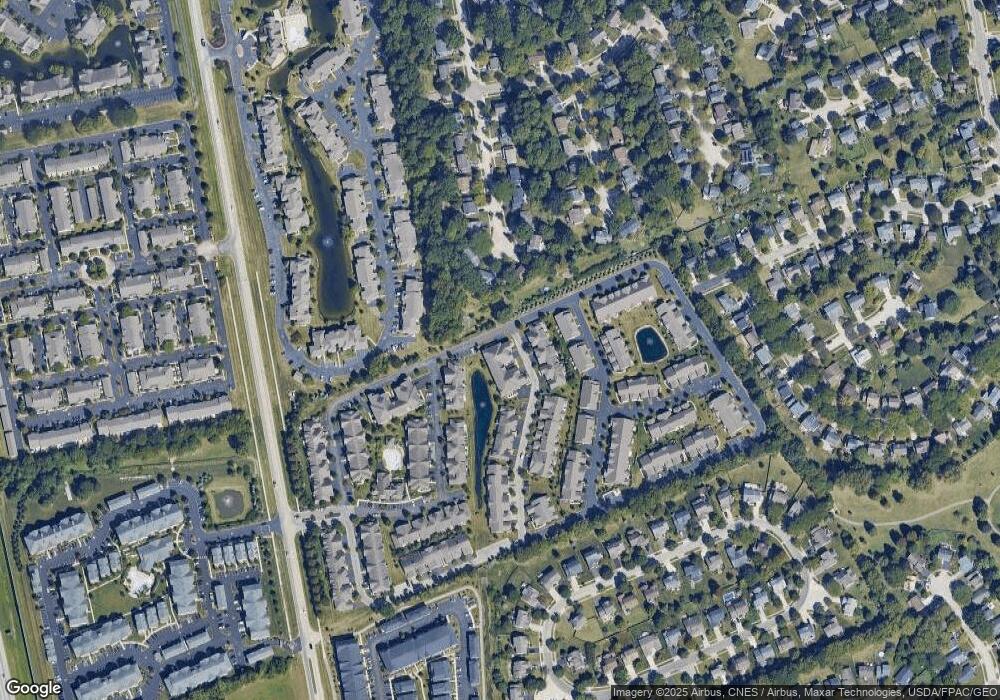

3907 Dinon Dr Unit A Columbus, OH 43221

Dexter Falls NeighborhoodEstimated Value: $304,000 - $346,000

2

Beds

2

Baths

1,575

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 3907 Dinon Dr Unit A, Columbus, OH 43221 and is currently estimated at $318,053, approximately $201 per square foot. 3907 Dinon Dr Unit A is a home located in Franklin County with nearby schools including Gables Elementary School, Ridgeview Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 11, 2019

Sold by

Thompson Michael James

Bought by

Patton Joseph M and Patton Valerie A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,150

Outstanding Balance

$147,532

Interest Rate

4.4%

Mortgage Type

New Conventional

Estimated Equity

$170,521

Purchase Details

Closed on

May 14, 2015

Sold by

Homa Cheryl L and Oxley Cheryl

Bought by

Thompson Michael James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,400

Interest Rate

3.64%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 10, 2010

Sold by

Brittany Place Lp

Bought by

Homan Cheryl L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,874

Interest Rate

4.49%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patton Joseph M | $177,000 | Northwest Select Title Agenc | |

| Thompson Michael James | $155,500 | Attorney | |

| Homan Cheryl L | $160,000 | Hummel Titl |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Patton Joseph M | $168,150 | |

| Previous Owner | Thompson Michael James | $124,400 | |

| Previous Owner | Homan Cheryl L | $157,874 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,119 | $91,770 | $17,850 | $73,920 |

| 2023 | $4,066 | $91,770 | $17,850 | $73,920 |

| 2022 | $3,055 | $58,910 | $18,130 | $40,780 |

| 2021 | $3,061 | $58,910 | $18,130 | $40,780 |

| 2020 | $3,065 | $58,910 | $18,130 | $40,780 |

| 2019 | $3,784 | $62,370 | $15,750 | $46,620 |

| 2018 | $3,439 | $62,370 | $15,750 | $46,620 |

| 2017 | $3,781 | $62,370 | $15,750 | $46,620 |

| 2016 | $3,418 | $51,600 | $10,190 | $41,410 |

| 2015 | $3,103 | $51,600 | $10,190 | $41,410 |

| 2014 | $3,110 | $51,600 | $10,190 | $41,410 |

| 2013 | $1,534 | $51,590 | $10,185 | $41,405 |

Source: Public Records

Map

Nearby Homes

- 5049 Dinard Way

- 3940 Rennes Dr

- 3894 Maidens Larne Dr

- 3873 Tweedsmuir Dr

- 4898 Davidson Run Dr

- 3761 Carnforth Dr

- 5500 Shannon Heights Blvd

- 5506 Shannon Heights Blvd

- 4253 Davidson Rd

- 5500 Saddlebrook Dr

- 3552 Mountshannon Rd

- 4222 Bradhurst Dr Unit 15

- 4664 Cutwater Ln

- 3660 Rivervail Dr

- 0 Davidson Rd

- 3578 Braidwood Dr

- 0 Hickory Chase Way

- 3741 Baybridge Ln

- 4044 Dumfries Ct

- 0 Riggins Rd

- 3907 Dinon Dr Unit 3907A

- 3907 Dinon Dr

- 3911 Dinon Dr Unit 3911

- 5117 Dinard Way Unit 5117

- 5111 Dinard Way Unit 5111

- 5109 Dinard Way Unit 5109

- 5107 Dinard Way Unit 5107

- 5103 Dinard Way Unit 5103

- 5099 Dinard Way Unit 5099

- 5095 Dinard Way Unit 5095

- 3867 Rue de Brittany Unit 3867

- 5116 Dinard Way Unit 5116

- 3871 Rue de Brittany Unit 3871

- 5110 Dinard Way Unit 5110

- 5167 Hialeah Ct

- 5106 Dinard Way Unit 5106

- 3875 Rue de Brittany Unit 3875

- 3879 Rue de Brittany Unit 3879

- 5087 Dinard Way Unit 5087