Li Zhihua | -- | First American Title Company | |

| Li Zhihua | $550,000 | First American Title Company | |

| Mcgovern Joseph P | $249,500 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Li Zhihua | $440,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,859 | $677,258 | $203,177 | $474,081 |

| 2024 | $7,859 | $663,981 | $199,194 | $464,787 |

| 2023 | $7,769 | $650,963 | $195,289 | $455,674 |

| 2022 | $7,361 | $638,203 | $191,461 | $446,742 |

| 2021 | $7,172 | $625,690 | $187,707 | $437,983 |

| 2020 | $7,081 | $619,277 | $185,783 | $433,494 |

| 2019 | $7,167 | $607,138 | $182,141 | $424,997 |

| 2018 | $7,023 | $595,237 | $178,571 | $416,666 |

| 2017 | $6,844 | $583,565 | $175,069 | $408,496 |

| 2016 | $6,318 | $572,125 | $171,637 | $400,488 |

| 2015 | $6,124 | $563,534 | $169,060 | $394,474 |

| 2014 | $6,232 | $552,496 | $165,749 | $386,747 |

Source: Public Records

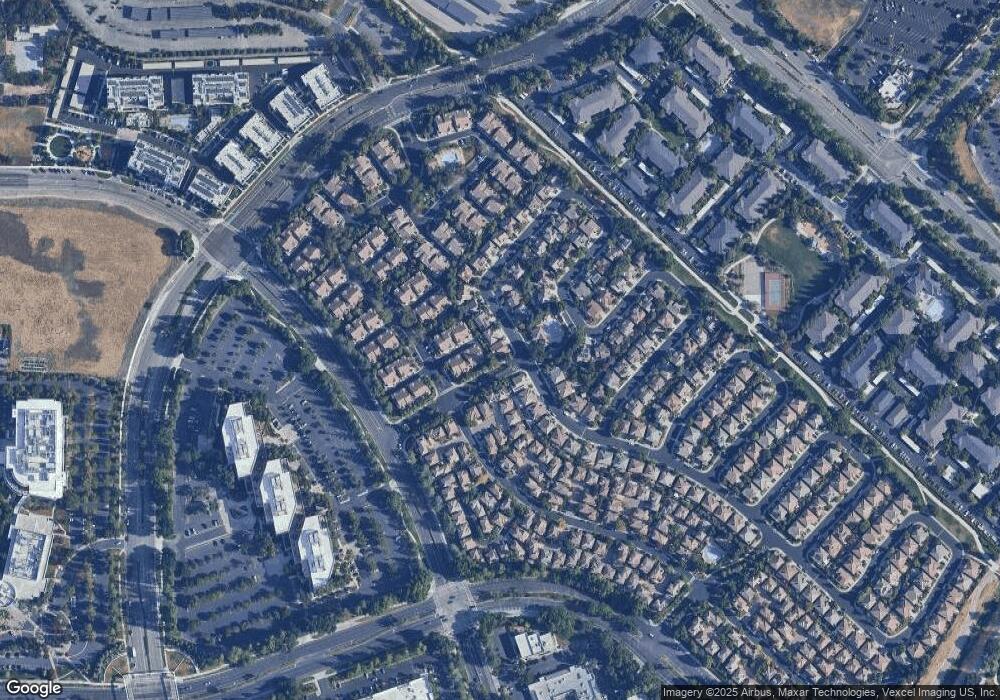

Map

Nearby Homes

- 4068 Ghiotti Ct

- 4052 Ghiotti Ct

- 4175 Alba Ct

- 4251 Lucero Ct

- 5111 Venice Ct

- 3254 Verde Ct

- 3080 Casadero Ct

- 3154 Pawnee Way

- 0 Highway 128 Hwy Unit 326001688

- 3259 Harvey Ct

- 3227 Harvey Ct

- 5399 Iron Horse Pkwy

- 5394 Arnold Rd

- 5406 Saffron Way

- 5581 Dublin Blvd

- 5501 De Marcus Blvd Unit 542

- 5501 De Marcus Blvd Unit 206

- 5501 De Marcus Blvd Unit 328

- 5501 De Marcus Blvd Unit 401

- 5422 Arnold Rd

- 3924 Appian St

- 4071 Ghiotti Ct

- 4087 Ghiotti Ct

- 4055 Ghiotti Ct

- 3942 Appian St

- 3880 Appian St

- 4084 Ghiotti Ct

- 4039 Ghiotti Ct

- 3901 Appian St

- 3925 Appian St

- 5122 Damiano Ct

- 4007 Ghiotti Ct

- 4023 Ghiotti Ct

- 3960 Appian St

- 3943 Appian St

- 3876 Appian St

- 4004 Ghiotti Ct

- 4036 Ghiotti Ct

- 5130 Damiano Ct

- 3871 Appian St