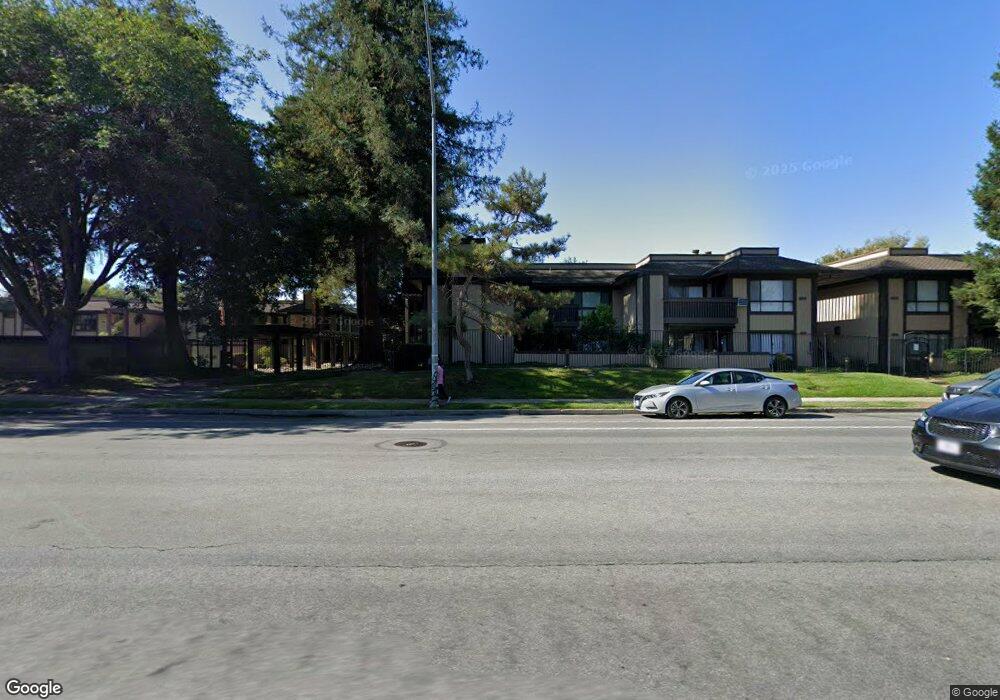

39191 Argonaut Way Unit 113 Fremont, CA 94538

Sundale NeighborhoodEstimated Value: $538,794 - $653,000

1

Bed

1

Bath

1,030

Sq Ft

$568/Sq Ft

Est. Value

About This Home

This home is located at 39191 Argonaut Way Unit 113, Fremont, CA 94538 and is currently estimated at $584,949, approximately $567 per square foot. 39191 Argonaut Way Unit 113 is a home located in Alameda County with nearby schools including Brier Elementary School, G.M. Walters Middle School, and John F. Kennedy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 18, 2012

Sold by

Sargiotto Sean and Sargiotto Alicia

Bought by

Galis Victor and Galis Ioana

Current Estimated Value

Purchase Details

Closed on

Jun 18, 2007

Sold by

Wenzel Douglas S and Wenzel Alma Rosa L

Bought by

Wood Alicia and Sargiotto Sean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,950

Interest Rate

6.21%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Jan 5, 2004

Sold by

Tubbs Noreen

Bought by

Wenzel Douglas S and Wenzel Alma Rosa L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,200

Interest Rate

4.4%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Galis Victor | -- | First American Title Company | |

| Wood Alicia | $350,000 | Ticor Title Company Of Ca | |

| Wenzel Douglas S | $259,000 | Alliance Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wood Alicia | $69,950 | |

| Previous Owner | Wenzel Douglas S | $207,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,535 | $253,663 | $76,099 | $177,564 |

| 2024 | $3,535 | $248,691 | $74,607 | $174,084 |

| 2023 | $3,427 | $243,814 | $73,144 | $170,670 |

| 2022 | $3,364 | $239,035 | $71,710 | $167,325 |

| 2021 | $3,293 | $234,348 | $70,304 | $164,044 |

| 2020 | $3,230 | $231,947 | $69,584 | $162,363 |

| 2019 | $3,196 | $227,400 | $68,220 | $159,180 |

| 2018 | $3,132 | $222,943 | $66,883 | $156,060 |

| 2017 | $3,055 | $218,571 | $65,571 | $153,000 |

| 2016 | $2,992 | $214,287 | $64,286 | $150,001 |

| 2015 | $2,941 | $211,068 | $63,320 | $147,748 |

| 2014 | $2,890 | $206,934 | $62,080 | $144,854 |

Source: Public Records

Map

Nearby Homes

- 39090 Presidio Way Unit 237

- 39530 Dorrington Ct

- 38837 Fremont Blvd

- 39134 Memorial St

- 4714 Serra Ave

- 39193 State St

- 4715 Mildred Dr

- 4328 Cognina Ct

- 39751 Bissy Common

- 4600 Nelson St

- 39753 Placer Way

- 4692 Nelson St

- 3275 Capitol Ave

- 38611 Country Common

- 3455 Gilman Common

- 38265 Corrigan Ct

- 3583 Madison Common

- 3454 Dayton Common

- 4715 Eggers Dr

- 4737 Boone Dr

- 39191 Argonaut Way Unit 117

- 39191 Argonaut Way Unit 115

- 39191 Argonaut Way Unit 218

- 39191 Argonaut Way Unit 214

- 39191 Argonaut Way Unit 216

- 39191 Argonaut Way Unit 114

- 39191 Argonaut Way Unit 118

- 39191 Argonaut Way Unit 4

- 39191 Argonaut Way Unit 3

- 39191 Argonaut Way Unit 7

- 39191 Argonaut Way Unit 12

- 39191 Argonaut Way Unit 9

- 39191 Argonaut Way Unit 8

- 39191 Argonaut Way Unit 5

- 39191 Argonaut Way Unit 1

- 39191 Argonaut Way

- 39191 Argonaut Way

- 39191 Argonaut Way Unit 10

- 4303 Sacramento Ave Unit 130

- 4303 Sacramento Ave Unit 127